Question: Please do steps for each calculate problem. 1 1 point Use the following information to answer questions #1-4. Cost of new equipment: $200,000 Installation: $20,000

Please do steps for each calculate problem.

Please do steps for each calculate problem.

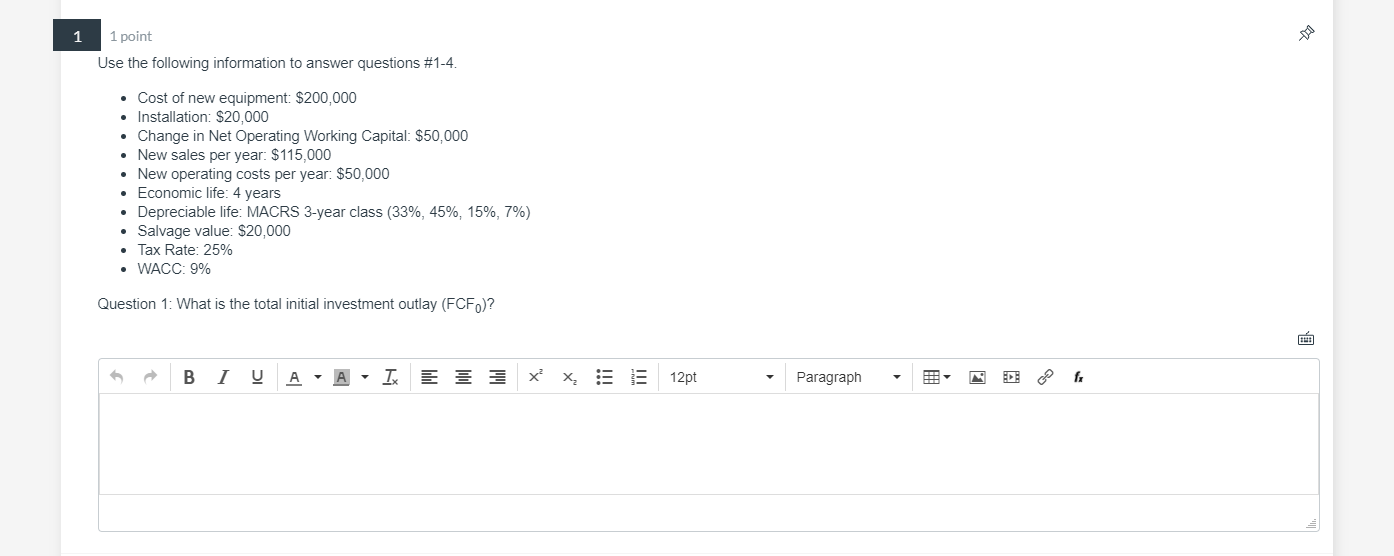

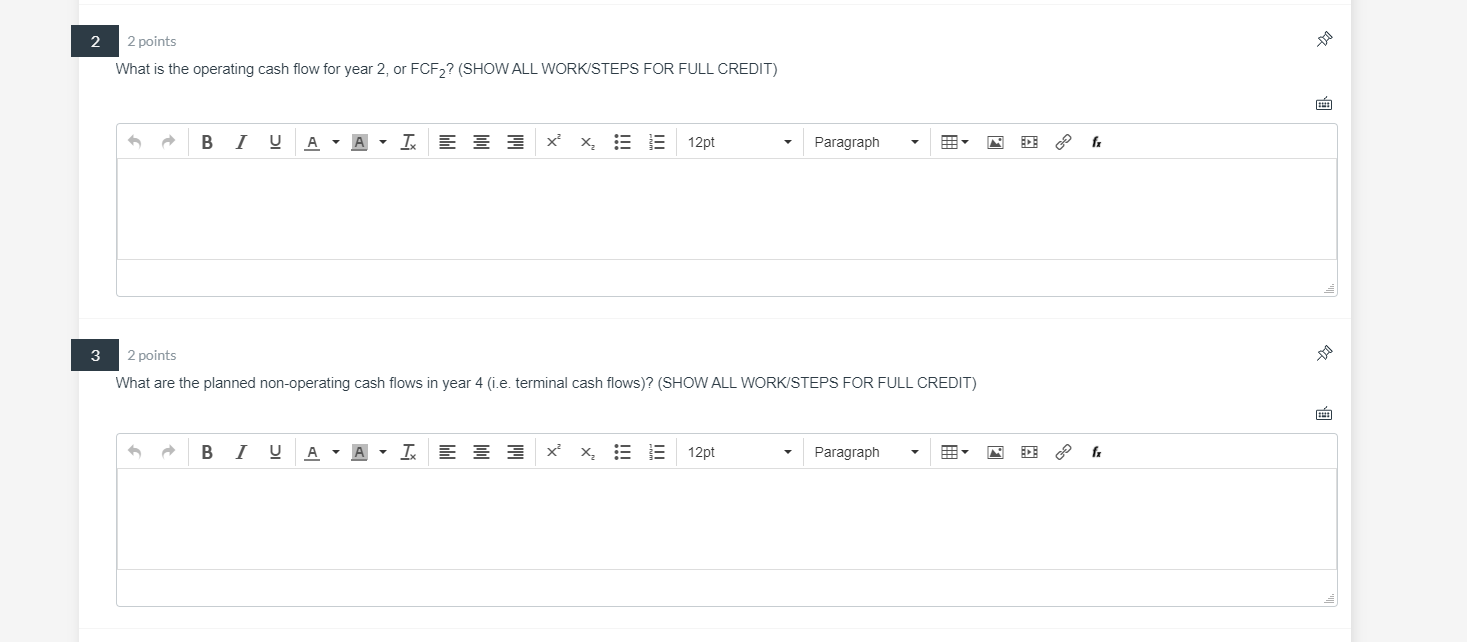

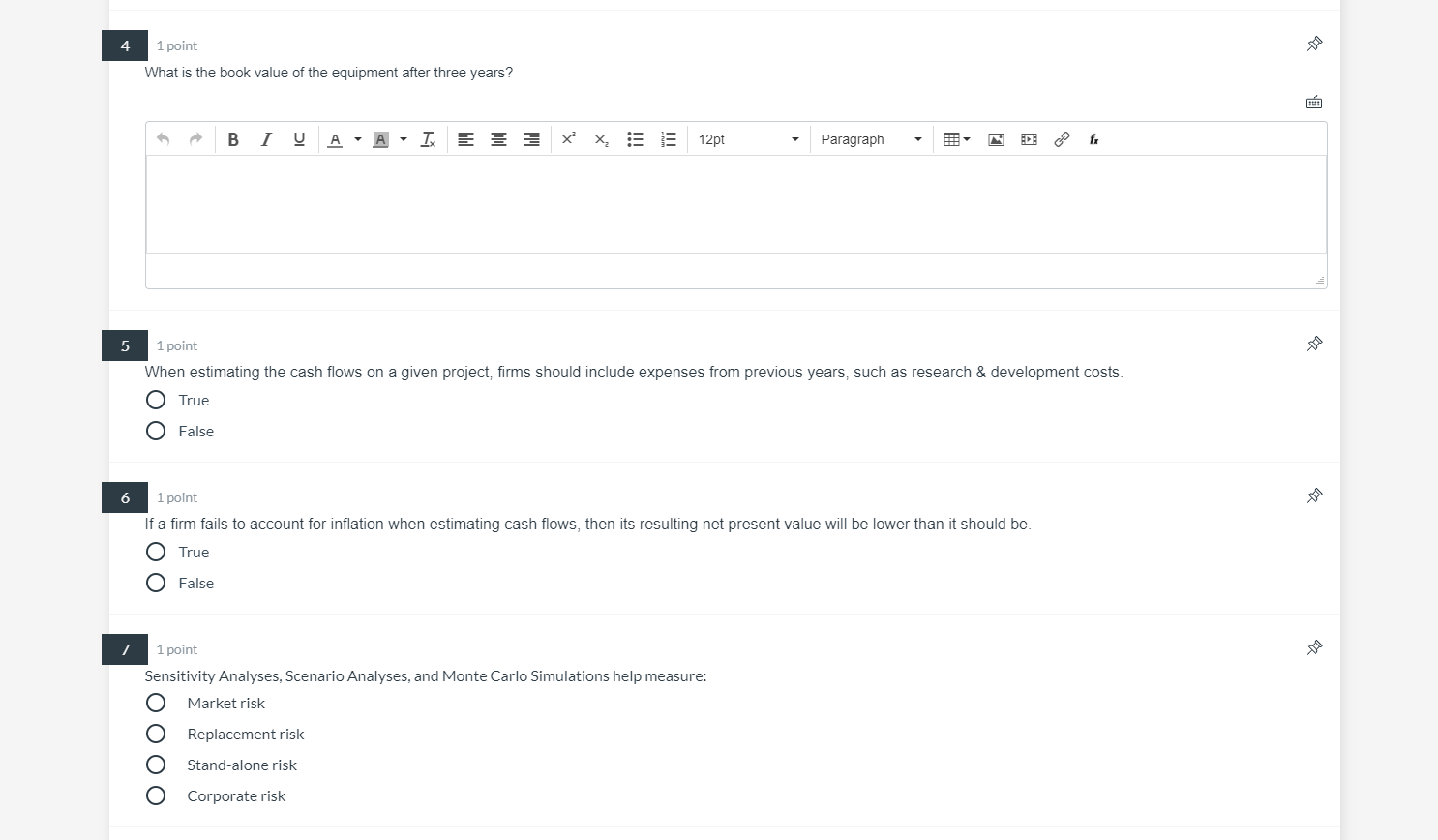

1 1 point Use the following information to answer questions #1-4. Cost of new equipment: $200,000 Installation: $20,000 Change in Net Operating Working Capital: $50,000 New sales per year: $115,000 New operating costs per year: $50,000 Economic life: 4 years Depreciable life: MACRS 3-year class (33%, 45%, 15%, 7%) Salvage value: $20,000 Tax Rate: 25% WACC: 9% Question 1: What is the total initial investment outlay (FCF.)? B I U IK x? X 12pt Paragraph f 2 2 points What is the operating cash flow for year 2, or FCF2? (SHOW ALL WORK/STEPS FOR FULL CREDIT) U A- A - TE x x, 12pt Paragraph 3 2 points What are the planned non-operating cash flows in year 4 (i.e. terminal cash flows)? (SHOW ALL WORK STEPS FOR FULL CREDIT) U TE X : 12pt Paragraph 1 point What is the book value of the equipment after three years? B 1 U A- A - TE x? XE 12pt Paragraph 5 1 point When estimating the cash flows on a given project, firms should include expenses from previous years, such as research & development costs. True False 1 point If a firm fails to account for inflation when estimating cash flows, then its resulting net present value will be lower than it should be True False 7 1 point Sensitivity Analyses, Scenario Analyses, and Monte Carlo Simulations help measure: Market risk Replacement risk OOOO Stand-alone risk Corporate risk 8 1 point O OOO Real options, such as abandonment, typically: Decrease profitability and increase project risk Have no impact on profitability and/or project risk Raise profitability and lower project risk Raise profitability and increase project risk Submit 1 1 point Use the following information to answer questions #1-4. Cost of new equipment: $200,000 Installation: $20,000 Change in Net Operating Working Capital: $50,000 New sales per year: $115,000 New operating costs per year: $50,000 Economic life: 4 years Depreciable life: MACRS 3-year class (33%, 45%, 15%, 7%) Salvage value: $20,000 Tax Rate: 25% WACC: 9% Question 1: What is the total initial investment outlay (FCF.)? B I U IK x? X 12pt Paragraph f 2 2 points What is the operating cash flow for year 2, or FCF2? (SHOW ALL WORK/STEPS FOR FULL CREDIT) U A- A - TE x x, 12pt Paragraph 3 2 points What are the planned non-operating cash flows in year 4 (i.e. terminal cash flows)? (SHOW ALL WORK STEPS FOR FULL CREDIT) U TE X : 12pt Paragraph 1 point What is the book value of the equipment after three years? B 1 U A- A - TE x? XE 12pt Paragraph 5 1 point When estimating the cash flows on a given project, firms should include expenses from previous years, such as research & development costs. True False 1 point If a firm fails to account for inflation when estimating cash flows, then its resulting net present value will be lower than it should be True False 7 1 point Sensitivity Analyses, Scenario Analyses, and Monte Carlo Simulations help measure: Market risk Replacement risk OOOO Stand-alone risk Corporate risk 8 1 point O OOO Real options, such as abandonment, typically: Decrease profitability and increase project risk Have no impact on profitability and/or project risk Raise profitability and lower project risk Raise profitability and increase project risk Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts