Question: Please do quickly! Requirement1-7 Wicked Witch Spells Limited has the following data: 2013 $ 21,000 2014 $ 35,000 2015 ($65,000) 2,000 4,000 3,000 23,000 Taxable

Please do quickly! Requirement1-7

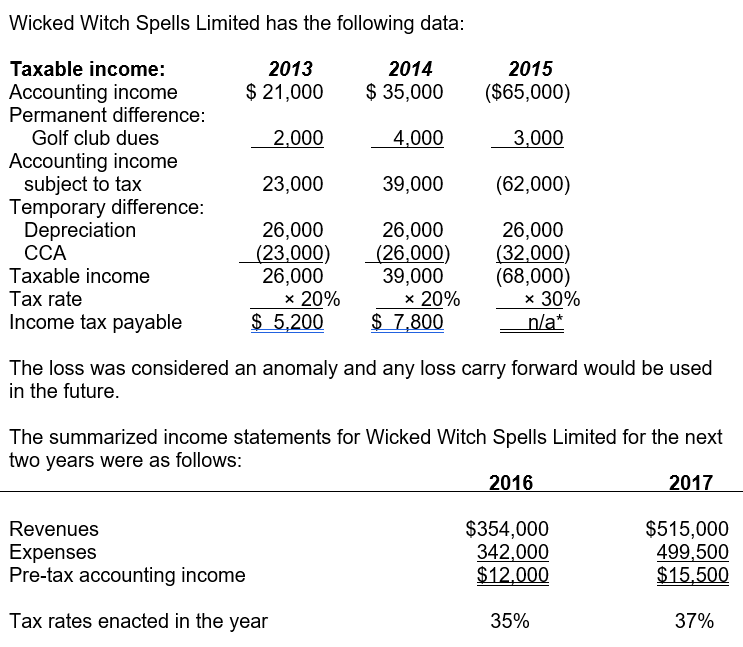

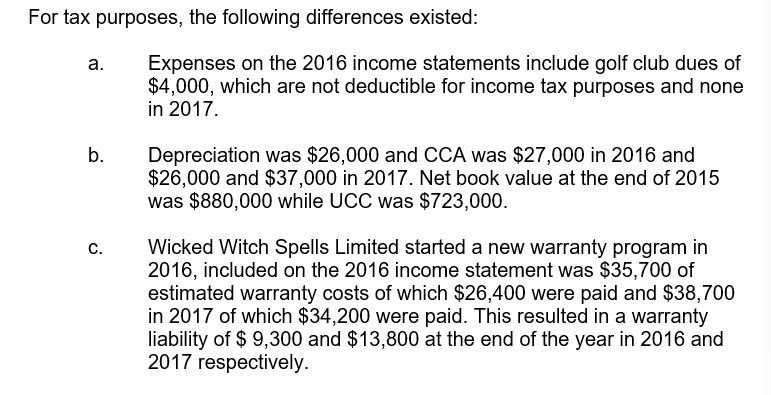

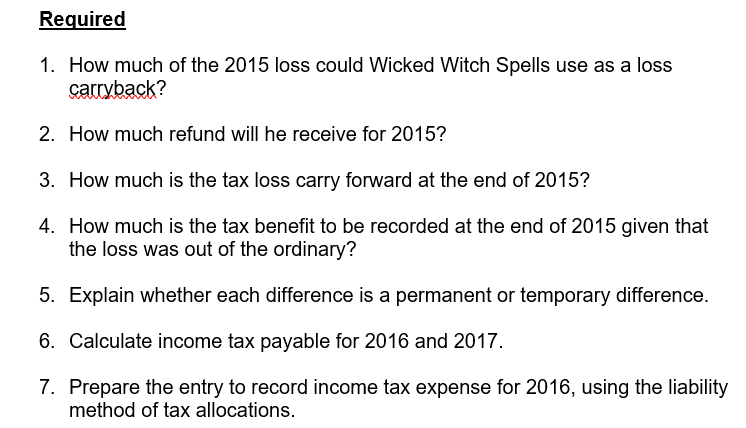

Wicked Witch Spells Limited has the following data: 2013 $ 21,000 2014 $ 35,000 2015 ($65,000) 2,000 4,000 3,000 23,000 Taxable income: Accounting income Permanent difference: Golf club dues Accounting income subject to tax Temporary difference: Depreciation CCA Taxable income Tax rate Income tax payable 39,000 (62,000) 26,000 (23,000) 26,000 * 20% $ 5,200 26,000 (26,000) 39,000 * 20% $ 7,800 26,000 (32,000) (68,000) * 30% n/a* The loss was considered an anomaly and any loss carry forward would be used in the future. The summarized income statements for Wicked Witch Spells Limited for the next two years were as follows: 2016 2017 Revenues Expenses Pre-tax accounting income $354,000 342,000 $12.000 $515,000 499,500 $15.500 Tax rates enacted in the year 35% 37% For tax purposes, the following differences existed: a. Expenses on the 2016 income statements include golf club dues of $4,000, which are not deductible for income tax purposes and none in 2017. b. Depreciation was $26,000 and CCA was $27,000 in 2016 and $26,000 and $37,000 in 2017. Net book value at the end of 2015 was $880,000 while UCC was $723,000. C. Wicked Witch Spells Limited started a new warranty program in 2016, included on the 2016 income statement was $35,700 of estimated warranty costs of which $26,400 were paid and $38,700 in 2017 of which $34,200 were paid. This resulted in a warranty liability of $ 9,300 and $13,800 at the end of the year in 2016 and 2017 respectively. Required 1. How much of the 2015 loss could Wicked Witch Spells use as a loss carryback? 2. How much refund will he receive for 2015? 3. How much is the tax loss carry forward at the end of 2015? 4. How much is the tax benefit to be recorded at the end of 2015 given that the loss was out of the ordinary? 5. Explain whether each difference is a permanent or temporary difference. 6. Calculate income tax payable for 2016 and 2017. 7. Prepare the entry to record income tax expense for 2016, using the liability method of tax allocations. Wicked Witch Spells Limited has the following data: 2013 $ 21,000 2014 $ 35,000 2015 ($65,000) 2,000 4,000 3,000 23,000 Taxable income: Accounting income Permanent difference: Golf club dues Accounting income subject to tax Temporary difference: Depreciation CCA Taxable income Tax rate Income tax payable 39,000 (62,000) 26,000 (23,000) 26,000 * 20% $ 5,200 26,000 (26,000) 39,000 * 20% $ 7,800 26,000 (32,000) (68,000) * 30% n/a* The loss was considered an anomaly and any loss carry forward would be used in the future. The summarized income statements for Wicked Witch Spells Limited for the next two years were as follows: 2016 2017 Revenues Expenses Pre-tax accounting income $354,000 342,000 $12.000 $515,000 499,500 $15.500 Tax rates enacted in the year 35% 37% For tax purposes, the following differences existed: a. Expenses on the 2016 income statements include golf club dues of $4,000, which are not deductible for income tax purposes and none in 2017. b. Depreciation was $26,000 and CCA was $27,000 in 2016 and $26,000 and $37,000 in 2017. Net book value at the end of 2015 was $880,000 while UCC was $723,000. C. Wicked Witch Spells Limited started a new warranty program in 2016, included on the 2016 income statement was $35,700 of estimated warranty costs of which $26,400 were paid and $38,700 in 2017 of which $34,200 were paid. This resulted in a warranty liability of $ 9,300 and $13,800 at the end of the year in 2016 and 2017 respectively. Required 1. How much of the 2015 loss could Wicked Witch Spells use as a loss carryback? 2. How much refund will he receive for 2015? 3. How much is the tax loss carry forward at the end of 2015? 4. How much is the tax benefit to be recorded at the end of 2015 given that the loss was out of the ordinary? 5. Explain whether each difference is a permanent or temporary difference. 6. Calculate income tax payable for 2016 and 2017. 7. Prepare the entry to record income tax expense for 2016, using the liability method of tax allocations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts