Question: Please do not use an answer that has already been posted. On February 1. 2011, Enzo Natale, head of Finance and Operations at Altimus Brands

Please do not use an answer that has already been posted.

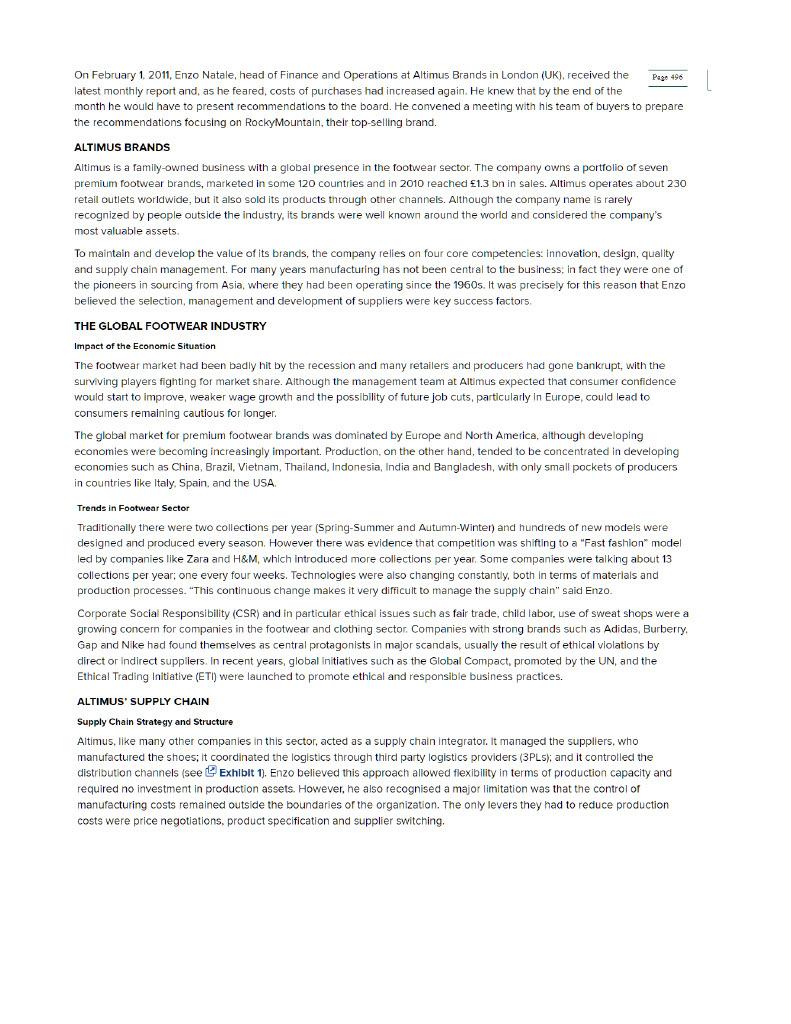

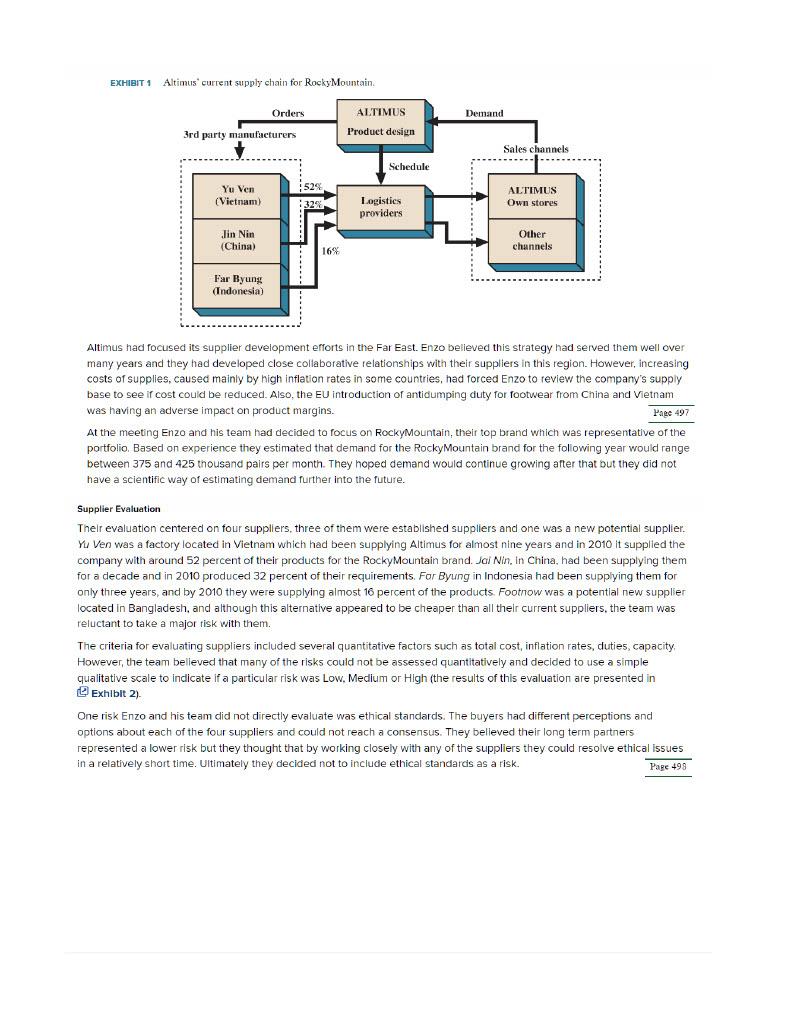

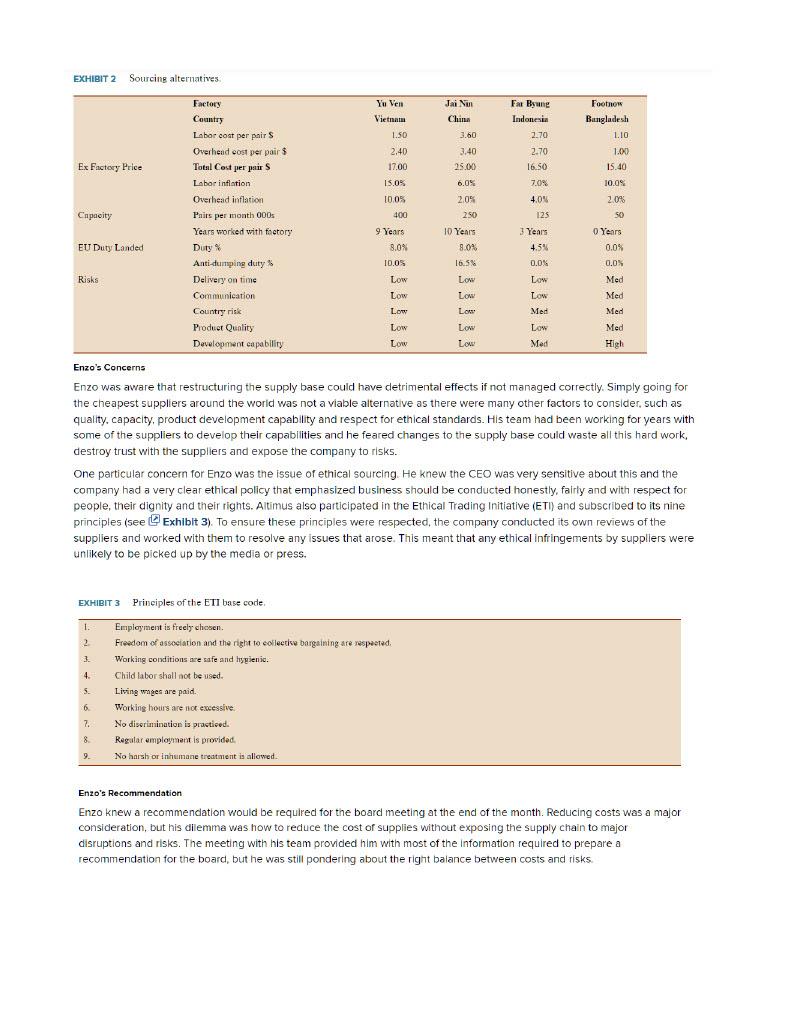

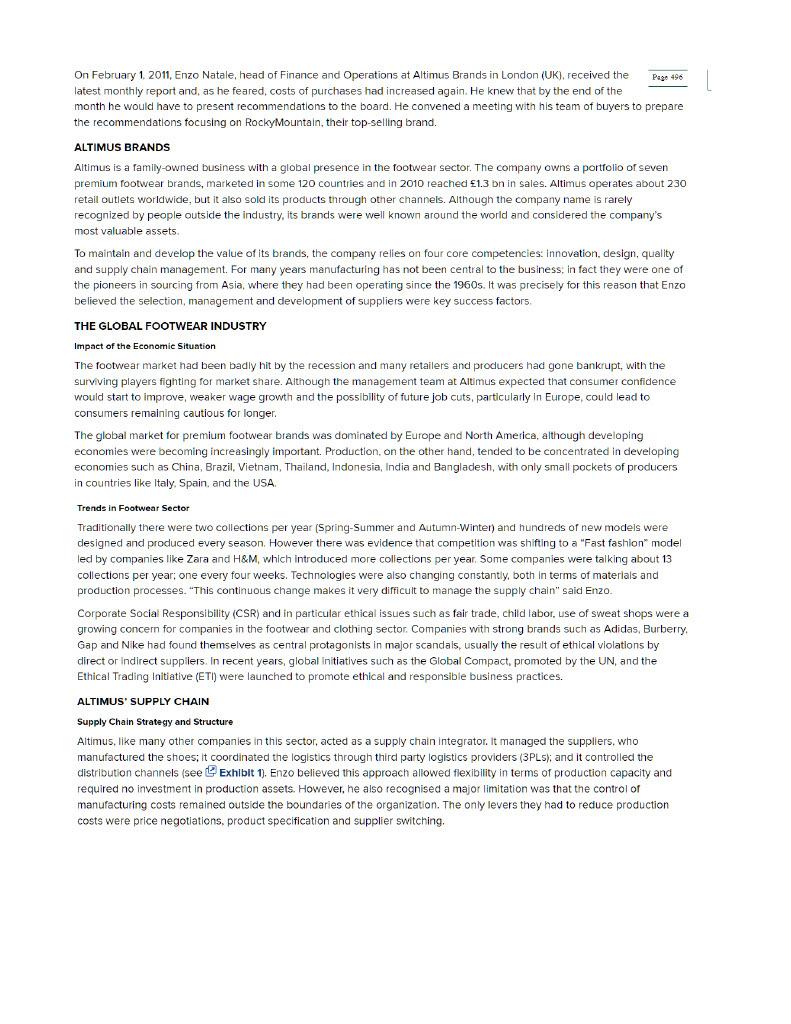

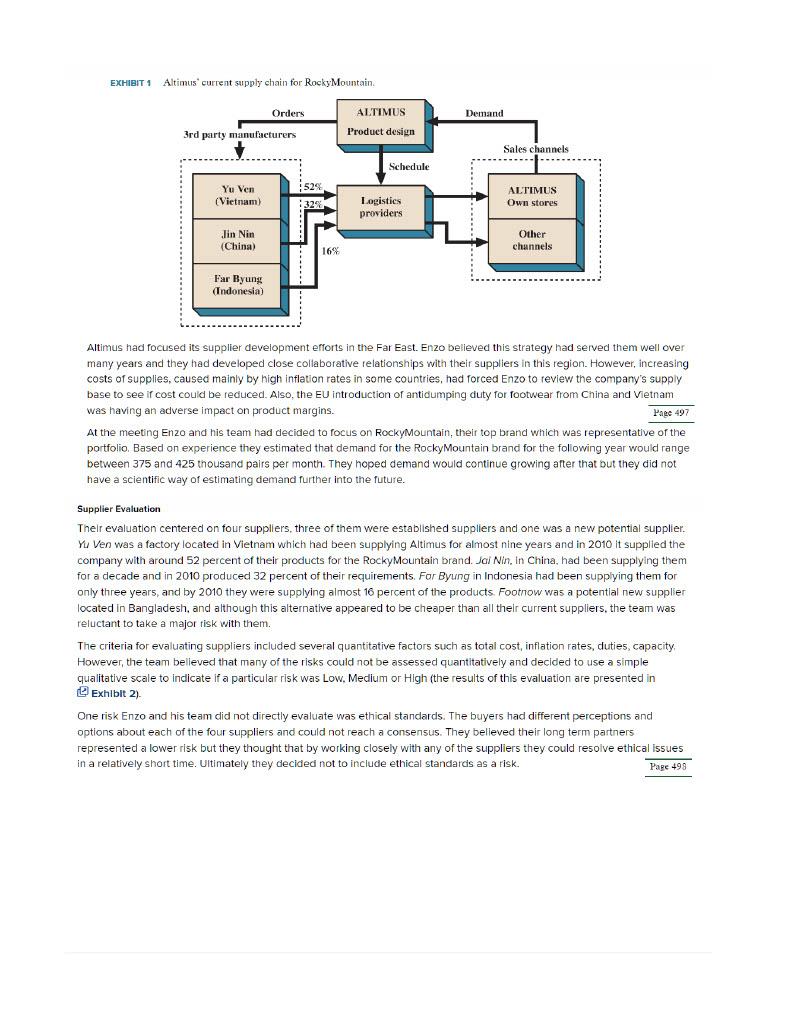

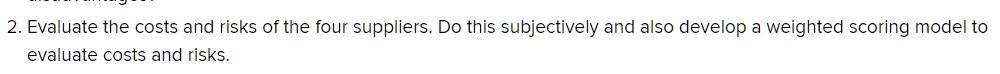

On February 1. 2011, Enzo Natale, head of Finance and Operations at Altimus Brands in London (UK), received the latest monthly report and, as he feared, costs of purchases had increased again. He knew that by the end of the month he would have to present recommendations to the board. He convened a meeting with his team of buyers to prepare the recommendations focusing on RockyMountain, their top-selling brand. ALTIMUS BRANDS Altimus is a family-owned business with a global presence in the footwear sector. The company owns a portfolio of seven premium footwear brands, marketed in some 120 countries and in 2010 reached 1.3 bn in sales. Altimus operates about 230 retall outlets worldwide, but it also sold its products through other channels. Although the company name is rarely recognized by people outside the industry, its brands were well known around the world and considered the company's most valuable assets. To maintain and develop the value of its brands, the company relles on four core competencies: Innovation, design, quality and supply chain management. For many years manufacturing has not been central to the business; in fact they were one of the pioneers in sourcing from Asia, where they had been operating since the 1960 . It was precisely for this reason that Enzo believed the selection, management and development of suppliers were key success factors. THE GLOBAL FOOTWEAR INDUSTRY Impact of the Economie Situation The footwear market had been badly hit by the recession and many retailers and producers had gone bankrupt, with the surviving players fighting for market share. Although the management team at Altimus expected that consumer confidence would start to improve, weaker wage growth and the possibility of future job cuts, particularly in Europe, could lead to consumers remaining cautious for longer. The global market for premium footwear brands was dominated by Europe and North America, although developing economies were becoming increasingly important. Production, on the other hand, tended to be concentrated in developing economies such as China, Brazil, Vietnam, Thailand, Indonesia, India and Bangladesh, with only small pockets of producers in countries like Italy, Spain, and the USA. Trends in Footwear Sector Traditionally there were two collections per year (Spring-Summer and Autumn-Winten) and hundreds of new models were designed and produced every season. However there was evidence that competition was shifting to a "Fast fashlon" model led by companies like Zara and H \&M, which introduced more collections per year. Some companies were talking about 13 collections per year; one every four weeks. Technologies were also changing constantiy, both in terms of materials and production processes. "This continuous change makes it very difficult to manage the supply chain" said Enzo. Corporate Social Responsibility (CSR) and in particular ethical issues such as fair trade, child labor, use of sweat shops were a growing concern for companies in the footwear and clothing sector. Companies with strong brands such as Adidas, Burberry. Gap and Nike had found themselves as central protagonists in major scandais, usually the result of ethical violations by direct or indirect suppliers. In recent years, global initiatives such as the Global Compact, promoted by the UN, and the Ethical Trading Initiative (ETI) were launched to promote ethical and responsible business practices. ALTIMUS' SUPPLY CHAIN Supply Chain Strategy and Structure Altimus, like many other companies in this sector, acted as a supply chain integrator. it managed the suppliers, who manufactured the shoes; it coordinated the loglstics through third party logistics providers (3PLs); and it controlled the distribution channels (see 6 Exhlbit 1). Enzo believed this approach allowed flexibility in terms of production capacity and required no investment in production assets. However, he also recognised a major limitation was that the control of manufacturing costs remained outside the boundaries of the organization. The only levers they had to recluce production costs were price negotiations, product specification and supplier switching. Altimus had focused its supplier development efforts in the Far East. Enzo belleved this strategy had served them well over many years and they had developed close collaborative relationships with their suppliers in this region. However, increasing costs of supplies, caused mainly by high inflation rates in some countries, had forced Enzo to review the company's supply base to see if cost could be reduced. Also, the EU introduction of antidumping duty for footwear from China and Vietnam was having an adverse impact on product margins. At the meeting Enzo and his team had decided to focus on Rockymountain, their top brand which was representative of the portfolio. Based on experience they estimated that demand for the RockyMountain brand for the following year would range between 375 and 425 thousand pairs per month. They hoped demand would continue growing after that but they did not have a scientific way of estimating demand further into the future. Supplier Evaluation Their evaluation centered on four suppllers, three of them were established suppliers and one was a new potential supplier. Yu Ven was a factory located in Vietnam which had been supplying Altimus for almost nine years and in 2010 it supplied the company with around 52 percent of their products for the RockyMountain brand. Jai Nin, In China, had been supplying them for a decade and in 2010 produced 32 percent of their requirements. For Byung in Indonesia had been supplying them for only three years, and by 2010 they were supplying almost 16 percent of the products. Footnow was a potential new supplier located in Bangladesh, and although this alternative appeared to be cheaper than all their current suppliers, the team was reluctant to take a major risk with them. The criteria for evaluating suppliers included several quantitative factors such as total cost, inflation rates, duties, capacity, However, the team belleved that many of the risks could not be assessed quantitatively and decided to use a simple qualitative scale to indicate if a particular risk was Low, Medium or High (the results of this evaluation are presented in () Exhlbit 2). One risk Enzo and his team did not directly evaluate was ethical standards. The buyers had different perceptions and options about each of the four suppliers and could not reach a consensus. They belleved their long term partners represented a lower risk but they thought that by working closely with any of the suppllers they could resolve ethical issues in a relatively short time. Ultimately they decided not to include ethical standards as a risk. Sourcing alternatives. Enzo's Concerns Enzo was avare that restructuring the supply base could have detrimental effects if not managed correctly. Simply going for the cheapest 5 uppliers around the world was not a viable aiternative as there were many other factors to consider, such as quality, capacity, product development capability and respect for ethical standards. His team had been working for years with some of the suppliers to develop their capablities and he feared changes to the supply base could waste all this hard work, destroy trust with the suppliers and expose the company to risks. One particular concern for Enzo was the issue of ethical sourcing. He knew the ceo was very sensitive about this and the company had a very clear ethical polioy that emphasized business should be conducted honestly, fairly and with respect for people, their dignity and their rights. Altimus also participated in the Ethical Trading Initiative (ETI) and subscribed to its nine principles (see Exhiblt 3). To ensure these principles were respected, the company conducted its own reviews of the suppliers and worked with them to resolve any issues that arose. This meant that any ethical infringements by suppliers were unlikely to be picked up by the media or press. EXHIBIT 3 Principles of the ETI base code. Enzo's Recommendation Enzo knew a recommendation would be requlred for the board meeting at the end of the month. Reducing costs was a major consideration, but his dilemma was how to reduce the cost of supplies without exposing the supply chain to major disruptions and risks. The meeting with his team provided him with most of the information required to prepare a recommendation for the board, but he was still pondering about the right balance between costs and risks. 2. Evaluate the costs and risks of the four suppliers. Do this subjectively and also develop a weighted scoring model to evaluate costs and risks