Question: please do the full and correct Current Atverrat in Dregrest dectiol place, 4 a5: 2%. Reiurenanacis 1i. Dividerst porout ratia : Wh. Heburn an common

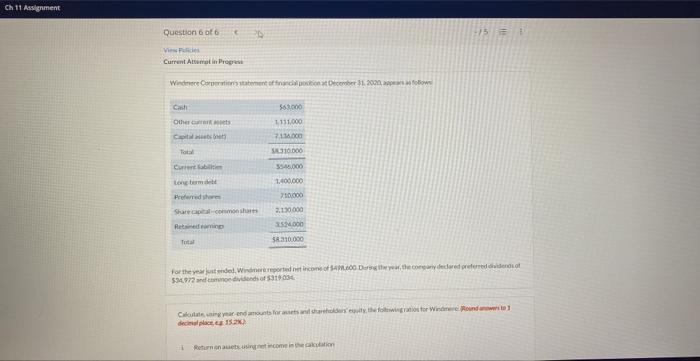

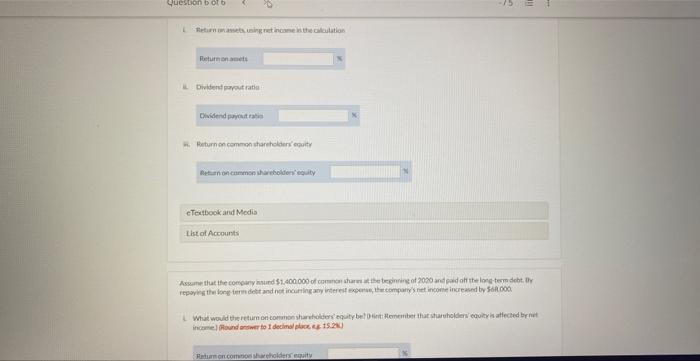

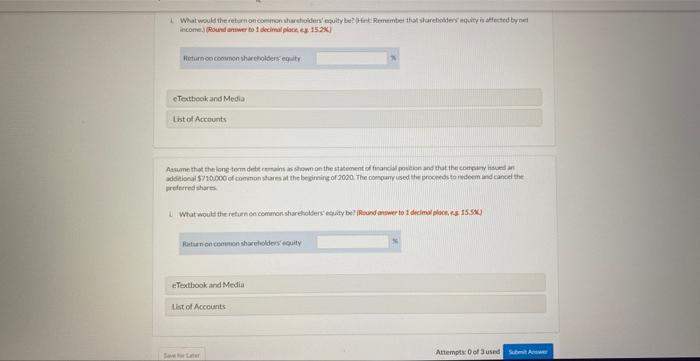

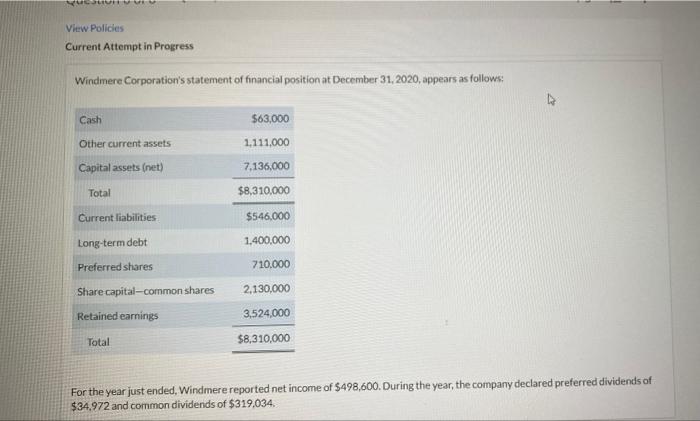

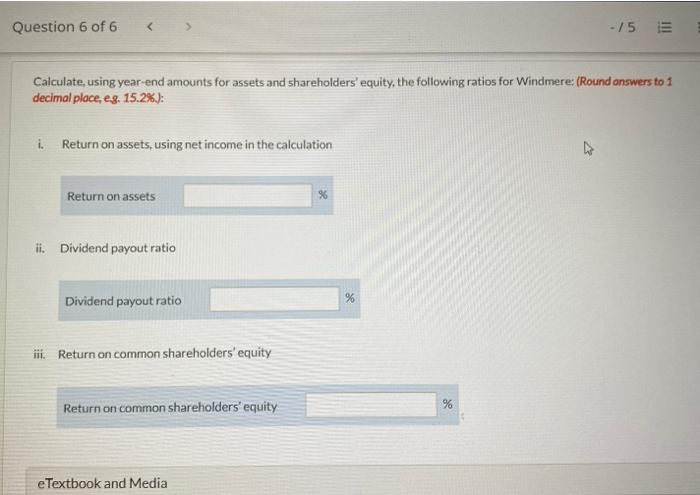

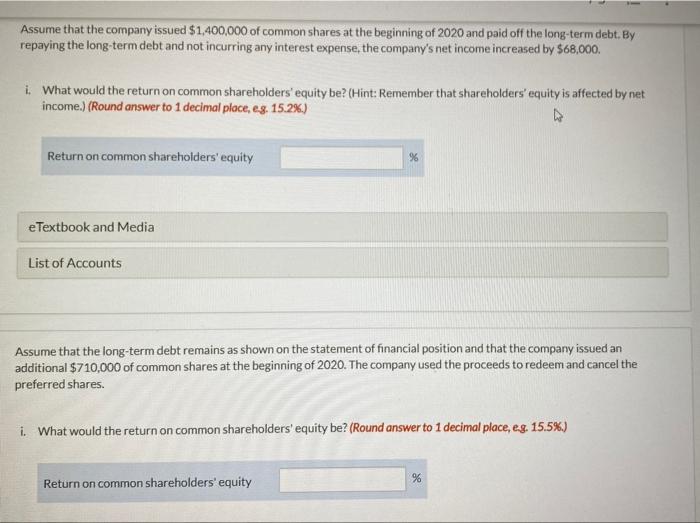

Current Atverrat in Dregrest dectiol place, 4 a5: 2%. Reiurenanacis 1i. Dividerst porout ratia : Wh. Heburn an common sharehelders' enaty eTreqbook and Modia List of fccourits inchere) Froind onswer fo 1 decimal plack e \& is 24 ) incone: Round artwer to 1 decima placi es 152k ) etertbock and Media List of Accounts arefternd sharen riextbook and Media View Policies Current Attempt in Progress Windmere Corporation's statement of financial position at December 31, 2020, appears as follows: For the year just ended, Windmere reported net income of $498,600. During the year, the company declared preferred dividends of $34,972 and common dividends of $319,034. Calculate, using year-end amounts for assets and shareholders' equity, the following ratios for Windmere: (Round onswers to 1 decimal place, e. 15.2\%): i. Return on assets, using net income in the calculation Return on assets $ ii. Dividend payout ratio Dividend payout ratio iii. Return on common shareholders' equity Assume that the company issued $1,400,000 of common shares at the beginning of 2020 and paid off the long-term debt. By repaying the long-term debt and not incurring any interest expense, the company's net income increased by $68,000. i. What would the return on common shareholders' equity be? (Hint: Remember that shareholders' equity is affected by net income.) (Round answer to 1 decimal ploce, eg. 15.2\%.) eTextbook and Media List of Accounts Assume that the long-term debt remains as shown on the statement of financial position and that the company issued an additional $710,000 of common shares at the beginning of 2020 . The company used the proceeds to redeem and cancel the preferred shares. i. What would the return on common shareholders' equity be? (Round answer to 1 decimal place, eg. 15.5\%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts