Question: PLEASE, DO NOT COPY ANOTHER ANSWER. THESE QUESTIONS ARE DIFFERENT AND THE ANSWERS WILL BE WRONG. PLEASE SHOW WORK AND ACTUALLY HELP ME. THANK YOU.

PLEASE, DO NOT COPY ANOTHER ANSWER. THESE QUESTIONS ARE DIFFERENT AND THE ANSWERS WILL BE WRONG. PLEASE SHOW WORK AND ACTUALLY HELP ME. THANK YOU. ALSO COMPLETE ALL PARTS. THANK YOU.

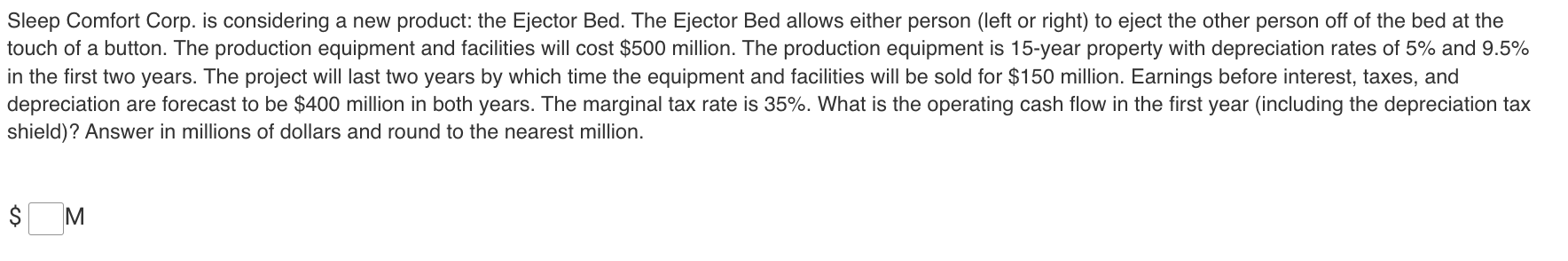

Sleep Comfort Corp. is considering a new product: the Ejector Bed. The Ejector Bed allows either person (left or right) to eject the other person off of the bed at the touch of a button. The production equipment and facilities will cost $500 million. The production equipment is 15-year property with depreciation rates of 5% and 9.5% in the first two years. The project will last two years by which time the equipment and facilities will be sold for $150 million. Earnings before interest, taxes, and depreciation are forecast to be $400 million in both years. The marginal tax rate is 35%. What is the operating cash flow in the first year (including the depreciation tax shield)? Answer in millions of dollars and round to the nearest million. $M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts