Question: Please do not copy from Chegg. Otherwise i have to report the answer. Case Study VII: Triangular Arbitrage As of Sunday, October 27th, 2019, 02:50

Please do not copy from Chegg. Otherwise i have to report the answer.

Please do not copy from Chegg. Otherwise i have to report the answer.

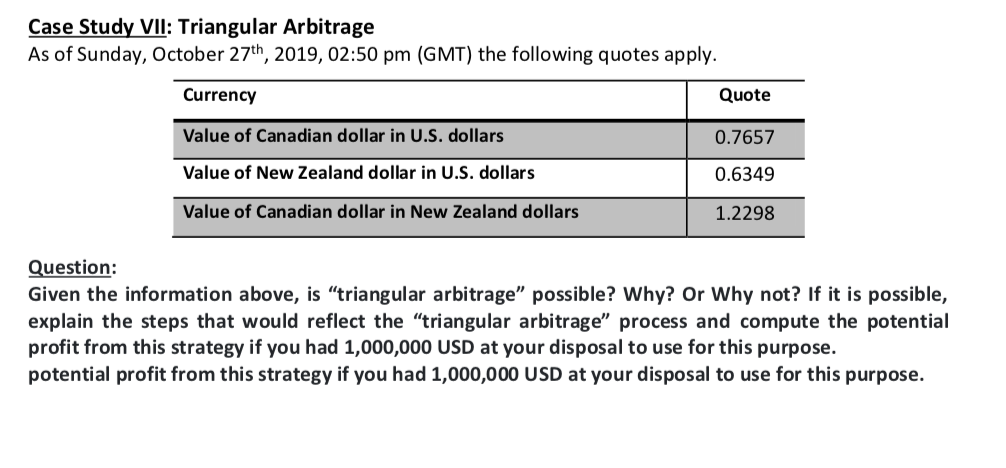

Case Study VII: Triangular Arbitrage As of Sunday, October 27th, 2019, 02:50 pm (GMT) the following quotes apply. Currency Quote Value of Canadian dollar in U.S. dollars 0.7657 Value of New Zealand dollar in U.S. dollars 0.6349 Value of Canadian dollar in New Zealand dollars 1.2298 Question: Given the information above, is triangular arbitrage possible? Why? Or Why not? If it is possible, explain the steps that would reflect the "triangular arbitrage process and compute the potential profit from this strategy if you had 1,000,000 USD at your disposal to use for this purpose. potential profit from this strategy if you had 1,000,000 USD at your disposal to use for this purpose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts