Question: Case Analysis!! No plagiarism. Will give thumbs up 100% guaranteed. Please help. Thankyou!! The industry environment is always changing, and organizations need to take this

Case Analysis!! No plagiarism. Will give thumbs up 100% guaranteed. Please help. Thankyou!!

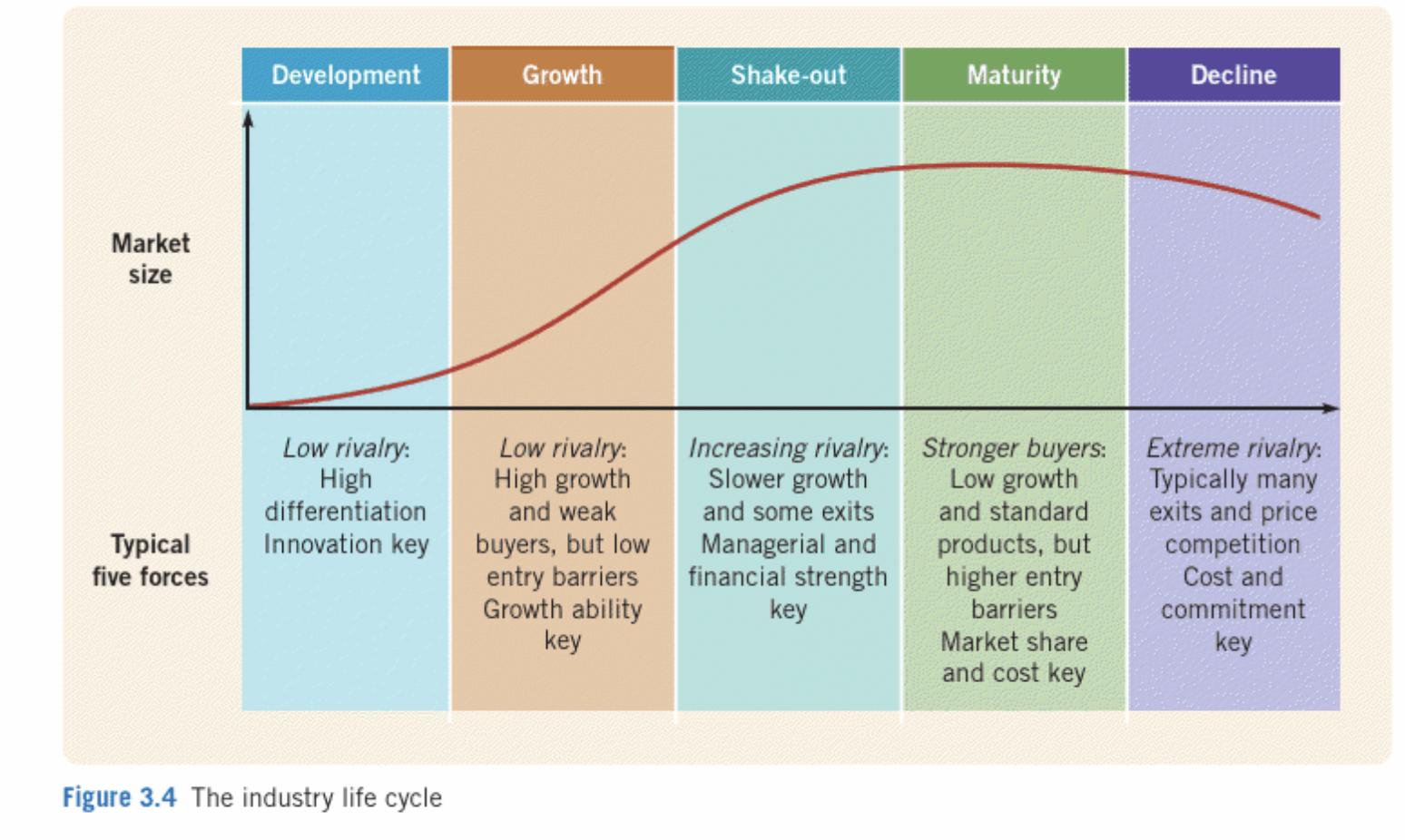

The industry environment is always changing, and organizations need to take this into account through their strategic management. Select the key aspects of Porters Five-force Framework (Figure 3.2) and analyze the chip manufacturing industry environment for Intel. Conclude your answer by identifying the stage of the industry life cycle(Figure 3.4) of global chip manufacturing. Identifying the key opportunities and/or threats that are likely to have an impact on Intels competitive position in the chip manufacturing industry.

Case analysis:

Figures:

Business The Economist January 23rd 2021 53 Also in this section 55 Bartleby: How to listen 56 A Tesla bull debates... 56 ...a Tesla bear 57 The MBA class of covid-19 58 Schumpeter: Sberbank's second pirouette 3T17 Semiconductors competition and innovation. Established chip designs, including those from AMD, A new architecture Nvidia and Intel, the world's biggest chip- maker by revenue, are being challenged by new creations. Web giants such as Amazon and Google, big customers of the incum- bents, are cooking up their own designs. They are joined by a gaggle of startups, ea- The global chip industry is becoming at once more diverse and more concentrated. The effects will be anything but nanoscopic ger to capitalise on demand for hardware tuned for the needs of Al, networking or N JANUARY 13TH Honda, a Japanese car- are used in nearly all smartphones, for other specialist applications. maker, said it had to shut its factory in $40bn. In October AMD, which makes blue- All this would be unequivocally great Swindon, a town in southern England, for a prints for graphics and general-purpose news for everyone, were it not for what is while. Not because of Brexit, or workers chips, announced another megadeal-to happening at the other end-in the fac- sick with covid-19. The reason was a short- acquire Xilinx, a maker of reprogrammable tories where those designs are turned into age of microchips. Other car firms are suf- chips, for $35bn. electronic circuits etched on shards of sili- fering, too. Volkswagen, which produces con. The ballooning costs of keeping up more vehicles than any other firm, has said Silicon splurge with advancing technology mean that the it will make 100,000 fewer this quarter as a Capital spending, too, is rising. Samsung, a explosion of chip designs is being fun- result. Like just about everything else these South Korean conglomerate, wants to in- nelled through a shrinking number of days-from banks to combine harvesters, vest more than $100bn over ten years in its companies capable of actually manufac- cars cannot run without computers. chip business (although some of that will turing them (see chart 2). Only three firms The chipmaking industry is booming. go to its memory chips used in things like in the world are able to make advanced pro- The market capitalisation of the world's flash drives rather than microprocessors). cessors: Intel, TSMC, whose home is an listed semiconductor firms now exceeds On January 14th Taiwan Semiconductor earthquake-prone island which China $4trn, four times what they were worth five Manufacturing Company (TSMC)which claims as its territory, and Samsung of ears (see chart 1 on next page). Chip- turns blueprints into silicon on behalf of South Korea, with a nuclear-armed despot- makers' share prices have surged during firms like AMD and Nvidia-stunned mar- ic neighbour to the north. The Semicon- the covid-19 pandemic, as work moved on- kets when it increased its planned capital ductor Industry Association, an American line and consumers turned to streaming spending for 2021 from $17.2bn to as much trade body, reckons that 80% of global and video games for succour. as $28bn, in anticipation of strong de- chipmaking capacity now resides in Asia. This has propelled a wave of dealmak- mand. That is one of the largest budgets of The vanguard may soon be down to two. ing. In September Nvidia, which designs any private firm in the world. Intel, which has pushed the industry's cut- powerful chips forgaming and artificial in- All this is happening amid a confluence ting edge for 30 years, has stumbled. On telligence (AI), said it would buy Arm, a of big trends that are realigning chipmak- January 18th news reports suggested that Britain-based company whose blueprints ing. At one end the industry is a hive of the company (which was due to report its 54 Business The Economist January 23rd 2021 5 4 3 IL... 2 1 cally. A raft of automated tools smooths the Nanobucks process. "It's not quite as simple as design- ing a custom T-shirt on Etsy," says Macolm Semiconductor firms, market capitalisation 1 Number of leading-edge 2 Penn, who runs Future Horizons, another Strn processor-manufacturing firms chip-industry analyst. But it isn't a world 30 away, either. TSMC 25 Although designing chips is now easier Samsung Electronics 20 than ever, making them has never been harder. Keeping up with Moore's law, even Nvidia 15 Intel as it slows, requires spending vast-and 10 Other growing-sums on factories stuffed with 5 ultra-advanced equipment: plasma-etch- ing kit, vapour-deposition devices and 180- tonne lithography machines the size of a 2005 10 15 211 2001 03 05 07 09 11 14 18 20 double-decker bus. After falling as a pro- *Not a pure semiconductor firm Sources: Bloomberg McKinsey, The Sconomist tatjan 19th Data unavailable for all years portion of overall revenue, the chip indus- try's capital spending is ticking up again (see chart 3). In absolute terms, the cost of latest quarterly results on January 21st, $1.4bn for Nuvia, a startup staffed by veter- high-tech "fabs", as chip factories are after The Economist went to press) may be ans of Apple's in-house chip-design team. known, has grown relentlessly-with no gin outsourcing some of its own produc- Custom silicon was an iffy proposition end in sight. tion to TSMC, which has overtaken it. a decade ago. General-purpose chips were Today's state-of-the-art is five-nano- And the world economy's foundational getting better quickly thanks to Moore's metre chips (though "5nm" no longer re- industry looks poised to polarise further, law, which holds that the number of com- fers to the actual size of transistors as earli- into ever greater effervescence in design ponents that can be crammed into a silicon er generations did). Both Samsung and and ever more concentrated production. chip should double every two years or so. TSMC began churning them out in 2020. This new architecture has far-reaching Today the Moorean metronome is breaking Their 3nm successors are due in 2022, with consequences for chipmakers and their down, as quirks offundamental physics in- 2nm pencilled in a few years later. customerswhich, in this day and age, in- terfere with components measured in na- cludes virtually everyone. nometres (billionths of a metre). Each tick Intel outside Start with the diversification. For years now takes closer to three years than two, At the turn of the millennium, a cutting- technology companies bought chips off the notes Linley Gwennap, who runs the Linley edge factory might have cost $ibn. A report shelf. In its 44-year history Apple has pro- Group, a research firm, and offers fewer in 2011 from McKinsey, a firm of manage- cured microprocessors for its desktops and benefits than it used to. ment consultants, put the typical cost of an laptops from Mos Technology, Motorola, That makes tweaking designs to eke out advanced fab at $3bn-4bn. More recently, IBM, and finally Intel. Soon after the launch performance gains more attractive, espe- TSMC's 3nm factory, completed in 2020, in of the original iPhone in 2007, however, the cially for big, vertically integrated firms. southern Taiwan, cost $19.5bn. The firm is firm decided to go it alone. Later iterations No one knows better than Apple exactly already pondering another for 2nm chips, of the smartphone employed its own de- how its chips will interact with the rest of which will almost certainly be more. Intel's signs, manufactured first by Samsung, and an iPhone's hardware and software. Cloud- stumbles have left it marooned at 10nm- later by TSMC. That approach proved so suc- computing giants have reams of data about and its boss, Bob Swan, out of a job. His in- cessful that in 2020 Apple announced that exactly how their hardware is used, and coming replacement, Pat Gelsinger, will it would replace Intel's products with tai- can tweak their designs to match. need to decide if the company, which, un- lor-made ones in its immobile Mac com- And whereas designing your own chips like TSMC, also designs its chips, wants to puters, too. once meant having to make them as well, keep making them. Potential new entrants Two years earlier Amazon Web Services, that is no longer true. These days most de- face enormous barriers to entry. The eco- the e-commerce giant's cloud computing signers outsource the manufacturing pro- nomics of fabs pushes these up higher with unit, began replacing some Intel chips in cess to specialists such as TSMC Or Global- every technological advance its data centres with its own "Graviton" de- Foundries, an American firm. Removing That matters. Not all chipmaking re- signs. Amazon claims its chips are up to the need to own factories cuts costs drasti- quires cutting-edge technology. Cars most- 40% more cost-efficient than Intel's. ly use older, duller semiconductors. Minia- Around the same time Google began offer turisation may seem less of an imperative ing its custom "Tensor Processing Unit" Fab-ulously expensive in roomy data centres. But it is crucial: chip, designed to boost Al calculations, to Semiconductor firms, capital expenditure there are some computations that only the its cloud clients. Baidu, a Chinese search As % of sales annual average most powerful chips can tackle. giant, claims its "Kunlun" Ar chips outpace 25 And demand for these is likely to grow offerings from Nvidia. Microsoft, the third as silicon infuses products from thermo- member of the Western cloud computing stats to tractors in the uber-connected "in- triumvirate, is rumoured to be working on ternet of Things". Between them TSMC and chip designs of its own. Samsung customers are already a "Who's Clever startups in the field are securing Who" of big tech-Apple, Amazon, Google, 10 billion-dollar valuations. Cerebras, an Nvidia, Qualcomm (and soon, if the news American firm which designs Ar chips, has reports are true, Intel itself). As things like 5 earned one of $1.2bn. A British rival called cars become more computerised and go Graphcore, which has been working with electric (see next article), the chips that go Microsoft, was valued at $2.8bn in Decem- into them will become more advanced, too. 1988 95 2000 05 10 15 20 ber. On January 13th Qualcomm, a firm Tesla, an American maker of electric cars, Source: Future Horizons Jan-Now best-known for its smartphone chips, paid already relies on TSMC's 7nm fabs to make - Myn The Economist January 23rd 2021 Business 55 its in-house self-driving chips. Asia's nanoscale duopoly remains fiercely competitive, as Samsung and TSMC keep each other on their toes. The Taiwan- ese firm's operating margins have been more or less steady since 2005, when 15 other firms were operating at the cutting edge. But the logical endpoint of the relent- less rise in manufacturing costs is that, at some point, one company, in all likelihood TSMC, could be the last advanced fab stand- ing. For years, says an industry veteran, tech bosses mostly ignored the problem in the hope it would go away. It has not. Those worries are sharpened by the in- vanced factories, has given handouts to dustry's growing political importance. As TSMC in return for a fab in Arizona. Sam- part of its economic war against China, sung may expand the one it runs in Texas. America has sought to deny Chinese firms Another package of subsidies and incen- the ability to build leading-edge chip fac- tives is awaiting funding from Congress. tories of their own. China has put semicon- The European Union, which has pockets of ductors at the core of a multibillion-dollar high technology in Belgium and the Neth- plan to become self-sufficient in critical erlands, wants more of them. In December technologies by 2025-especially now that 17 EU countries agreed to spend tens of bil- American sanctions have deprived it of lions in post-pandemic stimulus cash to some foreign imports. try to create leading-edge factories by the The structural forces behind increased middle of the decade. The chip industry's concentration are here to stay. America, history suggests these sums will only get worried about losing access to the most ad- more eye-watering with time. Bartleby Hear, hear The secrets of successful listening W pletely." Those words of Ernest Hemingway might be a pretty good guid- ing principle for many managers, as might the dictum enunciated by Zeno of Citium, a Greek philosopher: "We have two ears and one mouth, so we should listen more than we say." For people like being listened to. Some firms use a technique known as a "listening circle" in which participants are encouraged to talk openly and hon- estly about the issues they face (such as problems with colleagues). In such a circle, only one person can talk at a time and there is no interruption. A study cited in the Harvard Business Review found that employees who had taken part in a listening circle subsequently suffered less social anxiety and had fewer worries about work-related mat- ters than those who did not. Listening has been critical to the career of Richard Mullender, who was a British police officer for 30 years. Eventu- ally he became a hostage negotiator, dealing with everything from suicide interventions to international kidnaps. By the end of his stint in uniform, he was the lead trainer for the Metropolitan Police's hostage-negotiation unit. When he left the force in 2007, he realised that his skills might be applica- ble in the business world. So he set up a firm called the Listening Institute. Mr Mullender defines listening as "the identification, on and interpreta- tion of the key words that turn infor- mation into intelligence". It is crucial to all effective communication. Plenty of people think that good listening is about nodding your head or keeping eye contact. But that is not really listening, Mr Mullender argues. A good listener is always looking for facts, emo- tions and indications of the interlocutor's Of course, a listener needs to speak values. And when it comes to a negotia- occasionally. One approach is to make an tion, people are looking for an outcome. assessment of what the other person is The aim of listening is to ascertain what telling you and then check it with them the other side is trying to achieve. ("It seems to me that what you want is Another important point to bear in X"). That gives the other party a sense mind is that, when you talk, you are not that they are being understood. The listening. "Every time you share an opin- fundamental aim is to build up a rela- ion, you give out information about your- tionship so the other person likes you self," Mr Mullender says. In contrast, a and trusts you, Mr Mullender says. good listener, by keeping quiet, gains an The pandemic has meant that most edge over his or her counterpart business conversations now take place Hostage negotiators usually work in on the phone or online. Precious few teams, but the lead negotiator is the only in-person meetings occur. Some might one who talks. "What we teach is that the think this makes listening more difficult; second person in the team doesn't really it is harder to pick up the subtle cues that talk at all, because if they are busy thinking people reveal in their facial expressions about the next question to ask, they aren't and body language. really listening," Mr Mullender explains. But Mr Mullender says that too much The mistake many people make is to is made of body language. It is much ask too many questions, rather than let- easier to understand someone if you can ting the other person talk. The listener's hear them but not see them, than if you focus should be on analysis. If you are can see but not hear them. He prefers to trying to persuade someone to do some- negotiate by telephone thing, you need to know what their beliefs Another key to good listening is are. If someone is upset, you need to assess paying attention and avoiding distrac- their emotional state. tion. In the information age, it is all too easy for focus to drift to a news headline, a TikTok video or the latest outrage on Twitter. In another study in the Harvard Business Review, participants paired with distracted listeners felt more anxious than those who received full attention. The lockdown has increased the need for managers to listen to workers, since the opportunities for casual conversa- tion have dwindled. Mr Mullenderthinks that many people have become frustrat- ed in their isolation, which can lead to stress and anger. He thinks there may be a business opportunity in helping man- agers listen more efficiently, so they can enhance employee well-being. After a year of isolation, many workers would probably love the chance to be heard. The Economist May 2nd 2020 Business 61 Schumpeter | The riddle of Samsung What is weighing on one of the world's most remarkable companies? gious employer and a magnet for bright graduates. Mostenigmaticof all is the success bred by this inclementenvi- ronment. Within a few years of that frosty march, Samsung Elec- tronics' semiconductor business had caught up with its big Japa- nese competitors. In 2011, just two years after it had introduced its first smartphone, its Galaxy devices edged past Apple's iPhone in sales volume. Its speed is matched by its chutzpah; competitors, like Apple and Sony, are also the biggest customers for its compo- nents, from chips tOOLED screens. Samsung makes diversification seem like a virtue, not a distraction. When sales of phones and oth- er gadgets suffer, as they did in the first quarter owing to the co- vid-19 crisis, the memory-chip business provides ballast; it got a boost from lockdown-related use of cloud-based servers, Samsung said on April 29th. Ten years after the Lees decided to further div- ersify the conglomerate by 2020, the pandemic has helped turn Samsung Biologics, a manufacturer of vaccines and other pharma- ceuticals, into South Korea's third-most-valuable company. So what puts the fire into Samsung's kimchi? Mark Newman, a URE former Samsung Electronics employee now at Bernstein, an in- vestment firm, says the secret ingredient has always been faith in the founding family, who, for all their flaws, retain a godlike status withi he firm. As in Western companies, executives over VEN , complex Ecross-shareholdings and cultlike initiation rituals, samsung they quickly fall into line. That helps some of Samsung's bold, stra: , stands out as the most mysterious of firms. Founded in 1938 as a tegic bets to pay off. Others, such as Samsungcars and solar panels, provincial vegetable and dried-fish shop, it has grown into a con- have not glomerate accounting for a fifth of South Korea's exports. Its crown Samsung executives believe it is time for another big flutter on jewel, Samsung Electronics, has for years been one of the world's the future-nowhere more so than at Samsung Electronics. For all biggest seller of smartphones, televisions and chips, with a market its strengths, it has two big problems to grapple with. The first is capitalisation of more than $270bn and 310,000 workers in 74 how to become more than just the world's most exemplary slicer- countries. The group's riveting story, chronicled in a new book, and-dicer of chips, screens and gadgets. It wants to triumph in "Samsung Rising" by Geoffrey Cain, is one of entrepreneurial der- higher-margin (and chicer) software and services. As smartphone ring-do and excruciating work habits mixed with scandals, ven- sales peak, Apple is enveloping its customers in wearables, watch- dettas and political intrigue. What the author (a former contribu- ables and listenables. The American giant's returns dwarf Sam- tor to this newspaper) skips over is how a company with so many sung's. Rather than develop its own operating system to rival Ap- well-documented flaws can be such a resounding success. ple's, the Korean firm outsourced the job to Google's Android. To get a sense of the Samsung enigma consider first its ruling Instead of software, it has recently doubled down on manufactur- dynasty. Long before Kim Jong Un, North Korea's dictator, disap- ing non-memory chips and biopharmaceuticals. To make a suc- peared from view in April, Samsung's chairman, Lee Kun-hee, van- cess of services, especially in the era of the all-connected "Internet ished into hospital. The 78-year-old has not been heard from since of Things", it needs creative skills that it has struggled to nurture. 2014. No one outside the family knows how ill he is. His only son The second challenge is China. The country is changing both as and heir-apparent, Lee Jae-yong, aged 50, faces a retrial on charges a market and as a source of competition. Last year Samsung pulled of influence-peddling, for which he spent almost a year behind the plug on smartphone production in China after its market bars in 2017-18. Jay, as he calls himself, has exerted huge influence share, once in double digits, fell below 1%. Big Chinese firms have over Samsung Electronics despite directly owning a tiny fraction the cash and long-term focus to give it a run for its money in semi- of its shares and no longer sitting on its board, thanks to an own- conductors. Phone companies like Xiaomi are better at software ership structure set up around other group holdings and family and apps. As one of the biggest beneficiaries of globalisation, Sam- foundations. It is not clear who would represent the clan's inter- sung will draw little consolation from the prospect of supplying ests if Jay were found guilty. the West if the tech cold war gets worse. The chaebol's corporate culture is no less eyebrow-raising. Mr Cain describes a leadership style at Samsung Electronics that is Less leeway military-like, macho and intolerant of mistakes. When the con- Despite $81bn of net cash (more than the market value of Sony) to glomerate turned from fertilisers and transistors to semiconduc- invest, a sense of gloom pervades Samsung Electronics. With the tors in the early 1980s, the ruling family toughened up its chip en- Lee family in an agonising limbo, it is unable to place big strategic gineers with an overnight march in midwinter, followed by the wagers, jeopardising its ability to move beyond manufacturing or usual 16-hour work shift. In 1995, to embarrass its technicians for compete with Chinese rivals. There is a way forward. Like most dy- shoddy workmanship, the elder Mr Lee ordered a bonfire of nastic firms, Samsung will eventually have to put all its faith in 140,000 gadgets; $50m went up in smoke. Mr Cain recounts nu- professional managers, rather than in its founding family. Now is merous expletive-filled tirades by the firm's top brass. And yet as good a time as any tostart. To be sure, it will take the mystery out Samsung Electronics continues to be South Korea's most presti- of the firm. It doesn't have to kill its mojo. Intel Hard reboot Splaceme Can Pat Gelsinger turn the chipmaking giant around? UCCESS BREEDS complacency. Com- He takes the helm of a company that looks, placency breeds failure. Only the par- from some angles, to be in rude health. anoid survive. So said Andy Grove, the With $78bn in revenue in 2020, it is the Hungarian emigr who helped turn Intel world's biggest chipmaker by sales. It has a from a scrappy startup in the 1960s into the 93% share of the market for powerful-and firm that did more than any other to put lucrative-chips that go into data-centre the silicon in Silicon Valley. They will be computers, an 81% share in desktop PCs, ringing in the ears of Pat Gelsinger, Intel's and operating margins of around 30%. new boss, who took over on February 15th. Yet Intel's share price has underper- formed those of rivals. Nvidia, a firm with one-seventh of Intel's revenues, has a mar- When the chips are down ket capitalisation, at $370bn, that is half as Selected semiconductor firms high again (see chart). The manufacturing Market capitalisation, $bn technology on which much of Intel's suc- 600 cess was built has fallen behind. It has mis- sed the smartphone revolution. Some of its 500 big customers, such as Apple and Amazon, Intel TSMC 400 are turning into competitors. Mr Gelsinger inherits quite the in-tray, then. Nvidia 300 Start with production. Chipmaking is 200 propelled by the quest for smallness. Shrinking the components in integrated 100 circuits, these days to tens of nanometres AMD 0 (billionths of a metre), improves the per- formance of both the components and the 2000 05 10 15 21 microchip as a whole. For decades Intel led Source: Refinitiv Datastream the way, its "tick-tock strategy promising Moly Maremman 54 Business The Economist February 20th 2021 a manufacturing revolution every other cier desktop and graphics chips. Daniel chips are a front in America's tech war with year. Now "it has lost its mojo," says Alan Loeb, an activist investor with a sizeable China, politicians may veto a sale to a non- Priestley of Gartner, a research firm, who stake in Intel, sent a letter to the firm's American bidder. worked at Intel for many years. Its "ten na- management in December urging it to In any case, Mr Gelsinger has said he nometre" chips were originally pencilled abandon factories entirely and restrict it- will ignore Mr Loeb's suggestion. In Janu- in for 2015 or 2016 but did not start trickling self to designing chips that other firms, ary the new boss said that, although the out until 2019-an unprecedented delay. such as TSMC, would make. On paper, that firm may use more outsourcing for some The technology is still not mature. In July looks attractive: Intel capital expenditure products, he intends to pursue the hard, Intel said the next generation of "seven in 2020 amounted to $14.2bn, almost all of costly task of restoring Intel to its custom- nanometre" chips would not arrive until it on its chip factories. AMD, meanwhile, ary position at chipmaking's leading edge. 2022, a delay of at least six months. spun out its manufacturing business in He also seems minded to pursue his prede- Manufacturing stumbles have cost it 2009, and is thriving today. Nvidia has cessor's strategy of diversifying into new business. AMD, its most direct rival, out- been "fabless" since its founding in 1993. products, including graphics-to-AI chips. sources production to Taiwan Semicon- Finding a buyer could be tricky, says "Our opportunity as a world-leading semi- ductor Manufacturing Company (TSMC), Linley Gwennap, a veteran chip-industry conductor manufacturer is greater than it's whose technology is now ahead of Intel's. watcher, precisely because Intel's factories ever been," he wrote. The direction of trav- That means AMD's chips are generally fas- are now behind the cutting edge. Most of el, then, is not about to change. Intel's sha- ter, and consume less power; its market the world's chipmakers, which might be reholders will have to hope that Mr Gelsin- share has more than doubled since 2019. tempted by the fabs, are in Asia. Since ger can at least get it back on the pace. A second challenge is the industry's growing specialisation-a problem for In- tel's traditional forte of general-purpose The record industry chips, especially if desktop PCs continue to Musical shares stagnate. Technology giants, flush with cash and keen to extract every drop of per- formance for their specific purposes, in- creasingly design their own semiconduc- The latest listing of a major label shows the streaming boom is maturing tors. In 2020 Apple said it would drop Intel TROM "GOLD DIGGER" to "Money, Mon- down C7bn for Universal from SoftBank, from its laptops and desktops in favour of Fey, Money", Vivendi's shareholders a Japanese group, the offer looked gener- custom-designed chips. Amazon is rolling have lots of tunes to whistle as they stroll ous. The recorded-music industry was out its "Graviton" cloud-computing proc. to the bank. On February 13th the French on its knees, revenues cut almost in half essors, also designed in-house and made conglomerate announced plans to spin by online piracy. Now the internet is by TSMC. Microsoft, whose cloud business off Universal Music Group, its most powering a revival, as streamers like is second only to Amazon's, is rumoured to valuable asset and the world's largest Spotify bring in subscribers. Universal be working on something similar. record label. Vivendi and Tencent, Uni- posted a 5% rise in revenues, year on Intel has also failed to make any head- versal's Chinese co-owner, will each year, in the first nine months of 2020. way in smartphones, the most popular retain a 20% stake, with the rest distrib- Industry sales should surpass their peak computers ever made. An effort in the late uted among Vivendi's shareholders. in 1999 within three years, 1990s to build graphics chips, which have Universal, which owns the rights to By going solo Universal will shed the also proved handy for artificial intelli- those Kanye and ABBA classics, among "conglomerate discount" that weighs gence (AI), and to which Nvidia owes its other discographies, will be the second down Vivendi's shares, as would be enviable valuation, petered out. Attempts big label to go public. Warner Music investors in the music business are put to diversify into clever new sorts of pro- Group did so last June. Its value has since off by its parent's TV, advertising, tele- grammable or memory chips-in 2015 it risen by 28%, to $2bn. Vivendi expects coms and other interests. The music paid $16.7bn for Altera, which makes Universal's to exceed 30bn ($36bn). business is thirsty for capital. An exec- them-have so far not paid off in a big way. Eight years ago, when Vivendi turned utive at another label reports bidding Mr Gelsinger has yet to say how he wars in which artists offered $200,000 to plans to deal with the challenges. He does sign in the morning command $500,000 not look like a revolutionary. He began by day's end. Vivendi, for its part, is working at Intel aged 18, before leaving in looking at new media acquisitions, many 2009 to preside over EMC, a data-storage of which are going cheap firm, and for the past nine years heading Yet the listing also hints that recorded VMware, a software firm. In an email to In- music's comeback may be nearing a tel's staff after his appointment was an- crescendo. Double-digit revenue growth nounced he invoked its glory days, recall- in recent years will drop to about 3% a ing being "mentored at the feet of Grove, year by 2024, forecasts Bernstein, a (Robert) Noyce and (Gordon Moore", the broker. Three in five American homes last two being the firm's founders. Like now have a music-streaming subscrip- them but unlike his predecessor, Bob tion, up from one in five in 2016. The Swan, Mr Gelsinger is an engineer, who in share won't go much higher. Artists, as 1989 led the design of a flagship chip. well as platforms like TikTok, are press- His first job will be to try to turn the ing labels for a better deal on royalties. firm's ailing manufacturing division "There's a phrase in French: 'The trees around. Intel already outsources the man- don't grow right up to the sky," says ufacturing of some lower-end chips to Simon Gillham, who sits on Vivendi's TSMC. Its production woes will force it, at management board. "There's a right time least temporarily, to send more business to Kanye ponders Universal truths to cash in on the value you've created." Taiwan, perhaps including some of its pri- Potential entrants Threat of entry Suppliers Competitive rivalry Buyers Bargaining power Bargaining power Threat of substitutes Substitutes Figure 3.2 The Five Forces Framework Development Growth Shake-out Maturity Decline Market size Typical five forces Low rivalry: Low rivalry: High High growth differentiation and weak Innovation key buyers, but low entry barriers Growth ability key Increasing rivalry: Stronger buyers: Slower growth Low growth and some exits and standard Managerial and products, but financial strength higher entry key barriers Market share and cost key Extreme rivalry: Typically many exits and price competition Cost and commitment key Figure 3.4 The industry life cycle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts