Question: Please dont solve it in excel. I need work A stock price is currently $40. Over each of the next two three-month periods it is

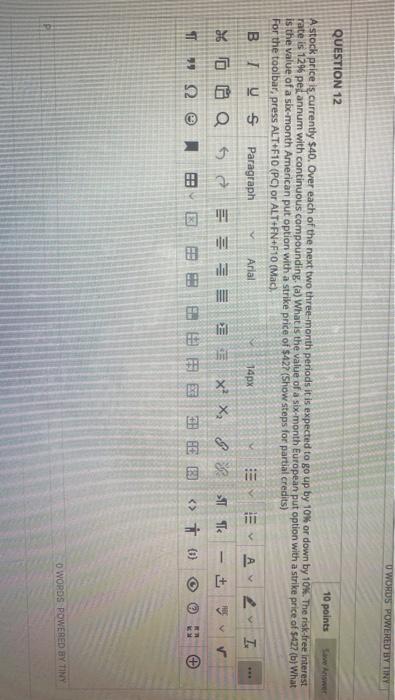

UWORDS POWERED BY TINY QUESTION 12 10 points A stock price is currently $40. Over each of the next two three-month periods it is expected to go up by 10% or down by 10%. The risk-free interest rate 12% pet annum with continuous compounding, (a) What is the value of a six-month European put option with a strike price of $427 (b) What is the value of a sbc-month American put option with a strike price of $427 (Show steps for partial credits) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac), BI V S Paragraph Arial J4px X GQ $ EE xXx T To T 10 3 E. EBBE 1) A +] 5 @ KM WORDS POWERED BY TINY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts