Question: Please don't use an excel function. In order to address its huge expenses, the South Sea Company issues a 20- year, callable bond with 8%

Please don't use an excel function.

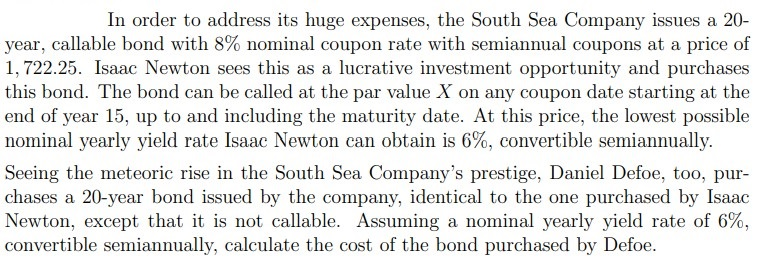

In order to address its huge expenses, the South Sea Company issues a 20- year, callable bond with 8% nominal coupon rate with semiannual coupons at a price of 1,722.25. Isaac Newton sees this as a lucrative investment opportunity and purchases this bond. The bond can be called at the par value X on any coupon date starting at the end of year 15, up to and including the maturity date. At this price, the lowest possible nominal yearly yield rate Isaac Newton can obtain is 6%, convertible semiannually. Seeing the meteoric rise in the South Sea Company's prestige, Daniel Defoe, too, pur- chases a 20-year bond issued by the company, identical to the one purchased by Isaac Newton, except that it is not callable. Assuming a nominal yearly yield rate of 6%, convertible semiannually, calculate the cost of the bond purchased by Defoe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts