Question: please do NOT use the lingo solution as it is hard to interpret. so please, use an excel spreadsheet along with the formulas while incorporating

please do NOT use the lingo solution as it is hard to interpret. so please, use an excel spreadsheet along with the formulas while incorporating the parameter, model, and constraints. thank you.

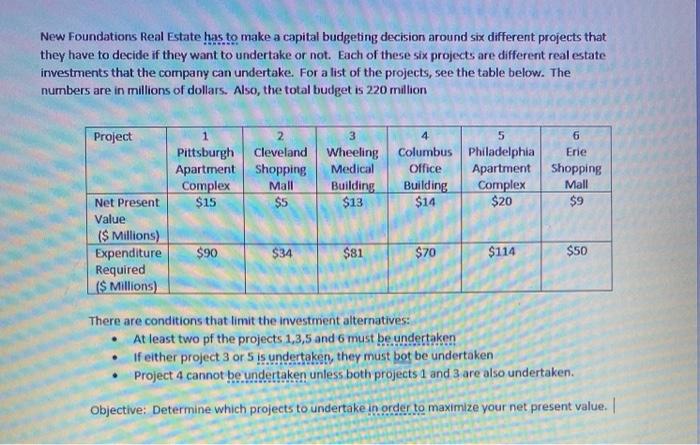

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock