Question: Please do not use excel to solve. I need to understand how to work this problem out by using a BAII plus calculator. Please go

Please do not use excel to solve. I need to understand how to work this problem out by using a BAII plus calculator. Please go in depth when providing the solution.

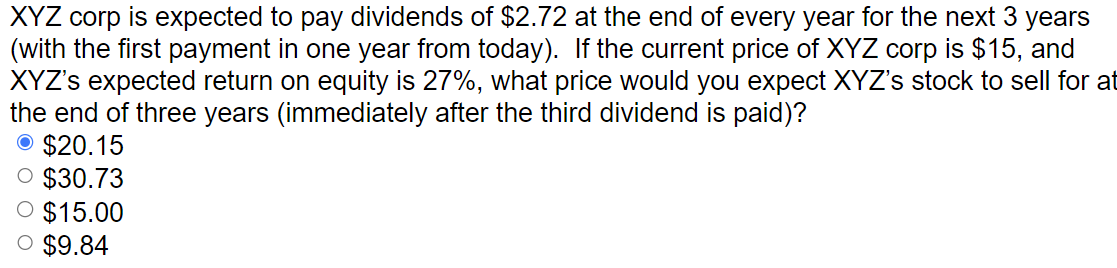

XYZ corp is expected to pay dividends of $2.72 at the end of every year for the next 3 years (with the first payment in one year from today). If the current price of XYZ corp is $15, and XYZ's expected return on equity is 27%, what price would you expect XYZ's stock to sell for a the end of three years (immediately after the third dividend is paid)? $20.15$30.73$15.00$9.84

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts