Question: Please don't copy from the wrong answers in chegg, as I received multiple incorrect answers already! If you copy from other sources, or make just

Please don't copy from the wrong answers in chegg, as I received multiple incorrect answers already! If you copy from other sources, or make just absolutely silly calculation errors from not reading the question properly, I would have to give you a dislike and possibly report. Please be mindful of your calculations as well, and show the progress. Thank you, and I hope you could understand.

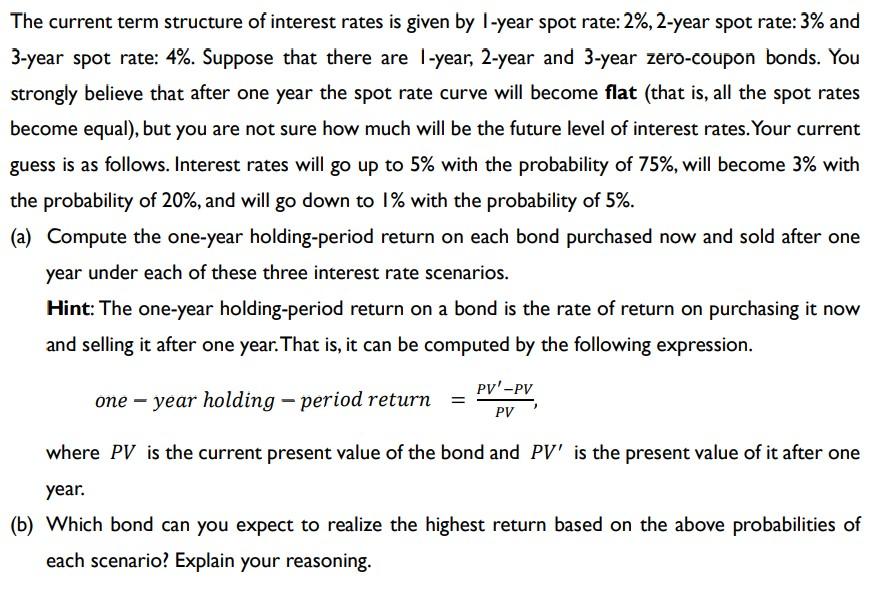

The current term structure of interest rates is given by I-year spot rate: 2%,2-year spot rate: 3% and 3-year spot rate: 4\%. Suppose that there are I-year, 2-year and 3-year zero-coupon bonds. You strongly believe that after one year the spot rate curve will become flat (that is, all the spot rates become equal), but you are not sure how much will be the future level of interest rates. Your current guess is as follows. Interest rates will go up to 5% with the probability of 75%, will become 3% with the probability of 20%, and will go down to 1% with the probability of 5%. (a) Compute the one-year holding-period return on each bond purchased now and sold after one year under each of these three interest rate scenarios. Hint: The one-year holding-period return on a bond is the rate of return on purchasing it now and selling it after one year. That is, it can be computed by the following expression. one-yearholding-periodreturn=PVPVPV where PV is the current present value of the bond and PV is the present value of it after one year. (b) Which bond can you expect to realize the highest return based on the above probabilities of each scenario? Explain your reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts