Question: Please do not forget to show swaps graphically as said. Otherwise I will not become a full solution. Thank you. Companies A and B face

Please do not forget to show swaps graphically as said. Otherwise I will not become a full solution. Thank you.

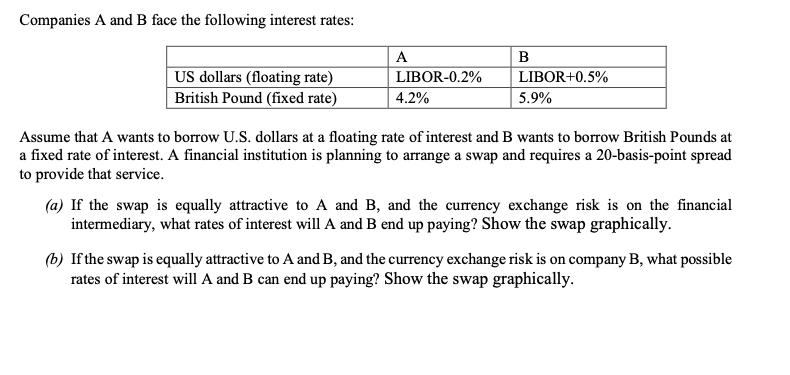

Companies A and B face the following interest rates: Assume that A wants to borrow U.S. dollars at a floating rate of interest and B wants to borrow British Pounds at a fixed rate of interest. A financial institution is planning to arrange a swap and requires a 20-basis-point spread to provide that service. (a) If the swap is equally attractive to A and B, and the currency exchange risk is on the financial intermediary, what rates of interest will A and B end up paying? Show the swap graphically. (b) If the swap is equally attractive to A and B, and the currency exchange risk is on company B, what possible rates of interest will A and B can end up paying? Show the swap graphically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts