Question: please dont do wrong, 4 (W) What is the total, systemat Mr. Abhishek is interested in investing 2,00,000 for which he is considering following three

please dont do wrong,

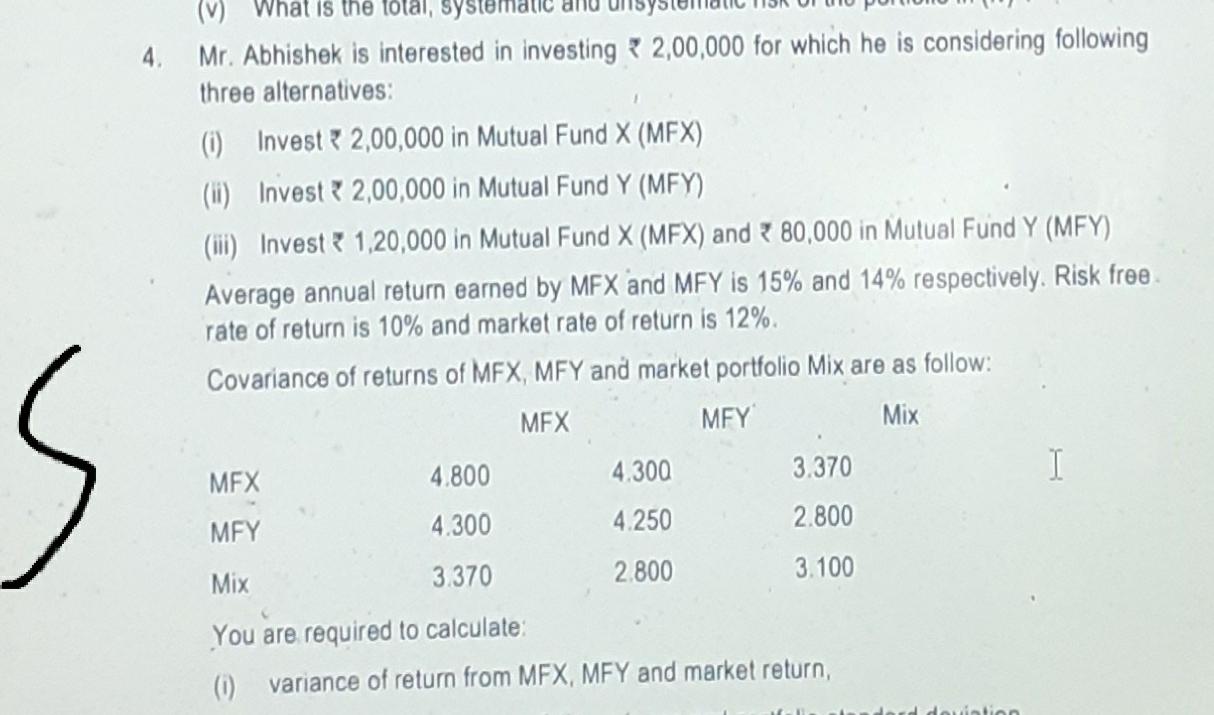

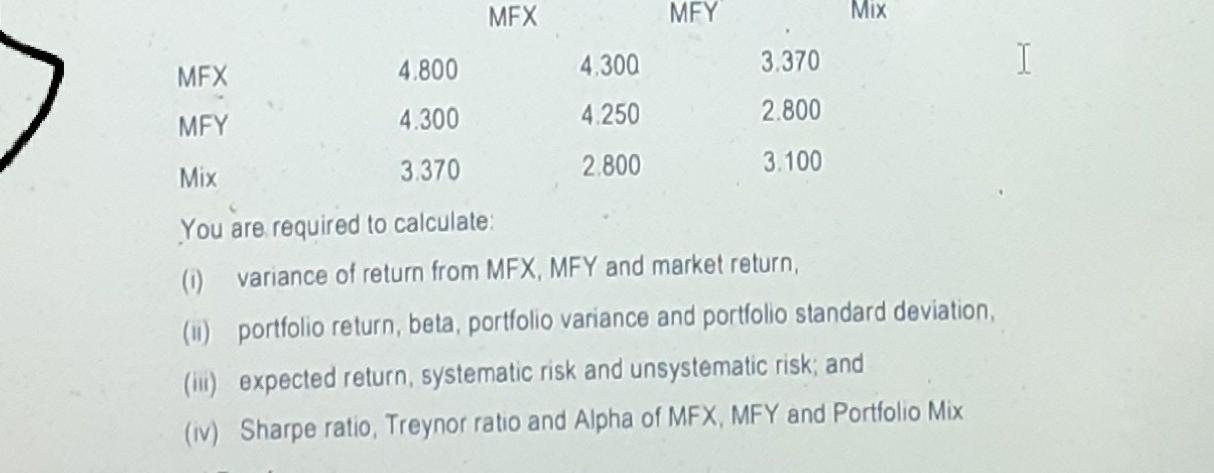

4 (W) What is the total, systemat Mr. Abhishek is interested in investing 2,00,000 for which he is considering following three alternatives: (i) Invest 2,00,000 in Mutual Fund X (MEX) (ii) Invest 2,00,000 in Mutual Fund Y (MFY) (iii) Invest 1,20,000 in Mutual Fund X (MFX) and 80,000 in Mutual Fund Y (MFY) Average annual return earned by MFX and MFY is 15% and 14% respectively. Risk free rate of return is 10% and market rate of return is 12%. Covariance of returns of MFX, MFY and market portfolio Mix are as follow: MEX MFY Mix MFX 4.800 4.300 3.370 I MFY 4.300 4.250 2.800 Mix 3.370 2.800 3.100 You are required to calculate () variance of return from MFX, MFY and market return, MFX MFY Mix MFX 4.800 4.300 3.370 I MFY 4.300 4.250 2.800 Mix 3.370 2.800 3.100 You are required to calculate: (0) variance of return from MFX, MFY and market return, (W) portfolio return, beta, portfolio variance and portfolio standard deviation, (ii) expected return, systematic risk and unsystematic risk; and (iv) Sharpe ratio, Treynor ratio and Alpha of MFX, MFY and Portfolio Mix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts