Question: please do question 3 Exercise 3-50 (Algorithmic) Prepayment of Expenses JDM Inc. made the following prepayments for expense items during 2019: a. Prepaid building rent

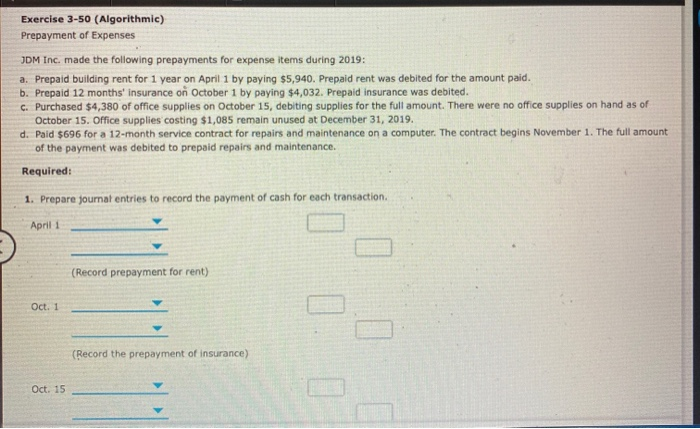

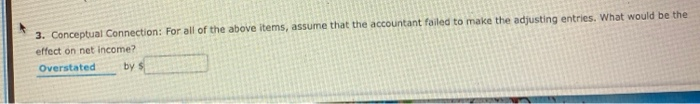

Exercise 3-50 (Algorithmic) Prepayment of Expenses JDM Inc. made the following prepayments for expense items during 2019: a. Prepaid building rent for 1 year on April 1 by paying $5,940. Prepaid rent was debited for the amount paid. b. Prepaid 12 months' insurance on October 1 by paying $4,032. Prepaid insurance was debited. C. Purchased $4,380 of office supplies on October 15, debiting supplies for the full amount. There were no office supplies on hand as of October 15. Office supplies costing $1,085 remain unused at December 31, 2019. d. Paid $696 for a 12-month service contract for repairs and maintenance on a computer. The contract begins November 1. The full amount of the payment was debited to prepaid repairs and maintenance. Required: 1. Prepare journal entries to record the payment of cash for each transaction. April (Record prepayment for rent) Oct. 1 a (Record the prepayment of insurance) Oct. 15 3. Conceptual Connection: For all of the above items, assume that the accountant failed to make the adjusting entries. What would be the effect on net income? Overstated by $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts