Question: Please do question 2! Many factors determine how much debt a firm takes on. Chief among them ought to be the effect of the debt

Please do question 2!

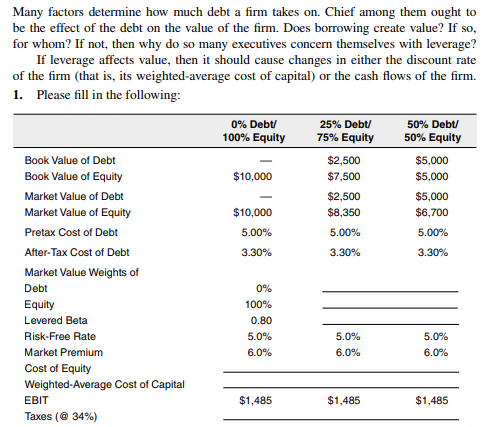

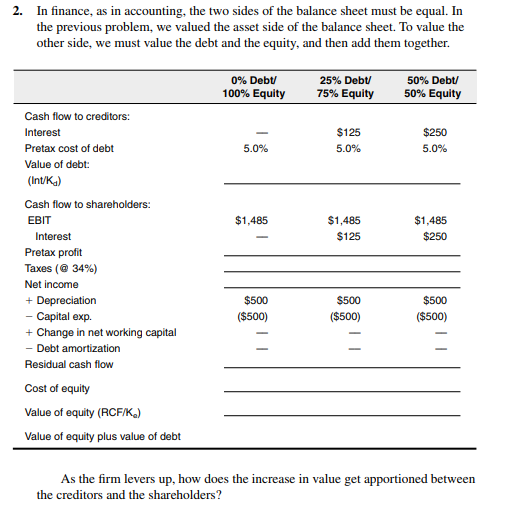

Many factors determine how much debt a firm takes on. Chief among them ought to be the effect of the debt on the value of the firm. Does borrowing create value? If so, for whom? If not, then why do so many executives concern themselves with leverage? If leverage affects value, then it should cause changes in either the discount rate of the firm (that is, its weighted-average cost of capital) or the cash flows of the firm. 1. Please fill in the following: 0% Debt/ 100% Equity 25% Debt/ 75% Equity $2,500 $7,500 $2,500 $8,350 5.00% 3.30% 50% Debt/ 50% Equity $5,000 $5,000 $5,000 $6,700 5.00% 3.30% Book Value of Debt Book Value of Equity Market Value of Debt Market Value of Equity Pretax Cost of Debt After-Tax Cost of Debt Market Value Weights of Debt Equity Levered Beta Risk-Free Rate Market Premium Cost of Equity Weighted-Average Cost of Capital EBIT Taxes (@ 34%) $10,000 $10,000 5.00% 3.30% 0% 100% 0.80 5.0% 6.0% 5.0% 6.0% 5.0% 6.0% $1,485 $1,485 $1,485

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts