Question: Please do this question ASAP I will upvote! The December bank statement and cash T-account for Stewart Company follow: NSF cheque from J. Left, a

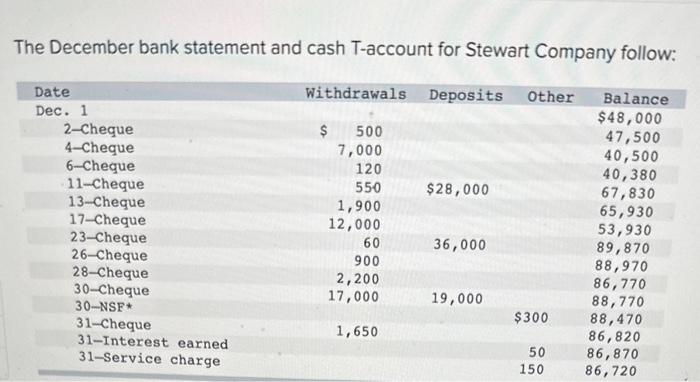

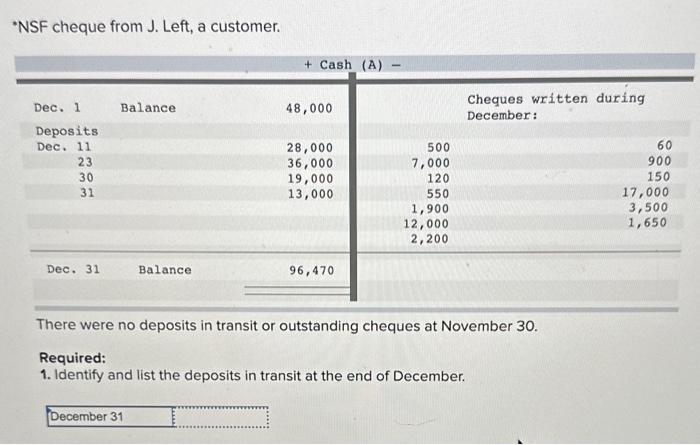

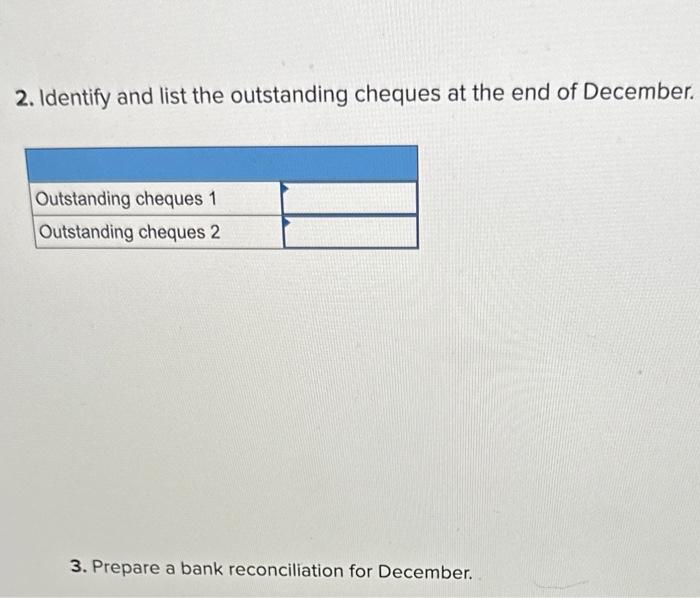

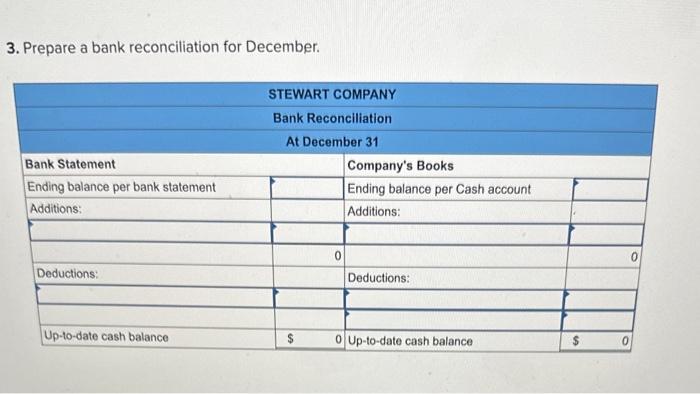

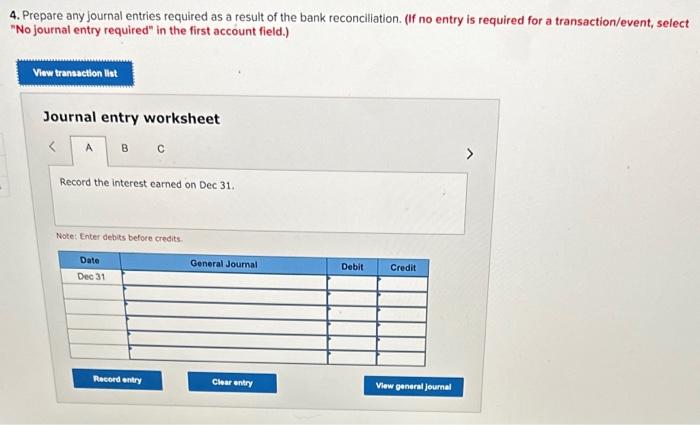

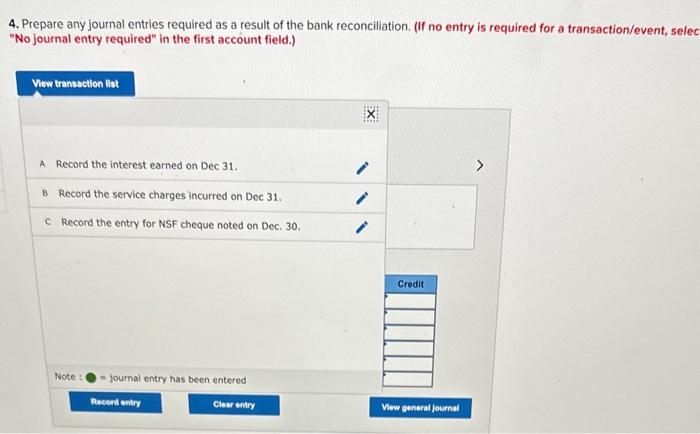

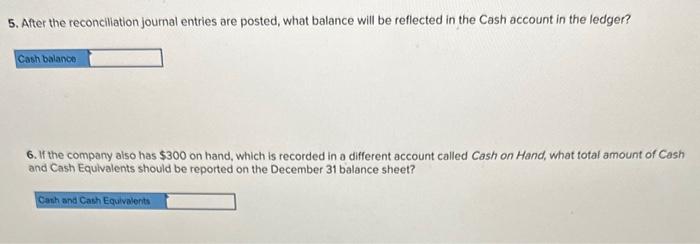

The December bank statement and cash T-account for Stewart Company follow: "NSF cheque from J. Left, a customer. There were no deposits in transit or outstanding cheques at November 30. Required: 1. Identify and list the deposits in transit at the end of December. 2. Identify and list the outstanding cheques at the end of December. 3. Prepare a bank reconciliation for December. 3. Prepare a bank reconciliation for December. 4. Prepare any journal entries required as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the interest carned on Dec 31 . Note: Enter debits before credits. 4. Prepare any journal entries required as a result of the bank reconciliation. (If no entry is required for a transaction/event, selec "No journal entry required" in the first account field.) A Record the interest earned on Dec 31 . B Record the service charges incurred on Dec 31 . c Record the entry for NSF cheque noted on Dec. 30 . Note: After the reconciliation joumal entries are posted, what balance will be reflected in the Cash account in the ledger? 6. If the company also has $300 on hand, which is recorded in a different account called Cash on Hand, what fotal amount of Cash and Cash Equivalents should be reported on the December 31 balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts