Question: quick ans E DIOCKS Standard Option 01: To issue 500,000 equity shares at Rs.10 each Option 02: To issue 350,000 equity shares at Rs.10 each

quick ans

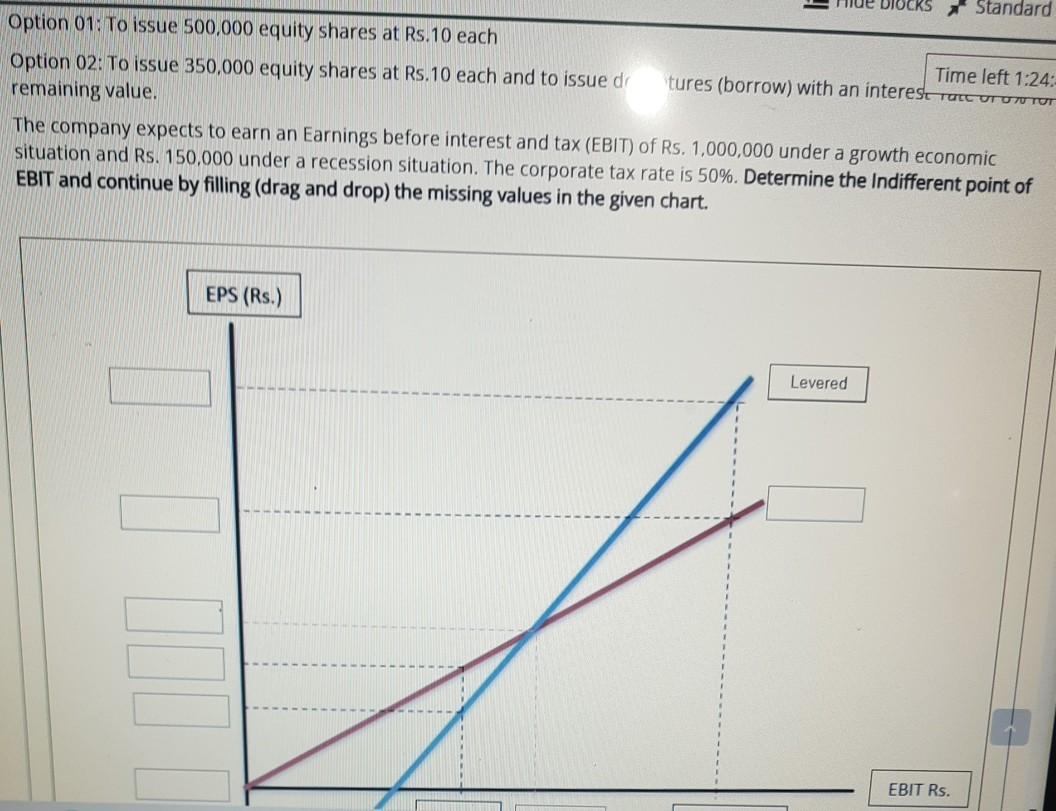

E DIOCKS Standard Option 01: To issue 500,000 equity shares at Rs.10 each Option 02: To issue 350,000 equity shares at Rs.10 each and to issued remaining value. Time left 1:24: tures (borrow) with an interest TULCOT UN TU The company expects to earn an Earnings before interest and tax (EBIT) of Rs. 1,000,000 under a growth economic situation and Rs. 150,000 under a recession situation. The corporate tax rate is 50%. Determine the Indifferent point of EBIT and continue by filling (drag and drop) the missing values in the given chart. EPS (Rs.) Levered EBIT Rs. E DIOCKS Standard Option 01: To issue 500,000 equity shares at Rs.10 each Option 02: To issue 350,000 equity shares at Rs.10 each and to issued remaining value. Time left 1:24: tures (borrow) with an interest TULCOT UN TU The company expects to earn an Earnings before interest and tax (EBIT) of Rs. 1,000,000 under a growth economic situation and Rs. 150,000 under a recession situation. The corporate tax rate is 50%. Determine the Indifferent point of EBIT and continue by filling (drag and drop) the missing values in the given chart. EPS (Rs.) Levered EBIT Rs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts