Question: Please do not use excel to answer question 4. Based on historical data for the 1926-2008 period, the average return and the standard deviation of

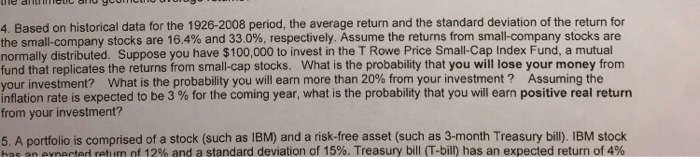

4. Based on historical data for the 1926-2008 period, the average return and the standard deviation of the return for the small-company stocks are 16.4% and 33.0%, respectively. Assume the returns from small-company stocks are normally distributed. Suppose you have $100,000 to invest in the T Rowe Price Small-Cap Index Fund, a mutual fund that replicates the returns from small-cap stocks. What is the probability that you will lose your money from your investment? What is the probability you will earn more than 20% from your investment ? Assuming the nflation rate is expected to be 3 % for the coming year, what is the probability that you will earn positive real return from your investment? 5. A portfolio is comprised of a stock (such as IBM) and a risk-free asset (such as 3-month Treasury bill). IBM stock has an enacted return of 12% and a standard deviation of 15%. Treasury bill (T-bill) has an expected return of 4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts