Question: Please do S5-3, S5-4, and S5-8. S5-3 Journalizing purchase transactions Consider the following transactions for Derry Drug Store: Learr Jun. 2 4 8 14 Derry

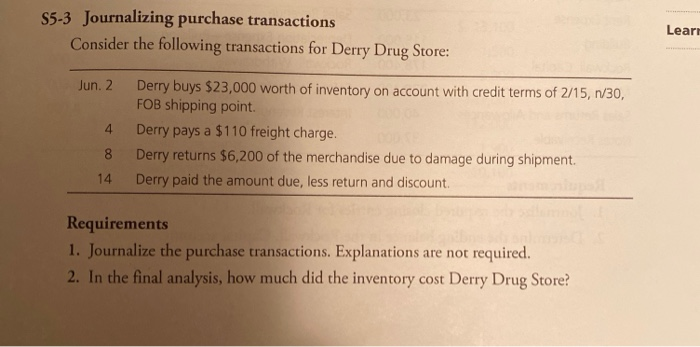

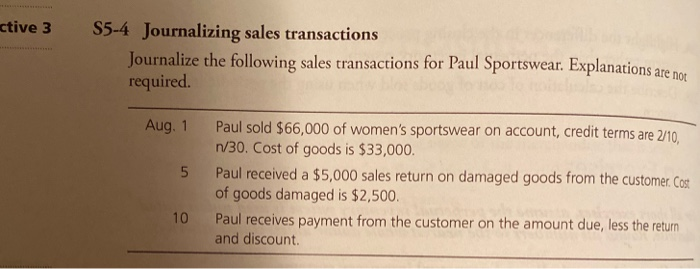

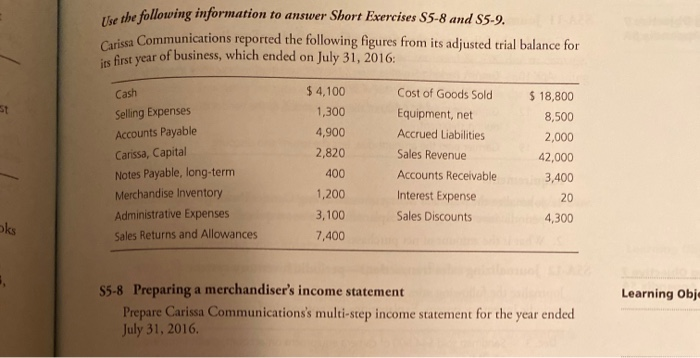

S5-3 Journalizing purchase transactions Consider the following transactions for Derry Drug Store: Learr Jun. 2 4 8 14 Derry buys $23,000 worth of inventory on account with credit terms of 2/15, 1/30, FOB shipping point. Derry pays a $110 freight charge. Derry returns $6,200 of the merchandise due to damage during shipment. Derry paid the amount due, less return and discount. Requirements 1. Journalize the purchase transactions. Explanations are not required. 2. In the final analysis, how much did the inventory cost Derry Drug Store? active 3 S5-4 Journalizing sales transactions Journalize the following sales transactions for Paul Sportswear. Explanations are ne required. Aug. 1 Paul sold $66,000 of women's sportswear on account, credit terms are 2/10 n/30. Cost of goods is $33,000. Paul received a $5,000 sales return on damaged goods from the customer Cost of goods damaged is $2,500. Paul receives payment from the customer on the amount due, less the return and discount. 10 e the following information to answer Short Exercises S5-8 and 85-9. Communications reported the following figures from its adjusted trial balance for its first year of business, which ended on July 31, 2016: Cash Selling Expenses Accounts Payable Carissa, Capital Notes Payable, long-term Merchandise Inventory Administrative Expenses Sales Returns and Allowances $4,100 1,300 4,900 2,820 400 1,200 3,100 7,400 Cost of Goods Sold Equipment, net Accrued Liabilities Sales Revenue Accounts Receivable Interest Expense Sales Discounts $ 18,800 8,500 2,000 42,000 3,400 20 4,300 Learning Obj. $5-8 Preparing a merchandiser's income statement Prepare Carissa Communications's multi-step income statement for the year ended July 31, 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts