Question: Please DO NOT POST EXCEL File. Caspian Sea Drinks (CSD) is considering the introduction of a new diet drink, Caspian Seas One Your team has

Please DO NOT POST EXCEL File.

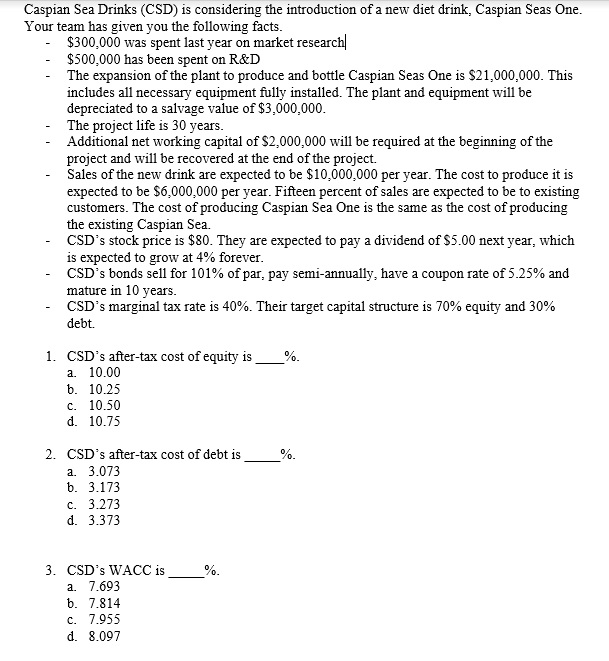

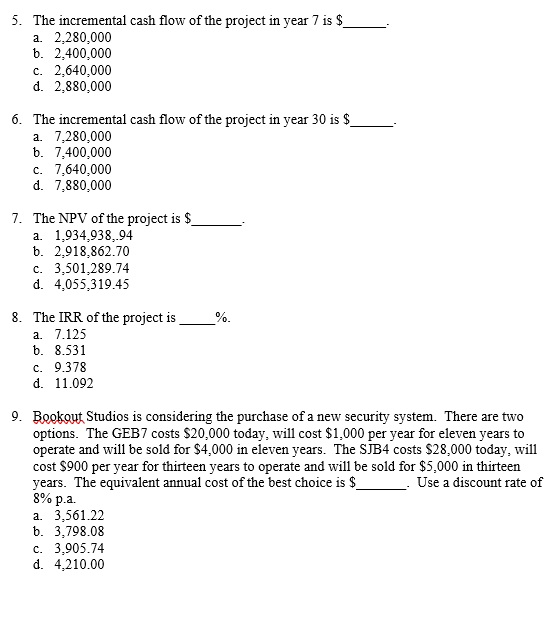

Caspian Sea Drinks (CSD) is considering the introduction of a new diet drink, Caspian Seas One Your team has given you the following facts - $300,000 was spent last year on market research $500,000 has been spent on R&D The expansion of the plant to produce and bottle Caspian Seas One is S21,000,000. This includes all necessary equipment fully installed. The plant and equipment will be depreciated to a salvage value of $3,000,000 The project life is 30 years Additional net working capital of $2,000,000 will be required at the beginning of the project and will be recovered at the end of the project. Sales of the new drink are expected to be $10,000,000 per year. The cost to produce it is expected to be $6,000,000 per year. Fifteen percent of sales are expected to be to existing customers. The cost of producing Caspian Sea One is the same as the cost of producing the existing Caspian Sea. CSD's stock price is $80. They are expected to pay a dividend of S5.00 next year, which is expected to grow at 4% forever CSD's bonds sell for 101% of par, pay semi-annually, have a coupon rate of 5.25% and mature in 10 years CSD's marginal tax rate is 40%. Their target capital structure is 70% equity and 30% debt. - - 1, CSD's after-tax cost of equity is a. 10.00 b. 10.25 c. 10.50 d. 10.75 % 2. CSD's after-tax cost of debt is a. 3.073 b. 3.173 . 3273 d. 3.373 3. CSD's WACC is a. 7.693 b. 7.814 c. 7.955 d. 8.097

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts