Question: PLEASE DON'T USE EXCEL AND PLEASE ANSWER ALL THE 3 QUESTIONS IN FULL ORDER AND WORK OUT.. Thank you:) Question 2 (a) Delta Bhd a

PLEASE DON'T USE EXCEL AND PLEASE ANSWER ALL THE 3 QUESTIONS IN FULL ORDER AND WORK OUT.. Thank you:)

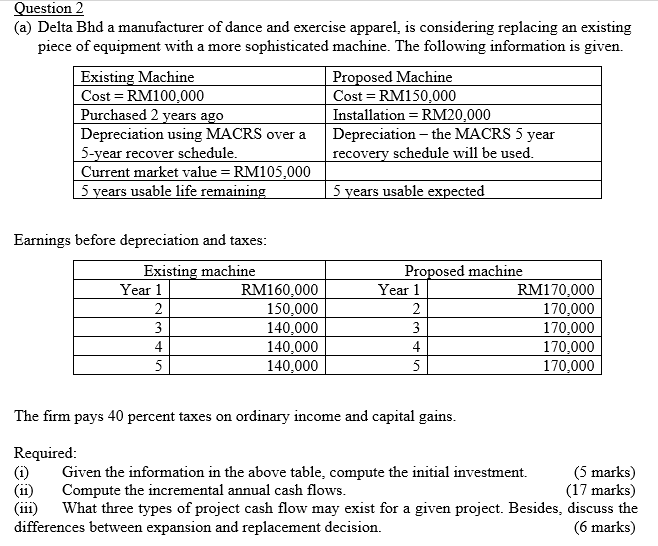

Question 2 (a) Delta Bhd a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given. Existing Machine Proposed Machine Cost = RM100,000 Cost =RM150,000 Purchased 2 years ago Installation = RM20,000 Depreciation using MACRS over a Depreciation - the MACRS 5 year 5-year recover schedule. recovery schedule will be used. Current market value = RM105,000 5 years usable life remaining 5 years usable expected Earnings before depreciation and taxes: Existing machine Year 1 RM160,000 2 150,000 3 140,000 4 140,000 5 140,000 Proposed machine Year 1 RM170,000 2 170,000 3 170,000 4 170,000 5 170,000 WIN The firm pays 40 percent taxes on ordinary income and capital gains. Required: (1) Given the information in the above table, compute the initial investment. (5 marks) (11) Compute the incremental annual cash flows. (17 marks) (111) What three types of project cash flow may exist for a given project. Besides, discuss the differences between expansion and replacement decision. (6 marks) Question 2 (a) Delta Bhd a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given. Existing Machine Proposed Machine Cost = RM100,000 Cost =RM150,000 Purchased 2 years ago Installation = RM20,000 Depreciation using MACRS over a Depreciation - the MACRS 5 year 5-year recover schedule. recovery schedule will be used. Current market value = RM105,000 5 years usable life remaining 5 years usable expected Earnings before depreciation and taxes: Existing machine Year 1 RM160,000 2 150,000 3 140,000 4 140,000 5 140,000 Proposed machine Year 1 RM170,000 2 170,000 3 170,000 4 170,000 5 170,000 WIN The firm pays 40 percent taxes on ordinary income and capital gains. Required: (1) Given the information in the above table, compute the initial investment. (5 marks) (11) Compute the incremental annual cash flows. (17 marks) (111) What three types of project cash flow may exist for a given project. Besides, discuss the differences between expansion and replacement decision. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts