Question: please do question 2.2, 2.3 & 2.4 Question 2 Fantastical Dreamers CC has come up with a new product, called TGTSSB (aka The Greatest Thing

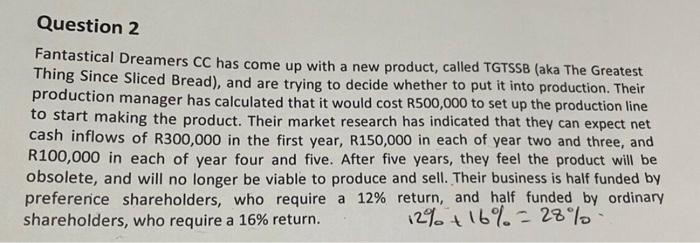

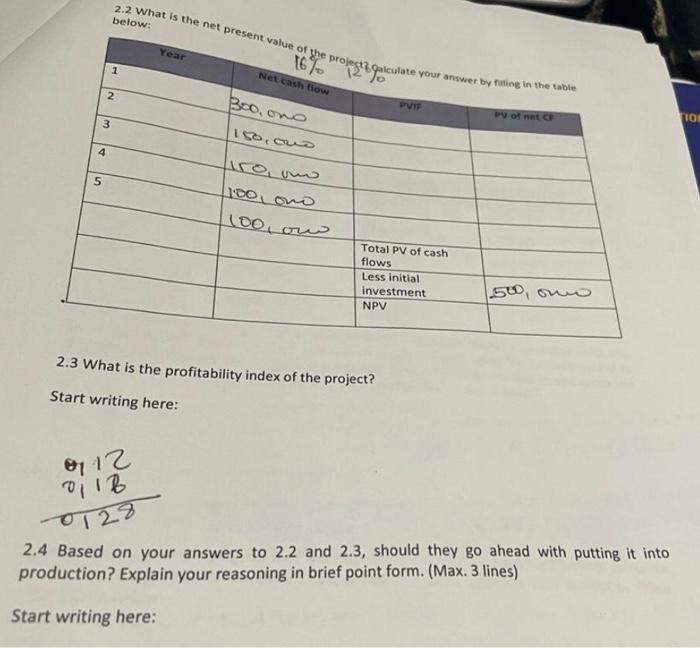

Question 2 Fantastical Dreamers CC has come up with a new product, called TGTSSB (aka The Greatest Thing Since Sliced Bread), and are trying to decide whether to put it into production. Their production manager has calculated that it would cost R500,000 to set up the production line to start making the product. Their market research has indicated that they can expect net cash inflows of R300,000 in the first year, R150,000 in each of year two and three, and R100,000 in each of year four and five. After five years, they feel the product will be obsolete, and will no longer be viable to produce and sell. Their business is half funded by preference shareholders, who require a 12% return, and half funded by ordinary shareholders, who require a 16% return. 12% + 16%- 28% below: 2.2 What is the net present value of the propeso corate your answer by ting in the table Year 167 1 Net cash flow 2 Bco, ono PV PV of het a 101 3 150,ows 4 5 firo, ou [100 Lond (0o, ou Total PV of cash flows Less initial investment NPV 50, ow 2.3 What is the profitability index of the project? Start writing here: 012 OLIB 0128 2.4 Based on your answers to 2.2 and 2.3, should they go ahead with putting it into production? Explain your reasoning in brief point form. (Max. 3 lines) Start writing here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts