Question: Kindly answer the question. Thanks This year Marta (single) received a $200 refund of state income taxes that she deducted on her tax return last

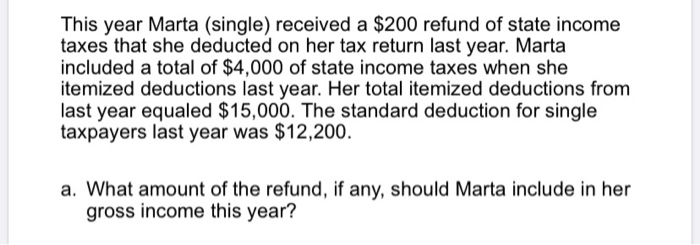

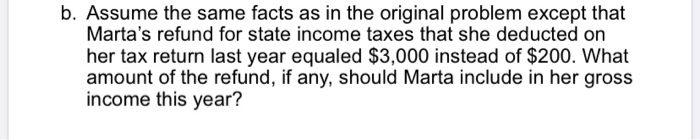

This year Marta (single) received a $200 refund of state income taxes that she deducted on her tax return last year. Marta included a total of $4,000 of state income taxes when she itemized deductions last year. Her total itemized deductions from last year equaled $15,000. The standard deduction for single taxpayers last year was $12,200. a. What amount of the refund, if any, should Marta include in her gross income this year? b. Assume the same facts as in the original problem except that Marta's refund for state income taxes that she deducted on her tax return last year equaled $3,000 instead of $200. What amount of the refund, if any, should Marta include in her gross income this year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts