Question: Please don't copy paste from other questions. Thanks! PROBLEM 3: Airbus' Dollar Exposure Airbus delivered two A330-200 aircrafts to Delta Airlines, a U.S. company, and

Please don't copy paste from other questions. Thanks!

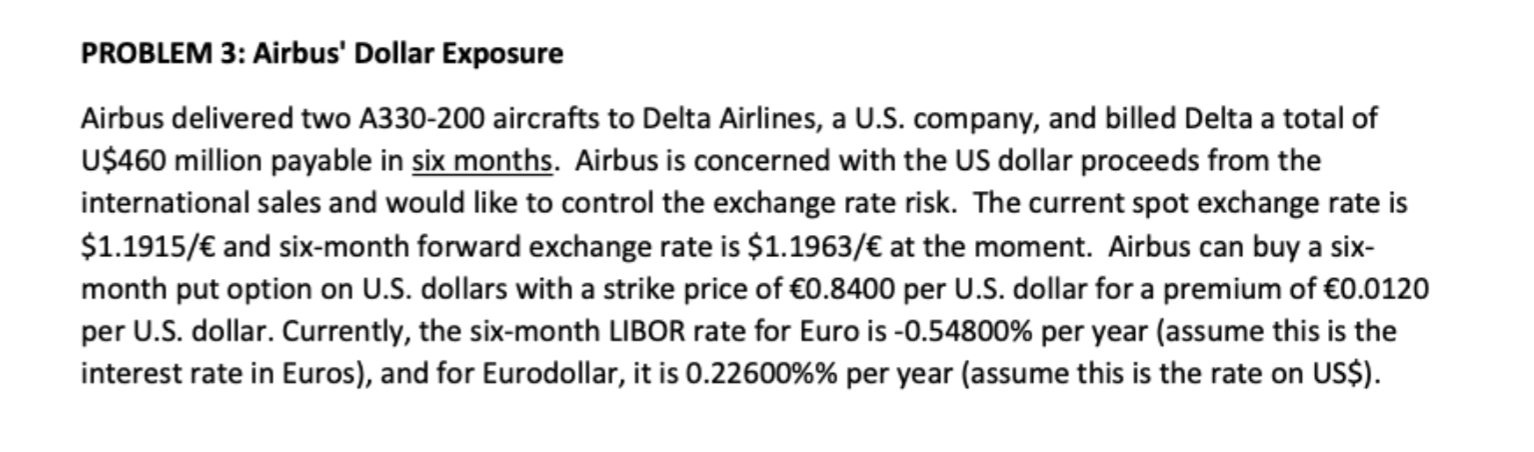

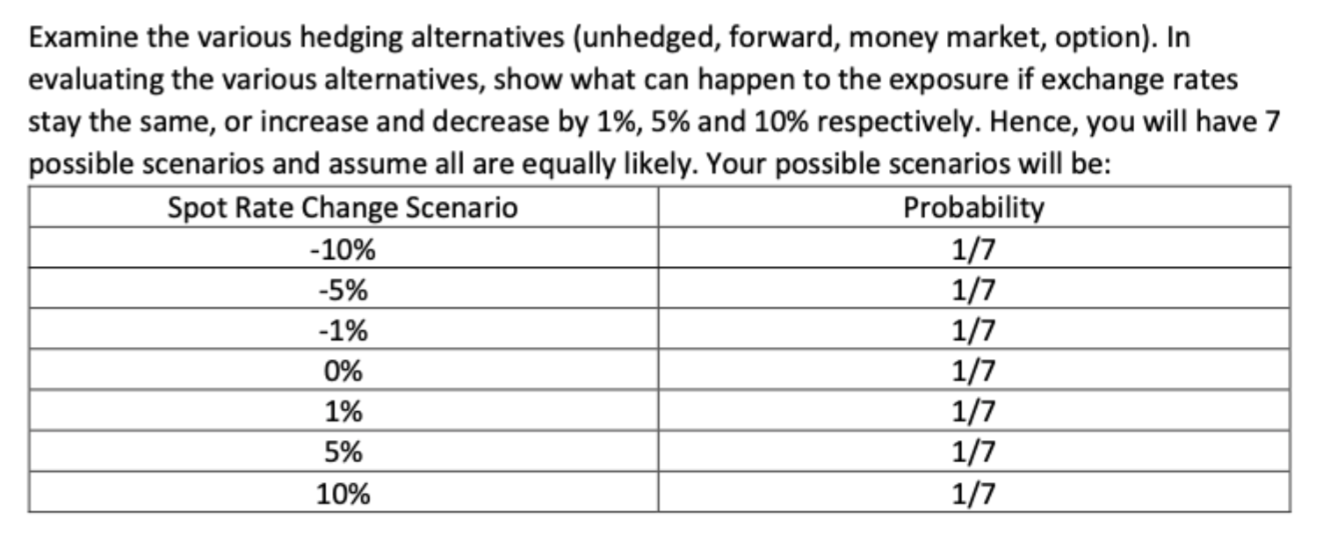

PROBLEM 3: Airbus' Dollar Exposure Airbus delivered two A330-200 aircrafts to Delta Airlines, a U.S. company, and billed Delta a total of U$460 million payable in six months. Airbus is concerned with the US dollar proceeds from the international sales and would like to control the exchange rate risk. The current spot exchange rate is $1.1915/ and six-month forward exchange rate is $1.1963/ at the moment. Airbus can buy a six- month put option on U.S. dollars with a strike price of 0.8400 per U.S. dollar for a premium of 0.0120 per U.S. dollar. Currently, the six-month LIBOR rate for Euro is -0.54800% per year (assume this is the interest rate in Euros), and for Eurodollar, it is 0.22600%% per year (assume this is the rate on US$). Examine the various hedging alternatives (unhedged, forward, money market, option). In evaluating the various alternatives, show what can happen to the exposure if exchange rates stay the same, or increase and decrease by 1%, 5% and 10% respectively. Hence, you will have 7 possible scenarios and assume all are equally likely. Your possible scenarios will be: Spot Rate Change Scenario Probability -10% 1/7 -5% 1/7 -1% 1/7 0% 1/7 1% 1/7 5% 1/7 10% 1/7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts