Question: please do not hand write the answer amd explain your answer. The impact of the pandemic for share prices started to be realized at the

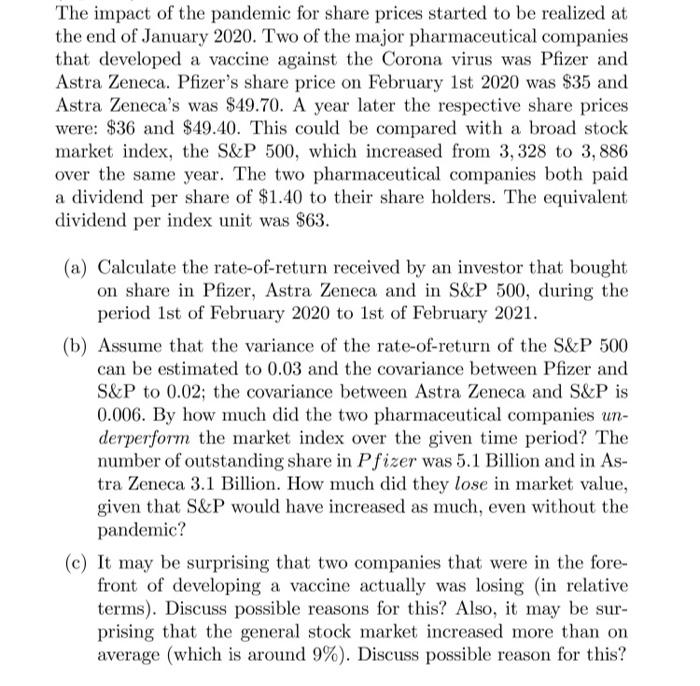

The impact of the pandemic for share prices started to be realized at the end of January 2020. Two of the major pharmaceutical companies that developed a vaccine against the Corona virus was Pfizer and Astra Zeneca. Pfizer's share price on February 1st 2020 was $35 and Astra Zeneca's was $49.70. A year later the respective share prices were: $36 and $49.40. This could be compared with a broad stock market index, the S&P 500, which increased from 3,328 to 3,886 over the same year. The two pharmaceutical companies both paid a dividend per share of $1.40 to their share holders. The equivalent dividend per index unit was $63. (a) Calculate the rate-of-return received by an investor that bought on share in Pfizer, Astra Zeneca and in S&P 500, during the period 1st of February 2020 to 1st of February 2021. (b) Assume that the variance of the rate-of-return of the S&P 500 can be estimated to 0.03 and the covariance between Pfizer and S&P to 0.02; the covariance between Astra Zeneca and S&P is 0.006. By how much did the two pharmaceutical companies un- derperform the market index over the given time period? The number of outstanding share in Pfizer was 5.1 Billion and in As- tra Zeneca 3.1 Billion. How much did they lose in market value, given that S&P would have increased as much, even without the pandemic? (c) It may be surprising that two companies that were in the fore- front of developing a vaccine actually was losing (in relative terms). Discuss possible reasons for this? Also, it may be sur- prising that the general stock market increased more than on average (which is around 9%). Discuss possible reason for this? The impact of the pandemic for share prices started to be realized at the end of January 2020. Two of the major pharmaceutical companies that developed a vaccine against the Corona virus was Pfizer and Astra Zeneca. Pfizer's share price on February 1st 2020 was $35 and Astra Zeneca's was $49.70. A year later the respective share prices were: $36 and $49.40. This could be compared with a broad stock market index, the S&P 500, which increased from 3,328 to 3,886 over the same year. The two pharmaceutical companies both paid a dividend per share of $1.40 to their share holders. The equivalent dividend per index unit was $63. (a) Calculate the rate-of-return received by an investor that bought on share in Pfizer, Astra Zeneca and in S&P 500, during the period 1st of February 2020 to 1st of February 2021. (b) Assume that the variance of the rate-of-return of the S&P 500 can be estimated to 0.03 and the covariance between Pfizer and S&P to 0.02; the covariance between Astra Zeneca and S&P is 0.006. By how much did the two pharmaceutical companies un- derperform the market index over the given time period? The number of outstanding share in Pfizer was 5.1 Billion and in As- tra Zeneca 3.1 Billion. How much did they lose in market value, given that S&P would have increased as much, even without the pandemic? (c) It may be surprising that two companies that were in the fore- front of developing a vaccine actually was losing (in relative terms). Discuss possible reasons for this? Also, it may be sur- prising that the general stock market increased more than on average (which is around 9%). Discuss possible reason for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts