Question: Please do not solve using excel. I am not allowed to use it for this class. If you could explain the reasoning and the base

Please do not solve using excel. I am not allowed to use it for this class. If you could explain the reasoning and the base equations used to solve that would be amazing. Thank you so much Please do not solve using excel. I am not allowed to use it for this class. If you could explain the reasoning and the base equations used to solve that would be amazing. Thank you so much

Please do not solve using excel. I am not allowed to use it for this class. If you could explain the reasoning and the base equations used to solve that would be amazing. Thank you so much

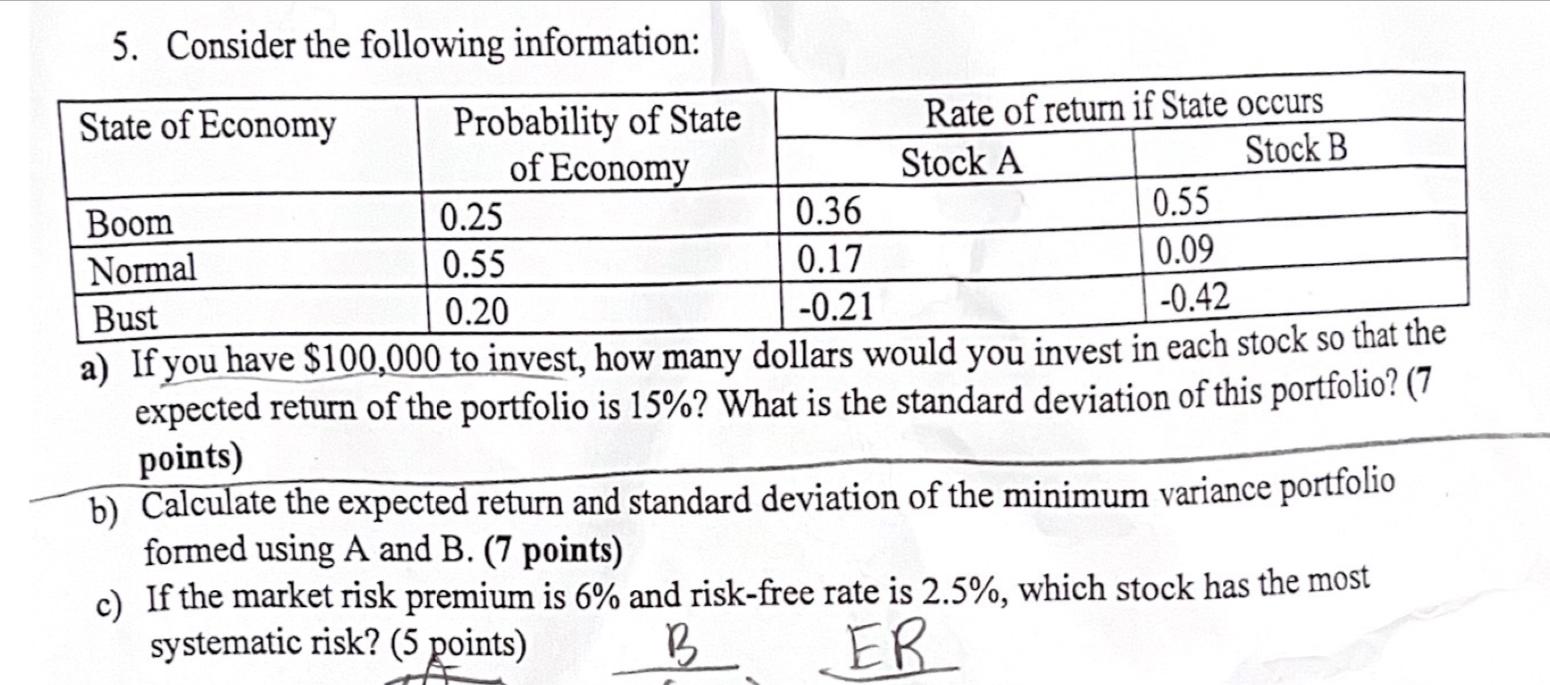

5. Consider the following information: State of Economy Probability of State Rate of return if State occurs of Economy Stock A Stock B Boom 0.25 0.36 0.55 Normal 0.55 0.17 0.09 Bust 0.20 -0.21 -0.42 a) If you have $100,000 to invest, how many dollars would you invest in each stock so that the expected return of the portfolio is 15%? What is the standard deviation of this portfolio? (7 points) b) Calculate the expected return and standard deviation of the minimum variance portfolio formed using A and B. (7 points) c) If the market risk premium is 6% and risk-free rate is 2.5%, which stock has the most systematic risk? (5 points) B. ER 5. Consider the following information: State of Economy Probability of State Rate of return if State occurs of Economy Stock A Stock B Boom 0.25 0.36 0.55 Normal 0.55 0.17 0.09 Bust 0.20 -0.21 -0.42 a) If you have $100,000 to invest, how many dollars would you invest in each stock so that the expected return of the portfolio is 15%? What is the standard deviation of this portfolio? (7 points) b) Calculate the expected return and standard deviation of the minimum variance portfolio formed using A and B. (7 points) c) If the market risk premium is 6% and risk-free rate is 2.5%, which stock has the most systematic risk? (5 points) B. ER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts