Question: Please do question 4 Problem 1: Exchange Rates (20 Points) Suppose that there are only two countries in the world: Localia (which is us), that

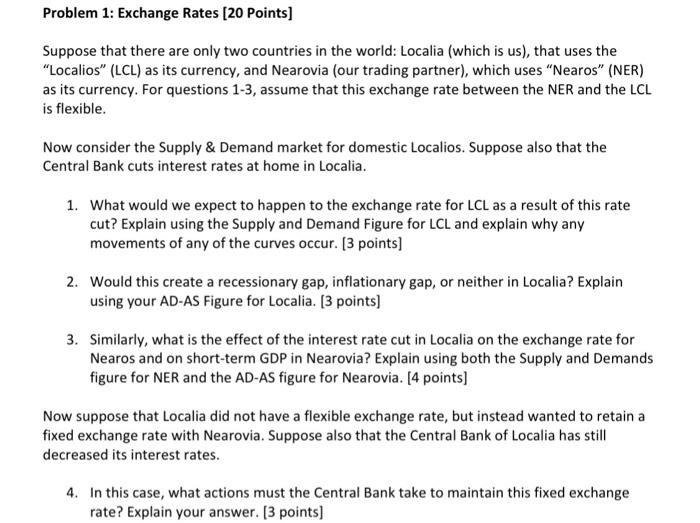

Problem 1: Exchange Rates (20 Points) Suppose that there are only two countries in the world: Localia (which is us), that uses the "Localios (LCL) as its currency, and Nearovia (our trading partner), which uses "Nearos (NER) as its currency. For questions 1-3, assume that this exchange rate between the NER and the LCL is flexible. Now consider the Supply & Demand market for domestic Localios. Suppose also that the Central Bank cuts interest rates at home in Localia. 1. What would we expect to happen to the exchange rate for LCL as a result of this rate cut? Explain using the supply and Demand Figure for LCL and explain why any movements of any of the curves occur. (3 points) 2. Would this create a recessionary gap, inflationary gap, or neither in Localia? Explain using your AD-AS Figure for Localia. (3 points) 3. Similarly, what is the effect of the interest rate cut in Localia on the exchange rate for Nearos and on short-term GDP in Nearovia? Explain using both the supply and Demands figure for NER and the AD-AS figure for Nearovia. [4 points) Now suppose that Localia did not have a flexible exchange rate, but instead wanted to retain a fixed exchange rate with Nearovia. Suppose also that the Central Bank of Localia has still decreased its interest rates. 4. In this case, what actions must the Central Bank take to maintain this fixed exchange rate? Explain your answer. [3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts