Question: please don't mind the answers provided on the attached image coz im not sure if thats the correct answer. PROBLEM 3 On July 1, 2020,

please don't mind the answers provided on the attached image coz im not sure if thats the correct answer.

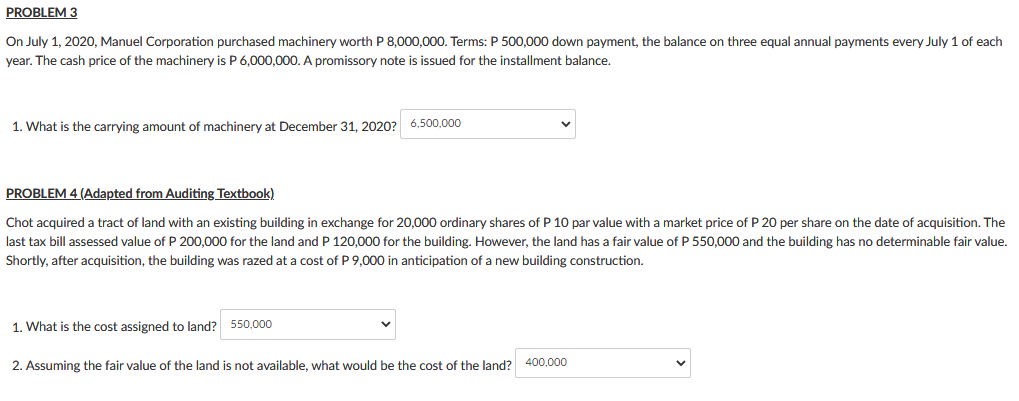

PROBLEM 3

On July 1, 2020, Manuel Corporation purchased machinery worth P 8,000,000. Terms: P 500,000 down payment, the balance on three equal annual payments every July 1 of each year. The cash price of the machinery is P 6,000,000. A promissory note is issued for the installment balance.

What is the carrying amount of machinery at December 31, 2020?["", "", ""]

PROBLEM 4 (Adapted from Auditing Textbook)

Chot acquired a tract of land with an existing building in exchange for 20,000 ordinary shares of P 10 par value with a market price of P 20 per share on the date of acquisition. The last tax bill assessed value of P 200,000 for the land and P 120,000 for the building. However, the land has a fair value of P 550,000 and the building has no determinable fair value. Shortly, after acquisition, the building was razed at a cost of P 9,000 in anticipation of a new building construction.

What is the cost assigned to land?["", "", "", ""]

Assuming the fair value of the land is not available, what would be the cost of the land?["", "", "", ""]

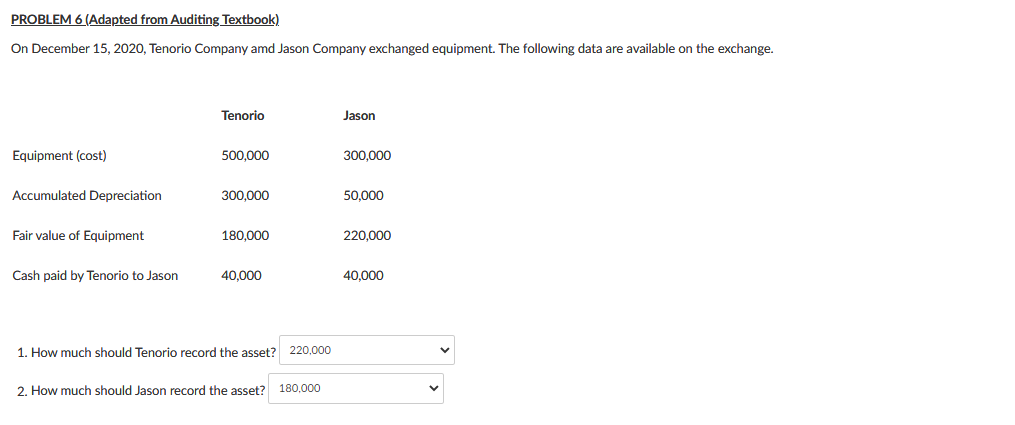

PROBLEM 6 (Adapted from Auditing Textbook)

On December 15, 2020, Tenorio Company amd Jason Company exchanged equipment. The following data are available on the exchange.

Tenorio Jason

Equipment (cost) 500,000 300,000

Accumulated Depreciation 300,000 50,000

Fair value of Equipment 180,000 220,000

Cash paid by Tenorio to Jason 40,000 40,000

How much should Tenorio record the asset?["", "", "", ""]

How much should Jason record the asset?["", "", "", ""]

PROBLEM 3 On July 1, 2020, Manuel Corporation purchased machinery worth P 8,000,000. Terms: P 500,000 down payment, the balance on three equal annual payments every July 1 of each year. The cash price of the machinery is P 6,000,000. A promissory note is issued for the installment balance. 1. What is the carrying amount of machinery at December 31, 2020? 6,500,000 PROBLEM 4 (Adapted from Auditing Textbook) Chot acquired a tract of land with an existing building in exchange for 20,000 ordinary shares of P 10 par value with a market price of P 20 per share on the date of acquisition. The last tax bill assessed value of P 200,000 for the land and P 120,000 for the building. However, the land has a fair value of P 550,000 and the building has no determinable fair value. Shortly, after acquisition, the building was razed at a cost of P 9,000 in anticipation of a new building construction. 1. What is the cost assigned to land? 550,000 2. Assuming the fair value of the land is not available, what would be the cost of the land? 400,000PROBLEM 6 (Adapted from Auditing Textbook) On December 15, 2020, Tenorio Company amd Jason Company exchanged equipment. The following data are available on the exchange. Tenorio Jason Equipment (cost) 500,000 300,000 Accumulated Depreciation 300,000 50,000 Fair value of Equipment 180,000 220,000 Cash paid by Tenorio to Jason 40,000 40,000 1. How much should Tenorio record the asset? 220,000 2. How much should Jason record the asset? 180,000 v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts