Question: Please do not use Excel to solve the problem, and please solve the problem step by step, thanks. _l Additional information you may.' find useful:

Please do not use Excel to solve the problem, and please solve the problem step by step, thanks.

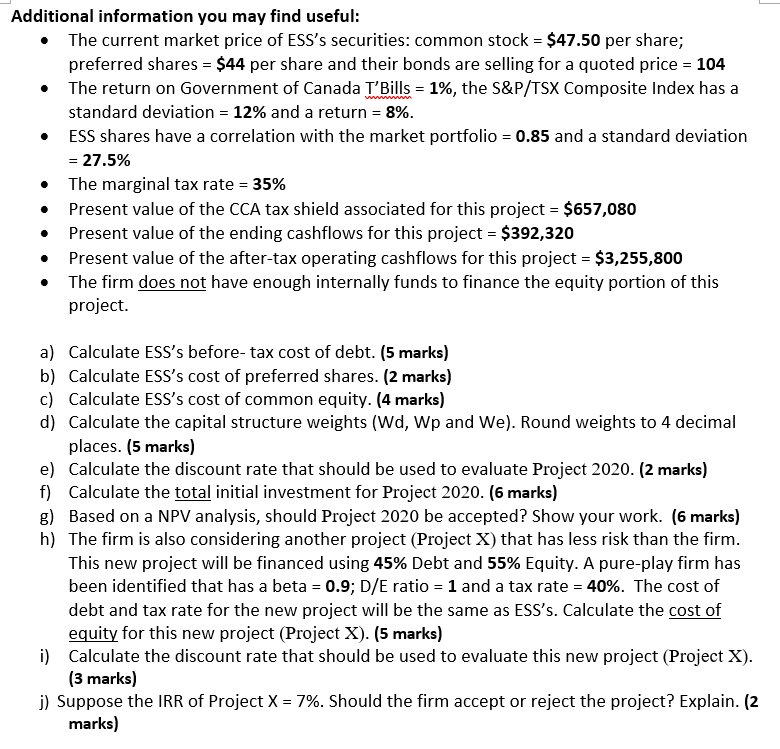

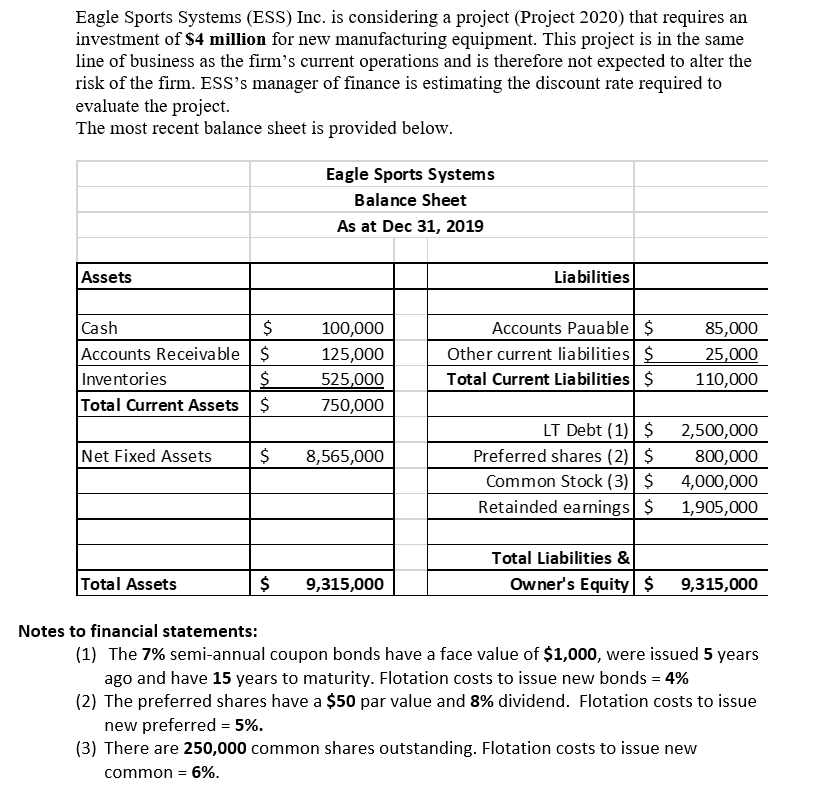

_l Additional information you may.' find useful: if The current market price of ESS's securities: common stock = $42.50 per share; preferred shares = $44 per share and their bonds are selling for a quoted price = 104 The return on Government of Canada T'Bills = 1%, the 5&PXTSX Composite Index has a standard deviation = 12% and a return = 3%. E55 shares have a correlation with the market portfolio = 0.35 and a standard deviation = 215% The marginal tax rate = 35% Present value of the CCA tax shield associated for this project = $652,080 Present value of the ending cashflows for this project = $392,320 Present value of the aftertax operating cashflows for this project = $3,255,300 The firm does not have enough internallv funds to finance the ecjuit'jr portion of this project. } Calculate ESS's before tax cost of debt. [5 marks] Calculate ESS's cost of preferred shares. [2 marks] Calculate ESS's cost of common equitv. [4 marks] Calculate the capital structure weights [Wd, Wp and We]. Hound weights to 4 decimal places. {5 marks] Calculate the discount rate that should be used to evaluate Project 2020. [2 marks] Calculate the Ltal initial investment for Project 2020. [0 marks] Based on a NP'v' analvsis, should Project 2020 be accepted? Show vour work. {6 marks] The firm is also considering another project {Project X} that has less risk than the firm. This new project will be financed using 45% Debt and 55% Equitv. A pureplav rm has been identified that has a beta = 0.9; DIE ratio = 1 and a tax rate = 40%. The cost of debt and tax rate for the new project will be the same as ESS's. Calculate the cost of eguigv for this new project (Project X). [5 marks] Calculate the discount rate that should be used to evaluate this new project {Project X). {3 marks] j} Suppose the IRR of Project X = 2%. Should the firm accept or reject the project? Explain. [2 marks] Eagle Sports Systems (ESS) Inc. is considering a project (Project 2020) that requires an investment of $4 million for new manufacturing equipment. This project is in the same line of business as the rm's current operations and is therefore not expected to alter the risk of the rm. ESS's manager of nance is estimating the discount rate required to evaluate the project. The most recent balance sheet is provided below. Eagle Sports Systems Balance Sheet As at Dec 31, 2019 _ Cash Accounts Pauahle Accounts Receivable S 125, Other current liabilities Inventories 525 Total Current Liabilities Total Current Assets 5 3'50, LT Debt in Net Fixed Assets S 8,565, Preferred shares (2} Common Stock (3} Retainded earnings Total Liabilities 8r. Notes to nancial statements: [1) The 3% semiannual coupon bonds have a face value ofSl, were issued 5 years ago and have 15 yea rs to maturity. Flotation costs to issue new bonds 2 4% [2) The preferred shares have a $50 par value and 8% dividend. Flotation costs to issue new preferred 2 5%. [3) There are 250,000 common shares outstanding. Flotation costs to issue newr common 2 6%