Question: Please use excel to solve this question and show all the formulas and calculations. Thanks! You and your partner are deliberating whether to purchase a

Please use excel to solve this question and show all the formulas and calculations.

Thanks!

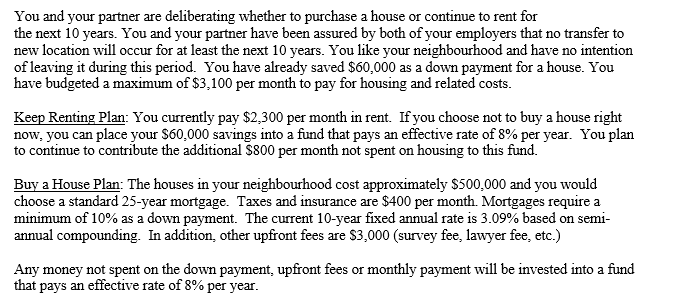

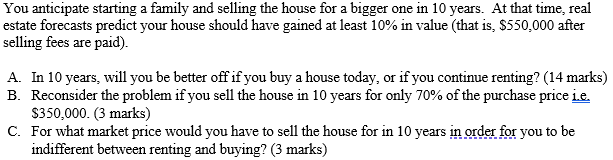

You and your partner are deliberating whether to purchase a house or continue to rent for the next 10 years. You and your partner have been assured by both of your employers that no transfer to new location will occur for at least the next 10 years. You like your neighbourhood and have no intention of leaving it during this period. You have already saved $60,000 as a down payment for a house. You have budgeted a maximum of $3,100 per month to pay for housing and related costs. Keep Renting Plan: You currently pay $2,300 per month in rent. If you choose not to buy a house right now, you can place your $60.000 savings into a fund that pays an effective rate of 8% per year. You plan to continue to contribute the additional $800 per month not spent on housing to this fund. Buy a House Plan: The houses in your neighbourhood cost approximately $500,000 and you would choose a standard 25-year mortgage. Taxes and insurance are $400 per month. Mortgages require a minimum of 10% as a down payment. The current 10-year fixed annual rate is 3.09% based on semi- annual compounding. In addition, other upfront fees are $3,000 (survey fee, lawyer fee, etc.) Any money not spent on the down payment upfront fees or monthly payment will be invested into a fund that pays an effective rate of 8% per year. You anticipate starting a family and selling the house for a bigger one in 10 years. At that time, real estate forecasts predict your house should have gained at least 10% in value (that is, $550,000 after selling fees are paid). A. In 10 years, will you be better off if you buy a house today, or if you continue renting? (14 marks) B. Reconsider the problem if you sell the house in 10 years for only 70% of the purchase price i.e. $350,000. (3 marks) C. For what market price would you have to sell the house for in 10 years in order for you to be indifferent between renting and buying? (3 marks) You and your partner are deliberating whether to purchase a house or continue to rent for the next 10 years. You and your partner have been assured by both of your employers that no transfer to new location will occur for at least the next 10 years. You like your neighbourhood and have no intention of leaving it during this period. You have already saved $60,000 as a down payment for a house. You have budgeted a maximum of $3,100 per month to pay for housing and related costs. Keep Renting Plan: You currently pay $2,300 per month in rent. If you choose not to buy a house right now, you can place your $60.000 savings into a fund that pays an effective rate of 8% per year. You plan to continue to contribute the additional $800 per month not spent on housing to this fund. Buy a House Plan: The houses in your neighbourhood cost approximately $500,000 and you would choose a standard 25-year mortgage. Taxes and insurance are $400 per month. Mortgages require a minimum of 10% as a down payment. The current 10-year fixed annual rate is 3.09% based on semi- annual compounding. In addition, other upfront fees are $3,000 (survey fee, lawyer fee, etc.) Any money not spent on the down payment upfront fees or monthly payment will be invested into a fund that pays an effective rate of 8% per year. You anticipate starting a family and selling the house for a bigger one in 10 years. At that time, real estate forecasts predict your house should have gained at least 10% in value (that is, $550,000 after selling fees are paid). A. In 10 years, will you be better off if you buy a house today, or if you continue renting? (14 marks) B. Reconsider the problem if you sell the house in 10 years for only 70% of the purchase price i.e. $350,000. (3 marks) C. For what market price would you have to sell the house for in 10 years in order for you to be indifferent between renting and buying

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts