Question: Please do not use ChatGPT to try and answer this question, it does not work. Here is the feedback given from class on previous attempts

Please do not use ChatGPT to try and answer this question, it does not work. Here is the feedback given from class on previous attempts to answer. Thank you in advance.

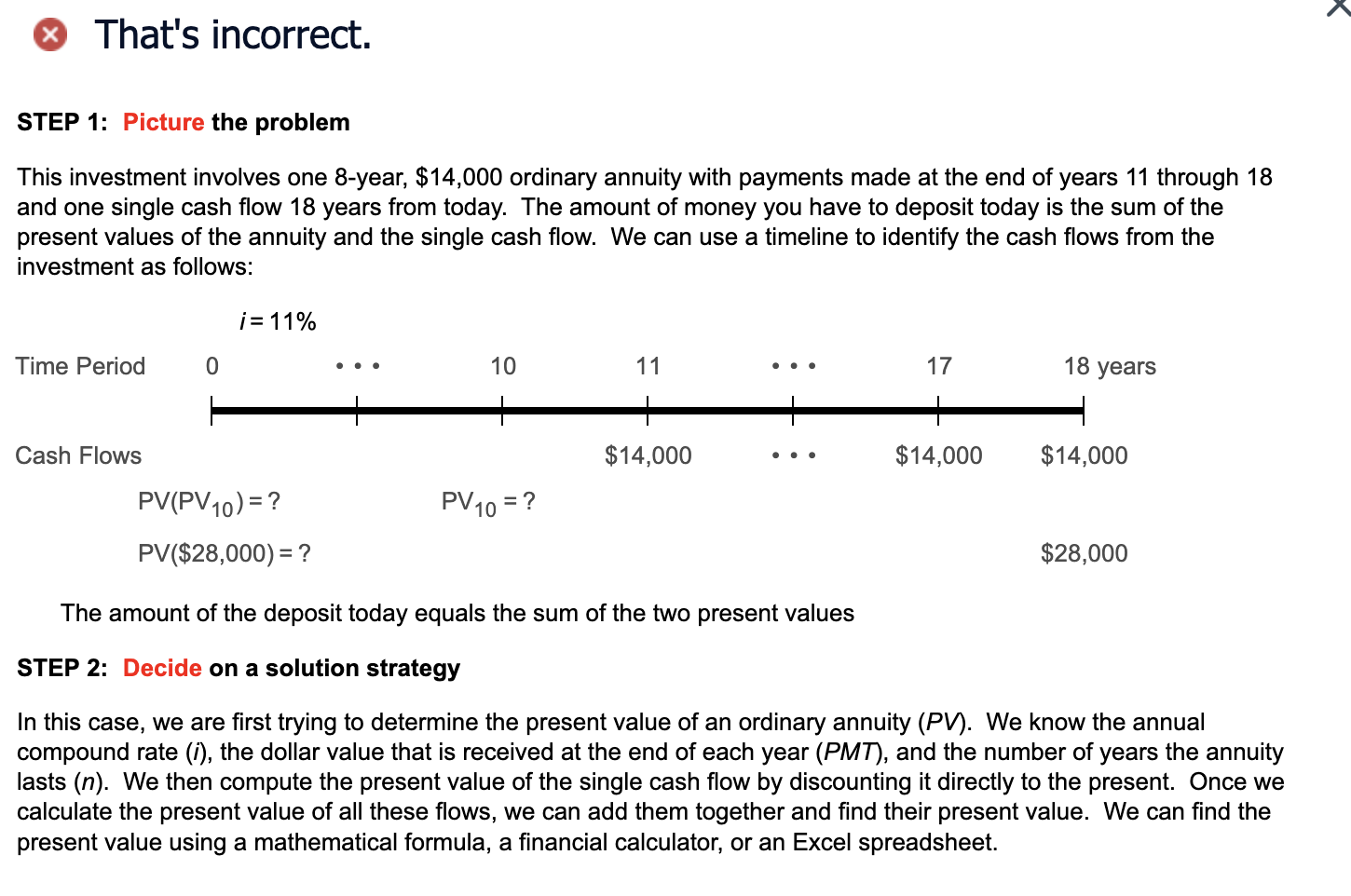

(Present value of complex cash flows) How much do you have to deposit today so that beginning 11 years from now you can withdraw $14,000 a year for the next 8 years (periods 11 through 18) plus an additional amount of $28,000 in the last year (period 18)? Assume an interest rate of 11 percent. That's incorrect. STEP 1: Picture the problem This investment involves one 8-year, \$14,000 ordinary annuity with payments made at the end of years 11 through 18 and one single cash flow 18 years from today. The amount of money you have to deposit today is the sum of the present values of the annuity and the single cash flow. We can use a timeline to identify the cash flows from the investment as follows: Time Peri Cash Flo The amount of the deposit today equals the sum of the two present values STEP 2: Decide on a solution strategy In this case, we are first trying to determine the present value of an ordinary annuity (PV). We know the annual compound rate (i), the dollar value that is received at the end of each year (PMT), and the number of years the annuity lasts (n). We then compute the present value of the single cash flow by discounting it directly to the present. Once we calculate the present value of all these flows, we can add them together and find their present value. We can find the present value using a mathematical formula, a financial calculator, or an Excel spreadsheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts