Question: Please only show a HEDGE WITH A PUT OPTION ON EXCEL when showing what happens to the expose of the exchange rates stay the same,

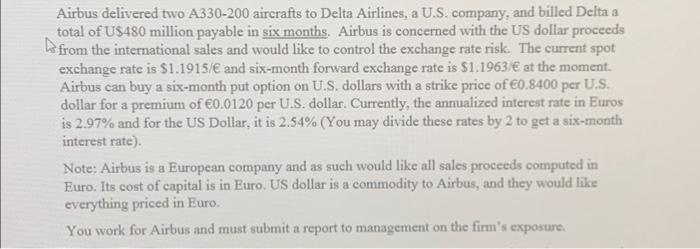

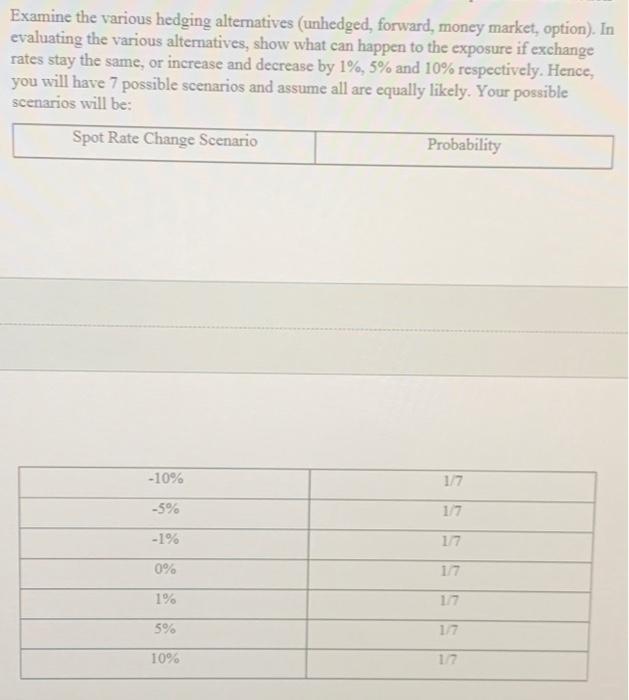

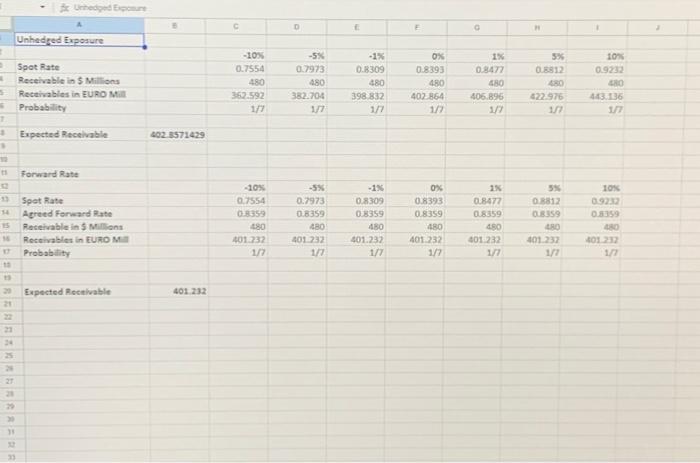

Airbus delivered two A.330-200 aircrafts to Delta Airlines, a U.S. company, and billed Delta a total of US480 million payable in six months. Airbus is concerned with the US dollar proceeds from the international sales and would like to control the exchange rate risk. The current spot exchange rate is $1.1915/ and six-month forward exchange rate is $1.1963/ at the moment. Airbus can buy a six-month put option on U.S. dollars with a strike price of 60.8400 per U.S. dollar for a premium of 60.0120 per U.S. dollar. Currently, the annualized interest rate in Euros is 2.97% and for the US Dollar, it is 2.54% (You may divide these rates by 2 to get a six-month interest rate). Note: Airbus is a European company and as such would like all sales proceds computed in Euro. Its cost of capital is in Euro. US dollar is a commodity to Airbus, and they would like everything priced in Euro. You work for Airbus and must submit a report to management on the firm's exposure. Examine the various hedging alternatives (unhedged, forward, money market, option). In evaluating the various altematives, show what can happen to the exposure if exchange rates stay the same, or increase and decrease by 1%,5% and 10% respectively. Hence, you will have 7 possible scenarios and assume all are equally likely. Your possible scenarios will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts