Question: please do not write with handwriting Let's assume that you are going to purchase a common stock that paid a dividend of $1.50 yesterday. Expected

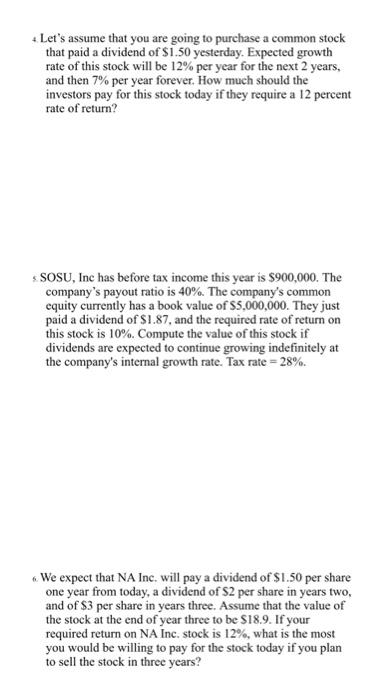

Let's assume that you are going to purchase a common stock that paid a dividend of $1.50 yesterday. Expected growth rate of this stock will be 12% per year for the next 2 years, and then 7% per year forever. How much should the investors pay for this stock today if they require a 12 percent rate of return? SOSU, Inc has before tax income this year is $900,000. The company's payout ratio is 40%. The company's common equity currently has a book value of $5,000,000. They just paid a dividend of $1.87, and the required rate of return on this stock is 10%. Compute the value of this stock if dividends are expected to continue growing indefinitely at the company's internal growth rate. Tax rate = 28%. We expect that NA Inc. will pay a dividend of $1.50 per share one year from today, a dividend of S2 per share in years two, and of S3 per share in years three. Assume that the value of the stock at the end of year three to be $18.9. If your required return on NA Inc. stock is 12%, what is the most you would be willing to pay for the stock today if you plan to sell the stock in three years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts