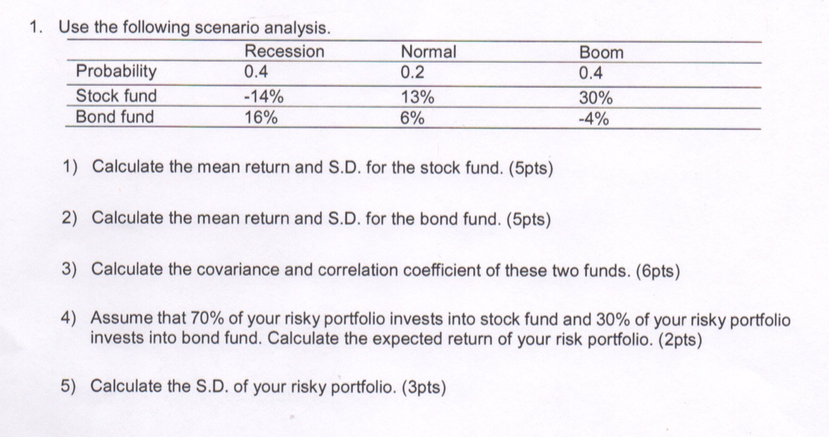

Question: Please don't solve it by EXCEL. 1. Use the ollowing scenario analysis. Probability Stock fund Bond fund Recession 0.4 -14% 16% Normal 0.2 13% 5%

Please don't solve it by EXCEL.

1. Use the ollowing scenario analysis. Probability Stock fund Bond fund Recession 0.4 -14% 16% Normal 0.2 13% 5% Boom 0.4 30% -4% 1) Calculate the mean return and S.D. for the stock fund. (5pts) 2) Calculate the mean return and S.D. for the bond fund. (5pts) 3) Calculate the covariance and correlation coefficient of these two funds. (6pts) 4) Assume that 70% of your risky portfolio invests into stock fund and 30% of your risky portfolio invests into bond fund. Calculate the expected return of your risk portfolio. (2pts) 5) Calculate the S.D. of your risky portfolio. (3pts)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock