Question: Please do question E15.19 d. Prepare the journal entry to record the first instalment payment. e. What are the non-current and current portions of the

Please do question E15.19

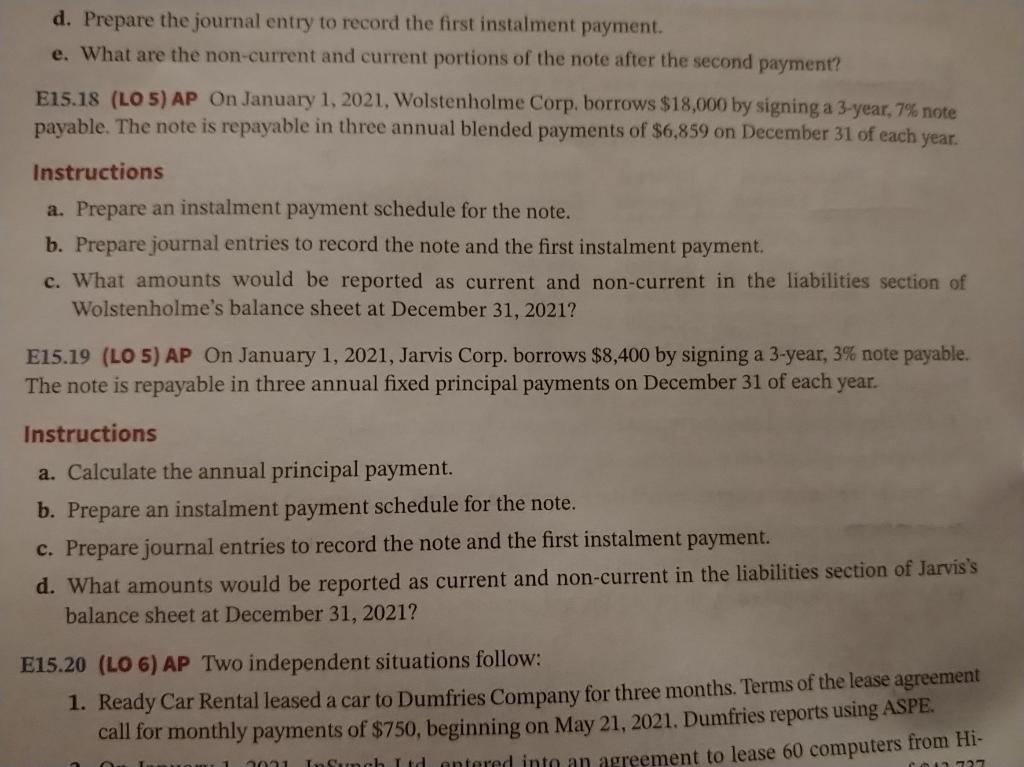

d. Prepare the journal entry to record the first instalment payment. e. What are the non-current and current portions of the note after the second payment? E15.18 (LO 5) AP On January 1, 2021, Wolstenholme Corp. borrows $18,000 by signing a 3-year, 7% note payable. The note is repayable in three annual blended payments of $6,859 on December 31 of each year. Instructions a. Prepare an instalment payment schedule for the note. b. Prepare journal entries to record the note and the first instalment payment. c. What amounts would be reported as current and non-current in the liabilities section of Wolstenholme's balance sheet at December 31, 2021? E15.19 (LO 5) AP On January 1, 2021, Jarvis Corp. borrows $8,400 by signing a 3-year, 3% note payable. The note is repayable in three annual fixed principal payments on December 31 of each year. Instructions a. Calculate the annual principal payment. b. Prepare an instalment payment schedule for the note. c. Prepare journal entries to record the note and the first instalment payment. d. What amounts would be reported as current and non-current in the liabilities section of Jarvis's balance sheet at December 31, 2021? E15.20 (LO 6) AP Two independent situations follow: 1. Ready Car Rental leased a car to Dumfries Company for three months. Terms of the lease agreement call for monthly payments of $750, beginning on May 21, 2021. Dumfries reports using ASPE. 2011 InSuch I td entered into an agreement to lease 60 computers from Hi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts