Question: Please don't copy paste the wrong answer from AI or from somewhere else. please show all the steps. I will upvote if it's right. Q

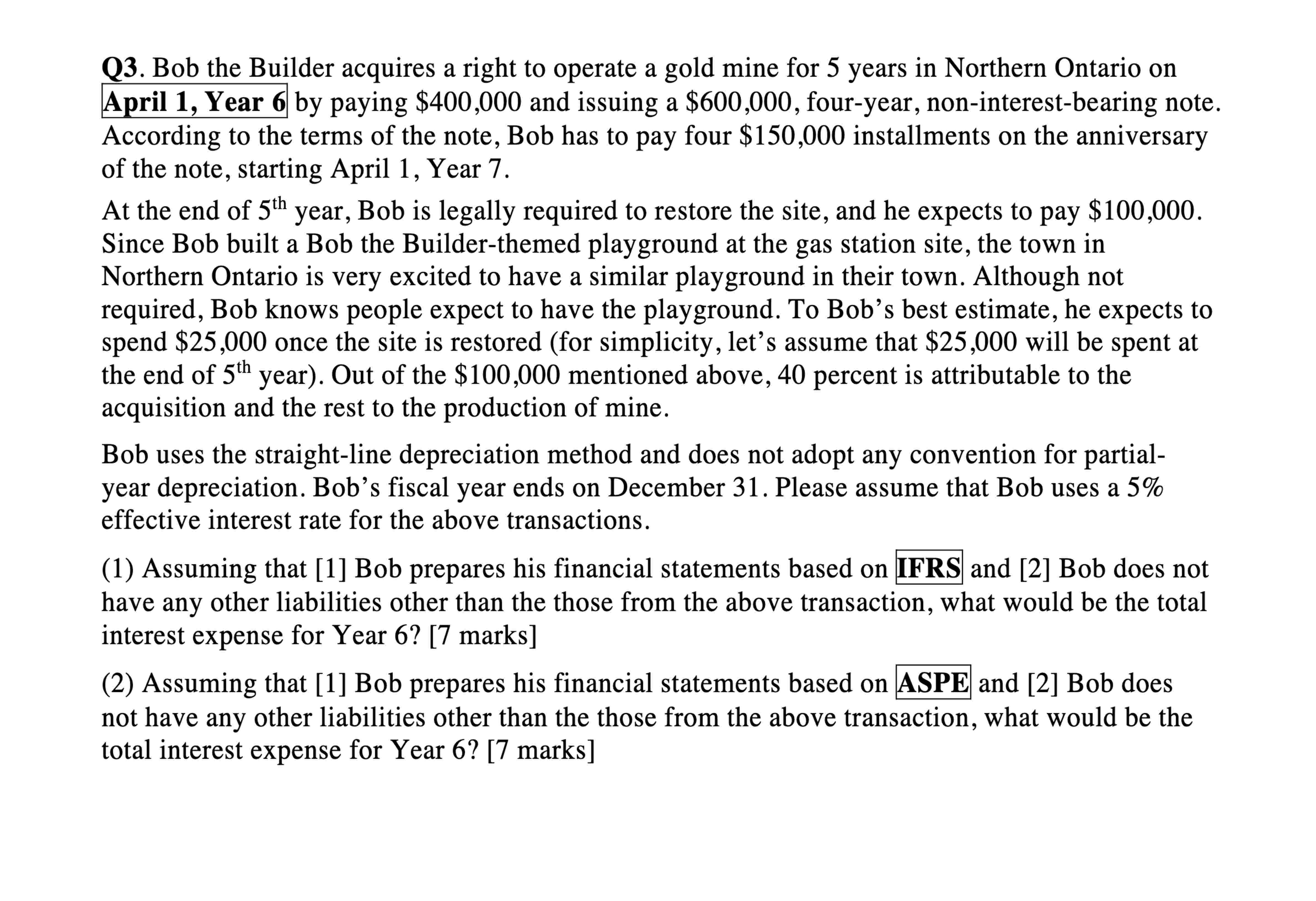

Please don't copy paste the wrong answer from AI or from somewhere else. please show all the steps. I will upvote if it's right. Q Bob the Builder acquires a right to operate a gold mine for years in Northern Ontario on April Year by paying $ and issuing a $ fouryear, noninterestbearing note. According to the terms of the note, Bob has to pay four $ installments on the anniversary of the note, starting April Year At the end of th year, Bob is legally required to restore the site, and he expects to pay $ Since Bob built a Bob the Builderthemed playground at the gas station site, the town in Northern Ontario is very excited to have a similar playground in their town. Although not required, Bob knows people expect to have the playground. To Bob's best estimate, he expects to spend $ once the site is restored for simplicity, let's assume that $ will be spent at the end of th year Out of the $ mentioned above, percent is attributable to the acquisition and the rest to the production of mine. Bob uses the straightline depreciation method and does not adopt any convention for partial year depreciation. Bob's fiscal year ends on December Please assume that Bob uses a effective interest rate for the above transactions. Assuming that Bob prepares his financial statements based on IFRS and Bob does not have any other liabilities other than the those from the above transaction, what would be the total interest expense for Year marks Assuming that Bob prepares his financial statements based on ASPE and Bob does not have any other liabilities other than the those from the above transaction, what would be the total interest expense for Year marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock