Question: please do the 1st question correctly and please solve question D for the 2nd question. this is my 2nd time posting it. Selected transactions follow

please do the 1st question correctly and please solve question D for the 2nd question. this is my 2nd time posting it.

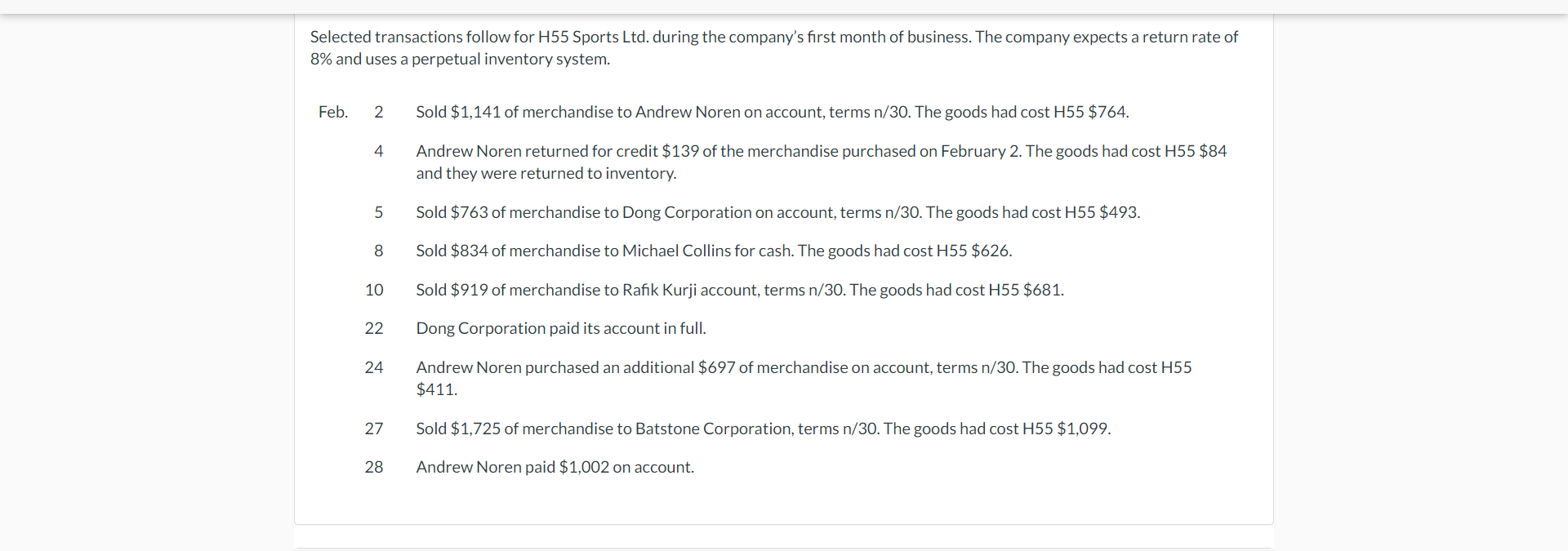

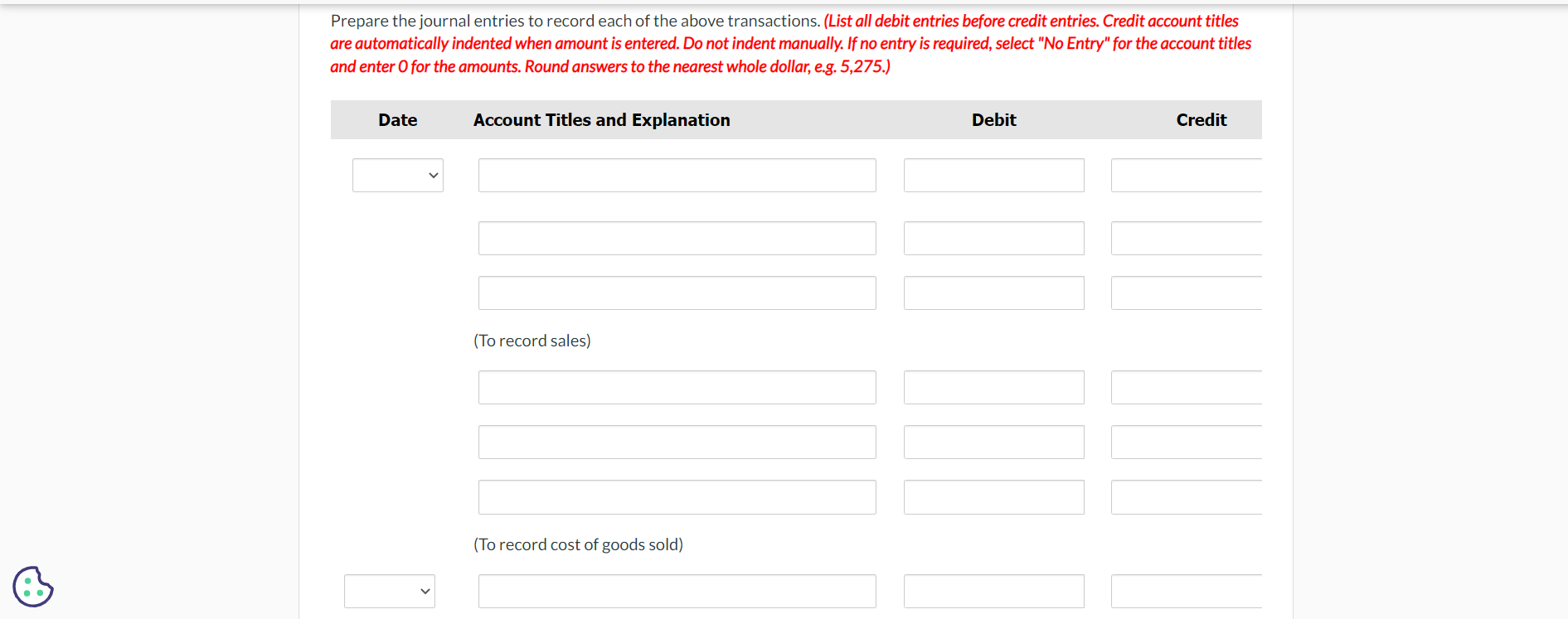

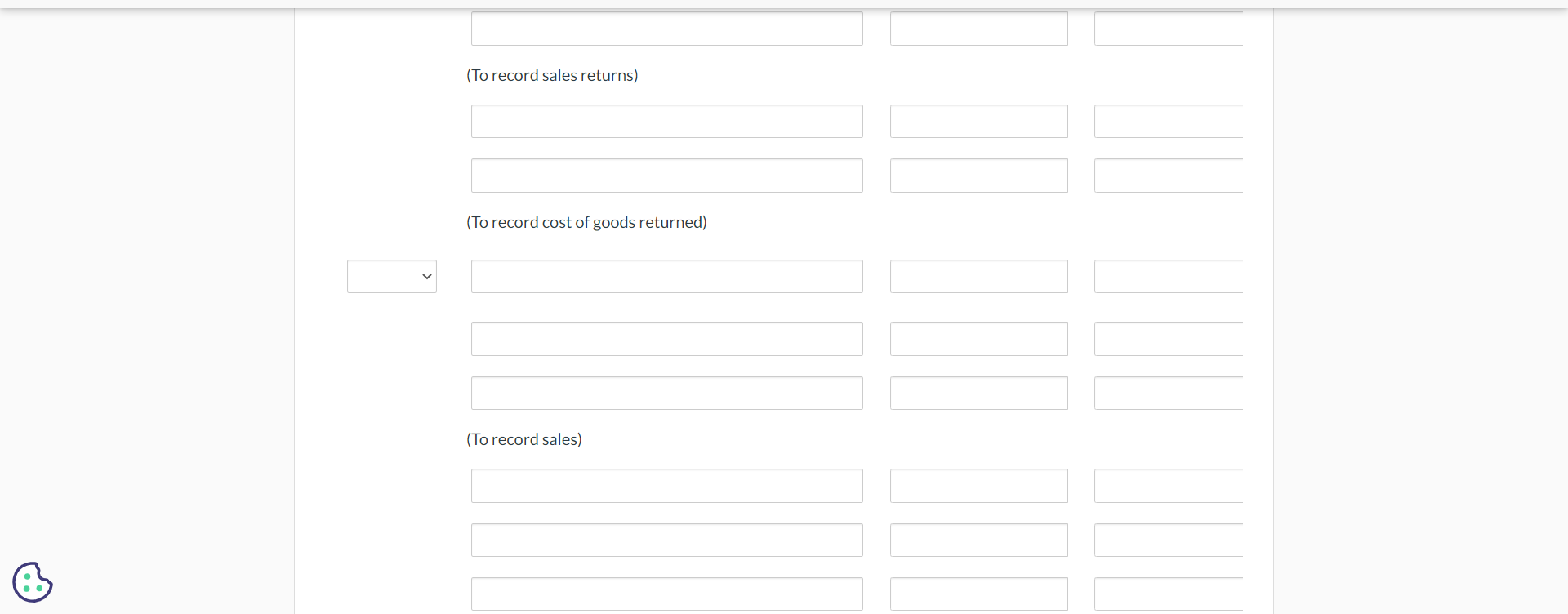

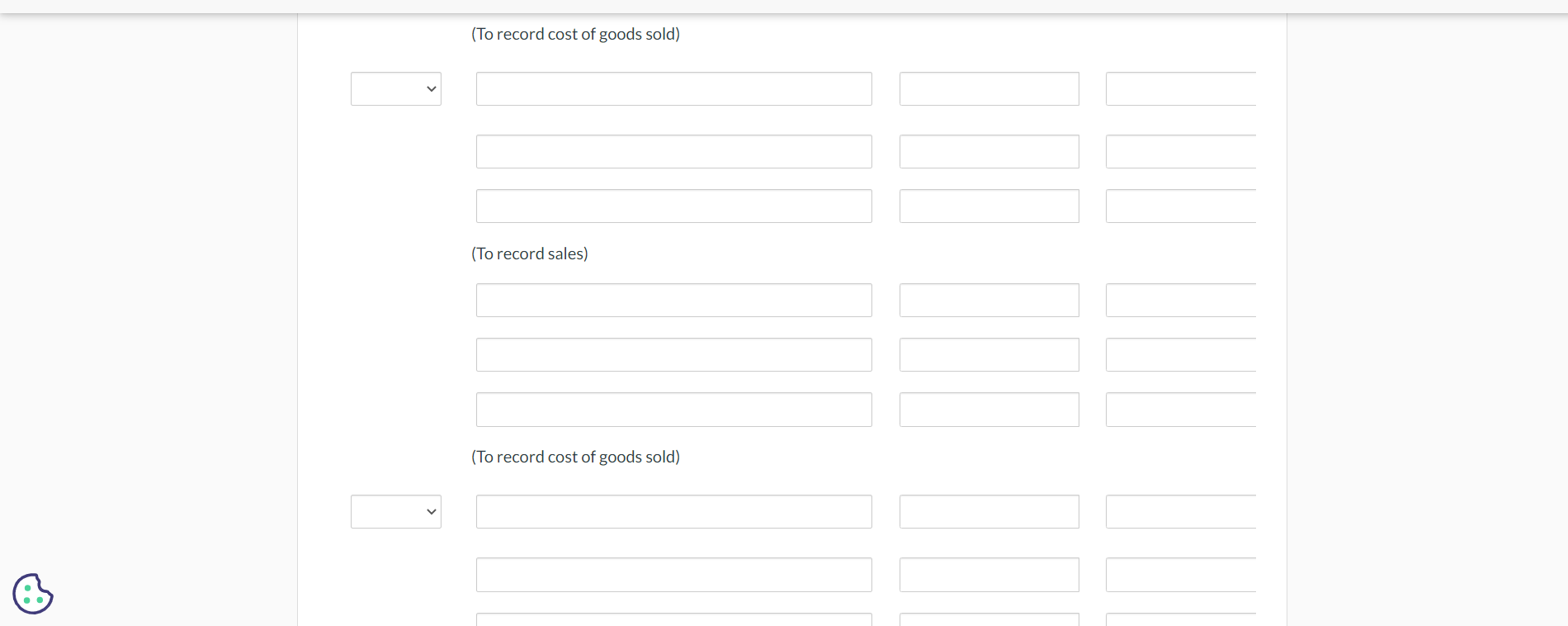

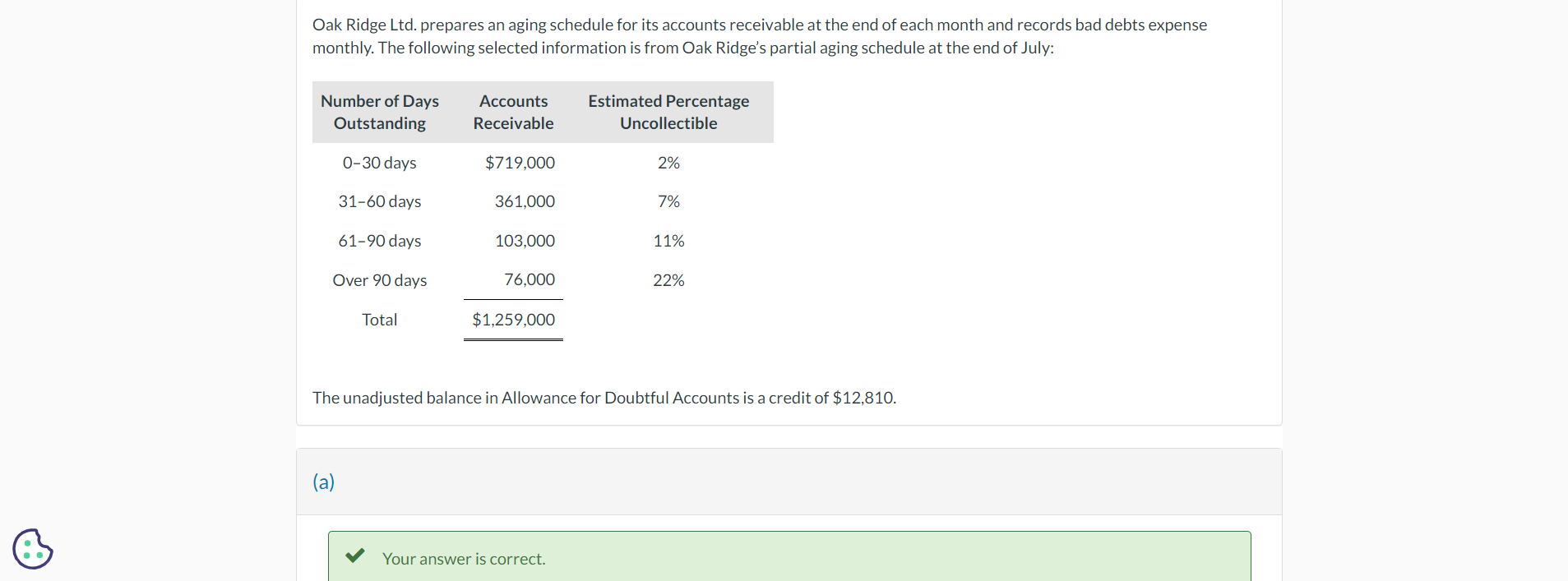

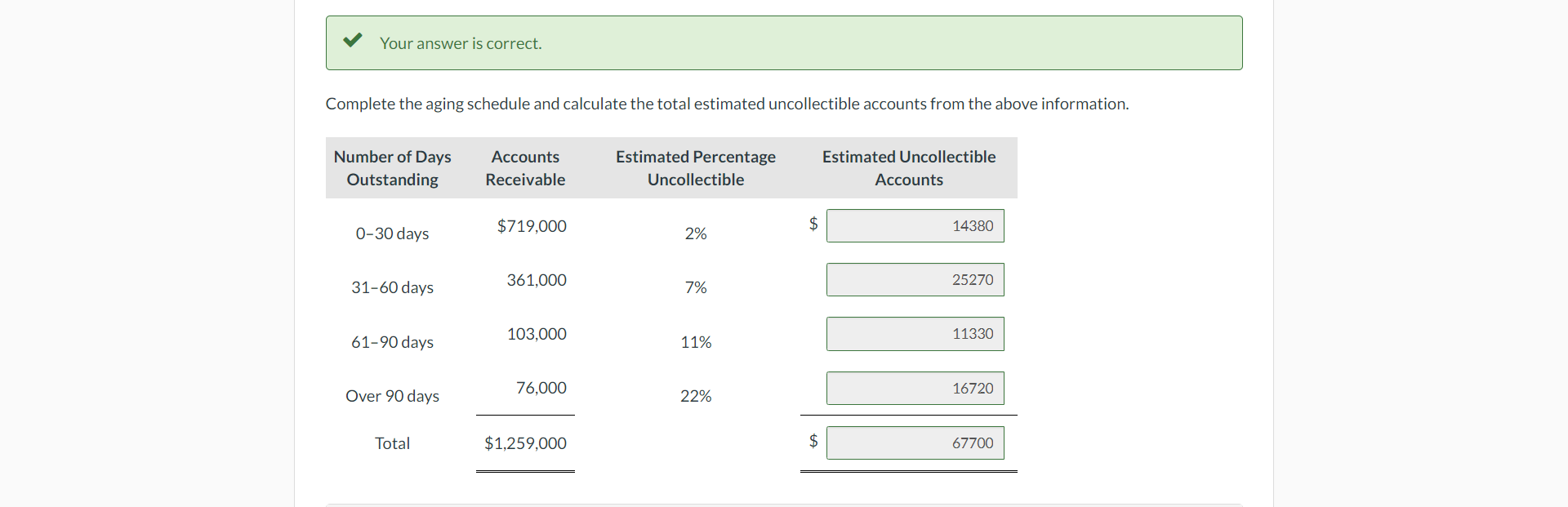

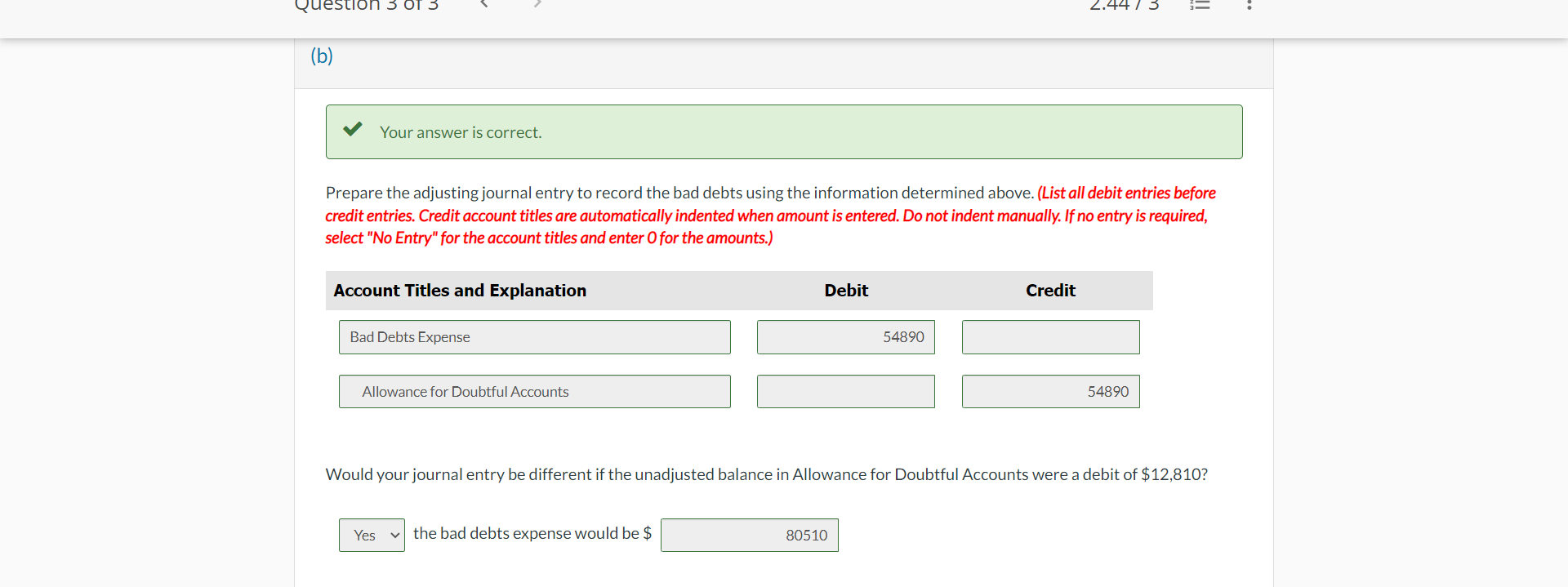

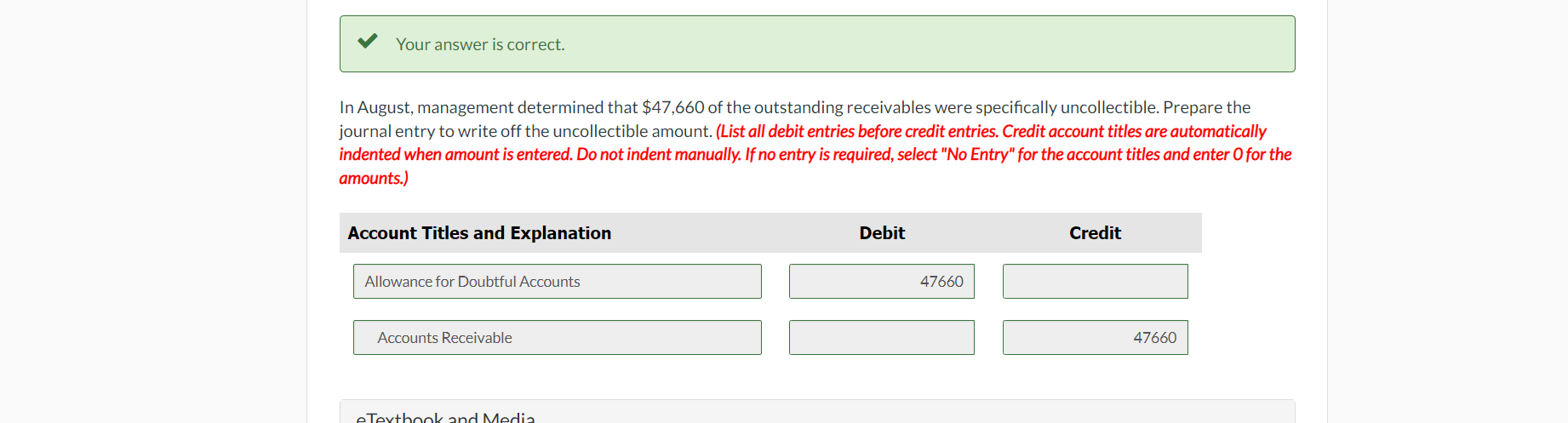

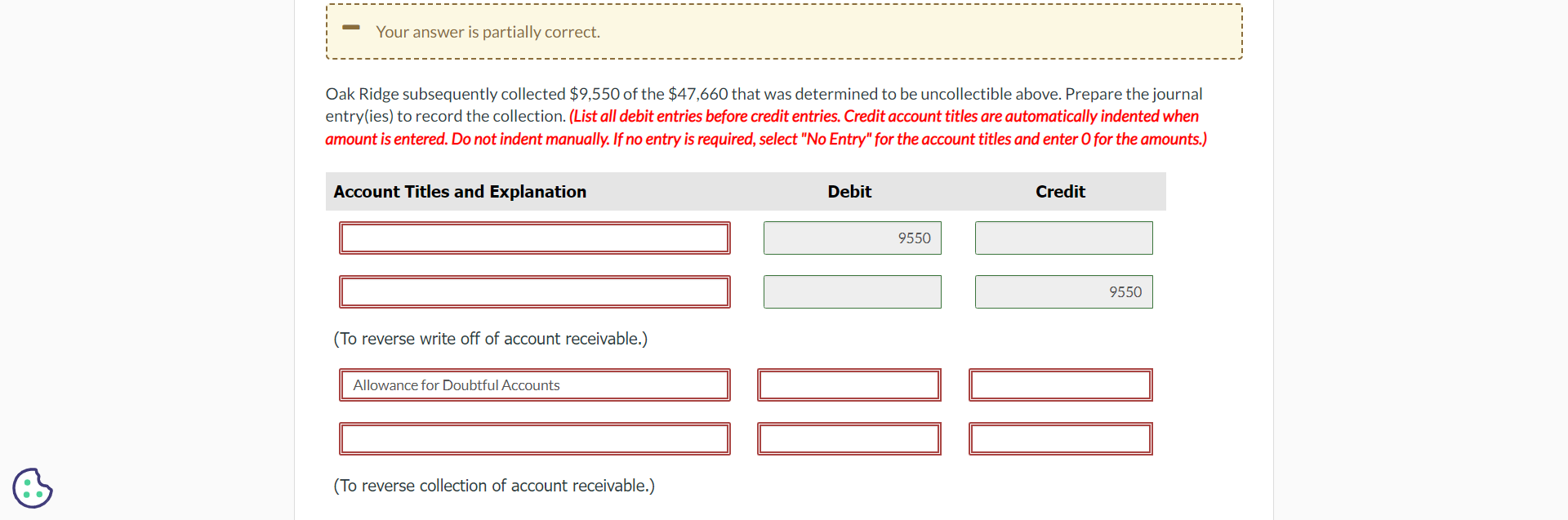

Selected transactions follow for H55 Sports Ltd. during the company's first month of business. The company expects a return rate of 8% and uses a perpetual inventory system. Feb. 2 Sold $1,141 of merchandise to Andrew Noren on account, terms n/30. The goods had cost H55$764. 4 Andrew Noren returned for credit $139 of the merchandise purchased on February 2. The goods had cost H55$84 and they were returned to inventory. 5 Sold $763 of merchandise to Dong Corporation on account, terms n/30. The goods had cost H55$493. 8 Sold $834 of merchandise to Michael Collins for cash. The goods had cost H55$626. 10 Sold $919 of merchandise to Rafik Kurji account, terms n/30. The goods had cost H55$681. 22 Dong Corporation paid its account in full. 24 Andrew Noren purchased an additional $697 of merchandise on account, terms n/30. The goods had cost H55 $411. 27 Sold $1,725 of merchandise to Batstone Corporation, terms n/30. The goods had cost H55$1,099. 28 Andrew Noren paid $1,002 on account. Prepare the journal entries to record each of the above transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to the nearest whole dollar, e.g. 5,275.) (To record sales returns) (To record cost of goods returned) (To record sales) (To record cost of goods sold) (To record sales) (To record cost of goods sold) (To record sales) (To record cost of goods sold) 03 (To record sales) (To record cost of goods sold) (To record sales) 0 (To record cost of goods sold) Oak Ridge Ltd. prepares an aging schedule for its accounts receivable at the end of each month and records bad debts expense monthly. The following selected information is from Oak Ridge's partial aging schedule at the end of July: The unadjusted balance in Allowance for Doubtful Accounts is a credit of $12,810. (a) Your answer is correct. Complete the aging schedule and calculate the total estimated uncollectible accounts from the above information. Your answer is correct. Prepare the adjusting journal entry to record the bad debts using the information determined above. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Would your journal entry be different if the unadjusted balance in Allowance for Doubtful Accounts were a debit of $12,810? the bad debts expense would be $ In August, management determined that $47,660 of the outstanding receivables were specifically uncollectible. Prepare the journal entry to write off the uncollectible amount. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Oak Ridge subsequently collected $9,550 of the $47,660 that was determined to be uncollectible above. Prepare the journal entry(ies) to record the collection. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts