Question: please do not use excel sheet to answer it thanks Multiple choice questions 1. You are asked to calculate the debt to equity (D/E) ratio

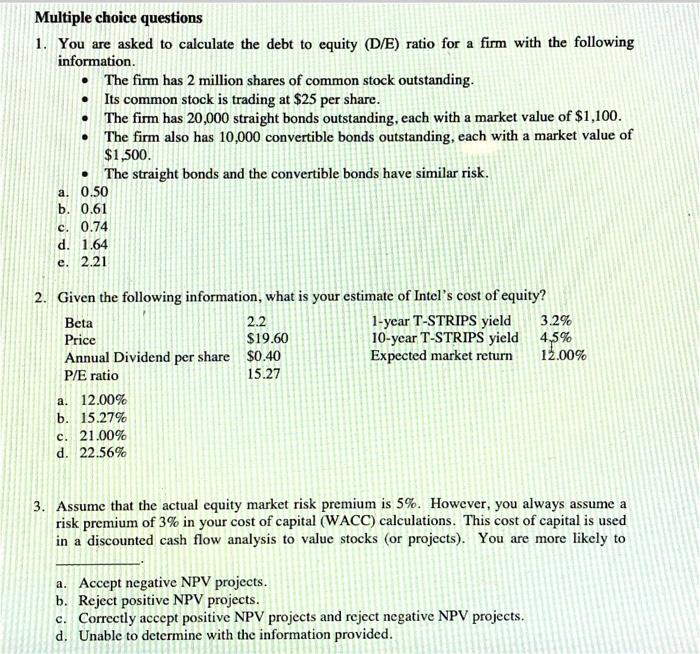

Multiple choice questions 1. You are asked to calculate the debt to equity (D/E) ratio for a firm with the following information. The firm has 2 million shares of common stock outstanding. Its common stock is trading at $25 per share. The firm has 20,000 straight bonds outstanding, each with a market value of $1,100. The firm also has 10,000 convertible bonds outstanding, each with a market value of $1,500. . The straight bonds and the convertible bonds have similar risk. a. 0.50 b. 0.61 c. 0.74 d. 1.64 e. 2.21 2. Given the following information, what is your estimate of Intel's cost of equity? Beta 2.2 3.2% Price $19.60 1-year T-STRIPS yield 10-year T-STRIPS yield Expected market return 4,5% 12.00% Annual Dividend per share $0.40 P/E ratio 15.27 a. 12.00% b. 15.27% c. 21.00% d. 22.56% 3. Assume that the actual equity market risk premium is 5%. However, you always assume a risk premium of 3% in your cost of capital (WACC) calculations. This cost of capital is used in a discounted cash flow analysis to value stocks (or projects). You are more likely to a. Accept negative NPV projects. b. Reject positive NPV projects. c. Correctly accept positive NPV projects and reject negative NPV projects. d. Unable to determine with the information provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts