Question: Question 2. The Markowitz portfolio selection model suggests that security selection should achieve the best risk-return combinations Discuss the advantages of investing in all the

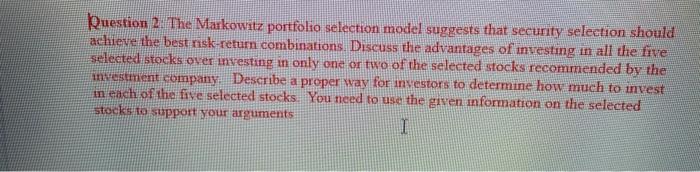

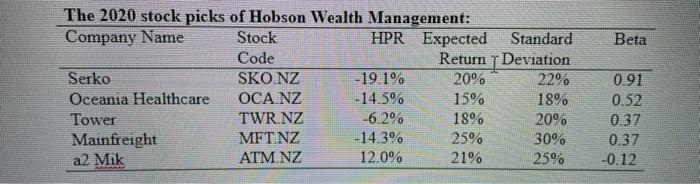

Question 2. The Markowitz portfolio selection model suggests that security selection should achieve the best risk-return combinations Discuss the advantages of investing in all the five selected stocks over investing in only one or two of the selected stocks recommended by the investment company Describe a proper way for investors to determine how much to invest in each of the five selected stocks. You need to use the given information on the selected stocks to support your arguments I Beta The 2020 stock picks of Hobson Wealth Management: Company Name Stock HPR Expected Code Return Serko SKO NZ -19.1% 20% Oceania Healthcare OCA.NZ -14.5% 15% Tower TWRNZ -6.2% 18% Mainfreight MFT NZ -14.3% 25% a2 Mik ATM.NZ 12.0% 21% Standard Deviation 22% 18% 20% 30% 25% 0.91 0.52 0.37 0.37 -0.12 Question 2. The Markowitz portfolio selection model suggests that security selection should achieve the best risk-return combinations Discuss the advantages of investing in all the five selected stocks over investing in only one or two of the selected stocks recommended by the investment company Describe a proper way for investors to determine how much to invest in each of the five selected stocks. You need to use the given information on the selected stocks to support your arguments I Beta The 2020 stock picks of Hobson Wealth Management: Company Name Stock HPR Expected Code Return Serko SKO NZ -19.1% 20% Oceania Healthcare OCA.NZ -14.5% 15% Tower TWRNZ -6.2% 18% Mainfreight MFT NZ -14.3% 25% a2 Mik ATM.NZ 12.0% 21% Standard Deviation 22% 18% 20% 30% 25% 0.91 0.52 0.37 0.37 -0.12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts