Question: Read the case and then answer the questions. Use excel or any kind of spreadsheet to show your work. Take answers from case questions and

Read the case and then answer the questions. Use excel or any kind of spreadsheet to show your work. Take answers from case questions and spreadsheet work and type a case write up on your findings. Use the guidelines below to format the structure of your write up. Send write up as an attachment when posted.

Worden Oil Company Case

Gus Worden is the chief operating officer of the Worden Oil Company in Litchfield, Connecticut. The company delivers petroleum products to gasoline stations. Gus has an opportunity to negotiate a new six-year contract hauling for a chain of independent gasoline stations. Since Gus fully employs his tractor-trailer units, the contract would require the purchase of a new rig at a cost of $500,000.

The New Rig. To be profitable a rig should log at least 100,000 miles per year. To prolong the rigs life, Gus would overhaul major systems after four years. This could cost as much as $60,000, but would ensure that the rig would last well beyond six years. The cost of the overhaul is a normal operating expense for tax purposes. After six years Gus would sell the rig for an expected salvage value of $50,000(conservative estimate).

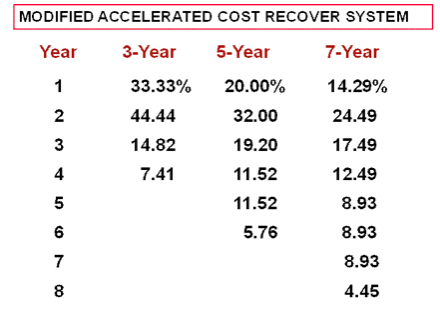

The Accelerated Cost Recovery System classifies the rig as a five year asset for depreciation purposes.

Projected Revenues. Gus is uncertain about the revenue that this contract will generate. Since revenue varies directly with the number of gallons delivered, Gus will earn more revenue if the independent gasoline stations experience high sales volume. Hence, if petroleum prices are low, Guss volume and revenue should be high. Of course, the price of petroleum is determined by world markets.

Guss best estimate is that the rig will deliver 100,000 gallons per day (on average). However, sales could be as low as 88,000 gallon per day or as high as 112,000 gallons. Gus believes that the probability of selling 88,000 gallons or less is no greater than 20%. Similarly, the probability of selling 112,000 gallons or more is no greater than 20%.

Total delivery revenues will depend on how many days per week Gus keeps the rig in service. If the rig runs five days per week, Gus expects to earn delivery revenues of $.025 per gallon. If the rig runs six days per week, Gus expects to earn average delivery revenues of only $.023 per gallon. Price concessions are essential to contract marginal business. Since the rig requires regular preventative maintenance, a seven-day week is not feasible.

Operating Expenses. Most operating expenses are closely related to delivery revenues. Wages and benefits run approximately 35% of revenues. Diesel fuel is 25% of revenues. Regular maintenance expenses average $25,000 per year plus between 7% and 9% of revenues. Insurance, registration and road taxes are fixed at $20,000 per year. Incremental administrative costs are $5000 per year. Finally, Gus will garage the new rig in a bay which the company owns and currently rents out for $20,000 per year.

The firms marginal tax rate is 34 percent.

The Cost of Capital. Gus plans to use a 9 percent discount rate to evaluate this investment opportunity. This is the interest rate which he pays on new bank debt. Although Gus has financed other recent investments with retained earnings, he plans to rely entirely on bank debt to finance the new rig.

Worden Oil is 70 percent equity financed and 30 percent debt financed. The stock is owned strictly by family members, who claim that they require a 25 percent return on their investment. However, Gus estimates that historically the company has rarely earned more than a 16 percent return on equity (ROE), and stockholders seem quite satisfied.

Guss Decision. Gus has requested your help. Build a spread sheet model projecting the net cash flow that this project will generated over time. Conduct a scenario analysis examining the attractiveness of the project under pessimistic, most likely and optimistic scenarios. Estimate several profitability metrics for each scenario.

Help Gus answer five pressing questions:

1. What discount rate should Gus use to evaluate this project?

2. Should Gus accept the six-year contract?

3. If so, should he operate the rig five days per week or six days?

4. How risky is this project?

5. If Gus chooses to invest, what managerial actions could increase the likelihood that this project will be profitable?

Here is the write up guidelines sheet:

Case Write-ups: Guidelines

A case study describes a real business problem, often providing detailed information about a companys background and recent performance. Students assume the role of management and recommend a solution to the problem at hand. Cases often provide more information than necessary to solve the problem.

Write-ups that are poorly written and difficult to understand will earn no credit. For this reason, you should 1) carefully outline your arguments before you begin writing, and 2) revise your write-up several times before submitting it.

organization. A case write-up should clearly define a specific managerial problem, recommend a viable solution, and defend that solution with appropriate supporting analysis. Unless you prefer an alternative format, write-ups could be structured as follows:

1. Problem Identification. Define the problem by identifying one or more specific objectives and one or more obstacles to achieving those objectives.

2. Recommended Solution. Recommend an operational plan for overcoming the stated obstacles and achieving the stated objectives.

3. Supporting Analysis. Defend your recommendation with appropriate logic, evidence and data analysis. A carefully designed (and clearly labeled) exhibit (table, graph, diagram, equation) can clarify your analysis.

COMPOSITION GUIDELINES. The following guidelines will help you to write clearly and concisely.

1. Paragraph Composition

a. Open each paragraph with a clear topic sentence that identifies its purpose or focus.

b. Develop one idea or argument per paragraph.

2. Sentence Structure

a. Use strong active verbs (invest, earn, reduce, capture), rather than passive verbs (is).

b. Make the focus of your analysis the subject of your sentence. Avoid using first person pronouns (I, We) as subjects.

c. Avoid long strings of prepositional phrases (of..., in..., for...).

3. Exhibits

a. Label each exhibit with a descriptive heading, which clearly identifies its purpose.

b. Make exhibits simple (not cluttered) and self-explanatory.

c. Explain the managerial implications of your exhibits in the text.

4. Word Choice

a. Choose precise, concrete words rather than vague, abstract words.

BAD: It was a promising year for the company.

GOOD: The company earned a 25 percent return on investment in 2000.

b. Avoid these expressions: because of the fact that , I feel that , In my opinion, As I mentioned, It is clear that .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts