Question: PLEASE DON'T JUST EXPLAIN WHAT TO DO. PLEASE ACTUALLY ADD DATA TO MY CHART AND THEN EXPLAIN BECAUSE I AM STILL CONFUSED WITH THE TERMS.

PLEASE DON'T JUST EXPLAIN WHAT TO DO. PLEASE ACTUALLY ADD DATA TO MY CHART AND THEN EXPLAIN BECAUSE I AM STILL CONFUSED WITH THE TERMS. ONCE I SEE WHERE THE DATA GOES, THEN I CAN START TO UNDERSTAND WHY THINGS ARE PLACED WHERE THEY ARE. I DON'T WANT TO CHEAT, I WANT TO UNDERSTAND.

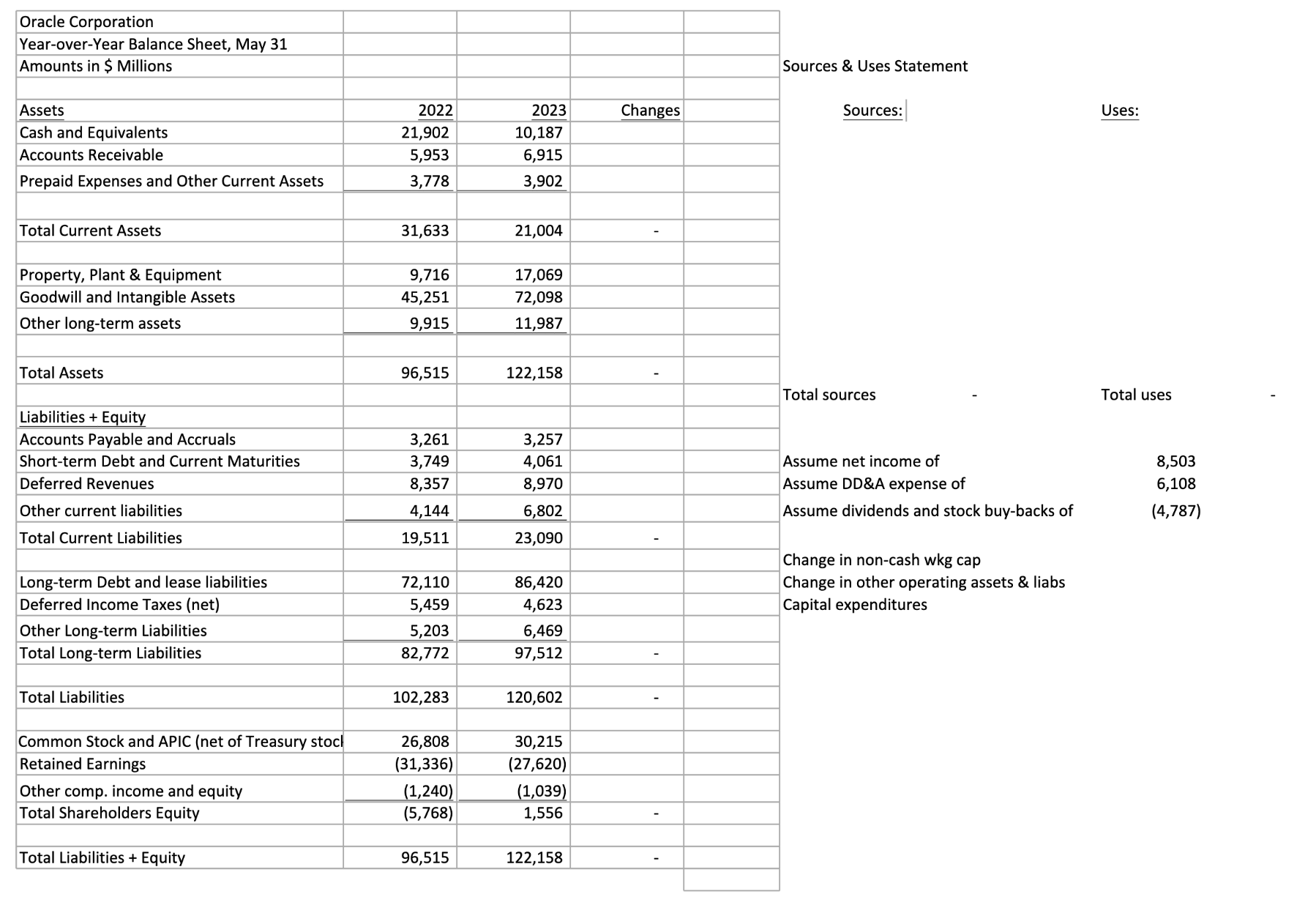

This exercise should crystallize in your mind the close relationship between the key financial statements a company is required to disclose (balance sheet, income statement and statement of cash flows). A clear understanding of the linkage between balance sheet changes, sources and uses of funds, net profits and dividends, and the cash flow statement will help you quickly evaluate a company's cash generation and usage and its overall financial performance.

Assignment instructions:

- Create an annual sources and uses of funds statement for Oracle.

- When the above statement is completed and the balances tie out:

- Adjust the change in PP&E for the year's depreciation expense to calculate capital expenditures.

- Consolidate the change in working capital accounts other than cash by adding together the changes in individual working capital accounts. BE ESPECIALLY MINDFUL OF USING THE CORRECT SIGNS.

- Similarly, consolidate changes in other operating assets and liabilities that would not be accounted for in other cash flow categories (i.e., investing or financing).

- Adjust the change in retained earnings to reflect its subcomponents and place those subcomponents in the appropriate "buckets" on the cash flow statement.

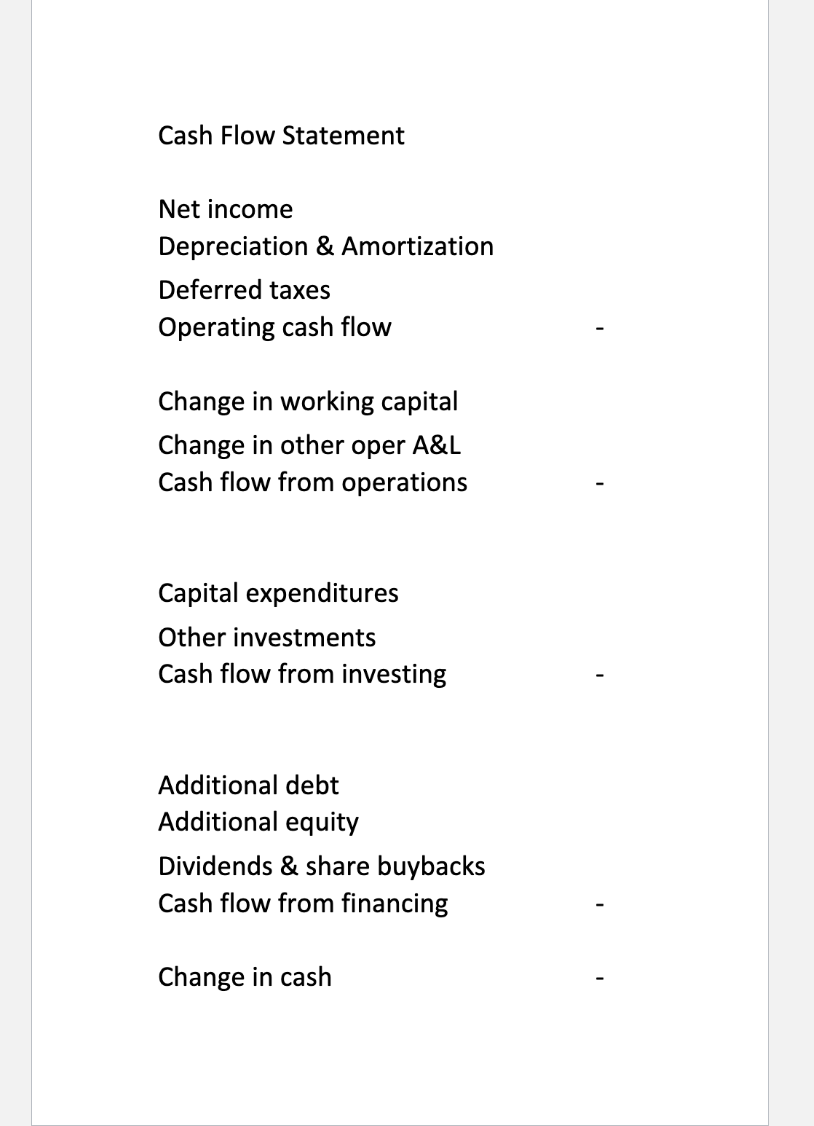

- Reorganize the rest of the adjusted sources and uses information to complete a properly formatted cash flow statement, using the required categories of operations, investing and financing and reconciling to the year's change in cash.

- Submit the completed sources and uses of funds and cash flow statements in Canvas as an Excel file.

Cash Flow Statement Net income Depreciation \& Amortization Deferred taxes Operating cash flow Change in working capital Change in other oper A\&L Cash flow from operations Capital expenditures Other investments Cash flow from investing Additional debt Additional equity Dividends \& share buybacks Cash flow from financing Change in cash Cash Flow Statement Net income Depreciation \& Amortization Deferred taxes Operating cash flow Change in working capital Change in other oper A\&L Cash flow from operations Capital expenditures Other investments Cash flow from investing Additional debt Additional equity Dividends \& share buybacks Cash flow from financing Change in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts