Question: Please do not copy from chegg otherwise i have to report the answer. Explain the answer throughly with showing each step of the calculation. State

Please do not copy from chegg otherwise i have to report the answer. Explain the answer throughly with showing each step of the calculation.

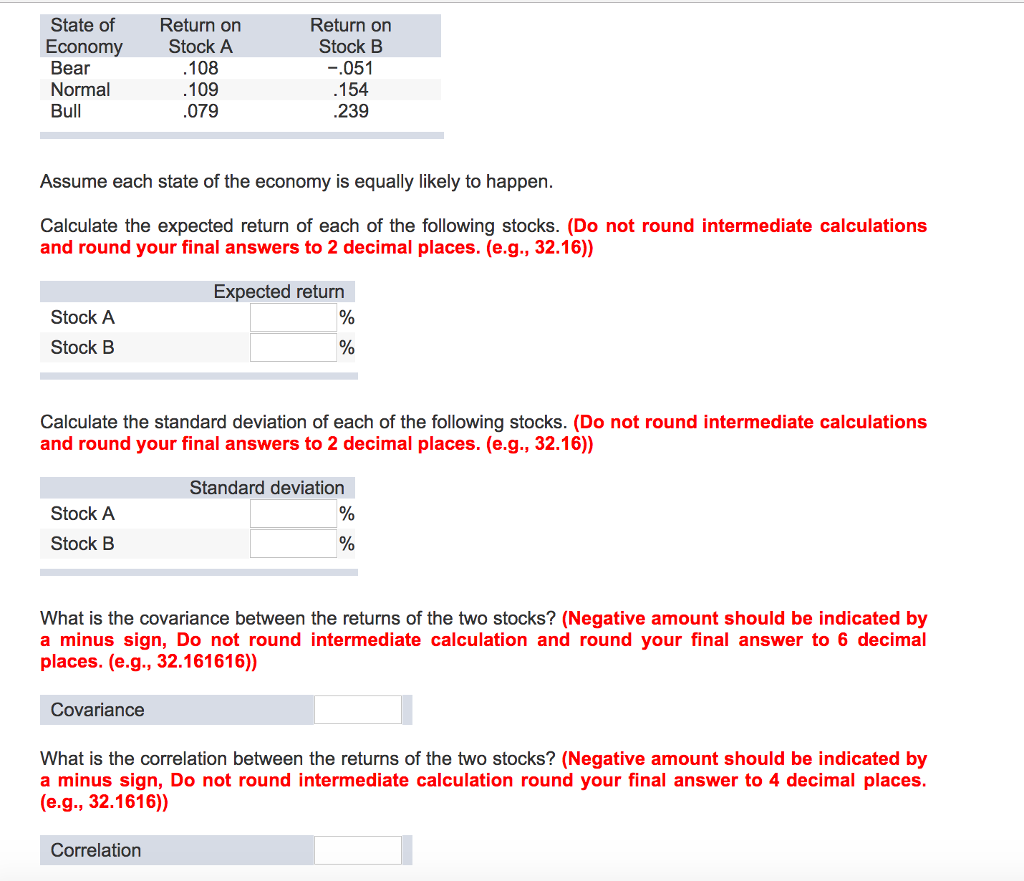

State of Economy Bear Normal Bull Return on Stock A . 108 Return on Stock B -.051 .154 .239 .109 .079 Assume each state of the economy is equally likely to happen. Calculate the expected return of each of the following stocks. (Do not round intermediate calculations and round your final answers to 2 decimal places. (e.g., 32.16)) Expected return % Stock A Stock B % Calculate the standard deviation of each of the following stocks. (Do not round intermediate calculations and round your final answers to 2 decimal places. (e.g., 32.16)) Standard deviation % Stock A Stock B % What is the covariance between the returns of the two stocks? (Negative amount should be indicated by a minus sign, Do not round intermediate calculation and round your final answer to 6 decimal places. (e.g., 32.161616)) Covariance What is the correlation between the returns of the two stocks? (Negative amount should be indicated by a minus sign, Do not round intermediate calculation round your final answer to 4 decimal places. (e.g., 32.1616) Correlation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts