Question: Please don't use Excel in Answer. Question 8 21 pts [Problems 8 - 10 A stock price is currently $60. Assume that the expected return

Please don't use Excel in Answer.

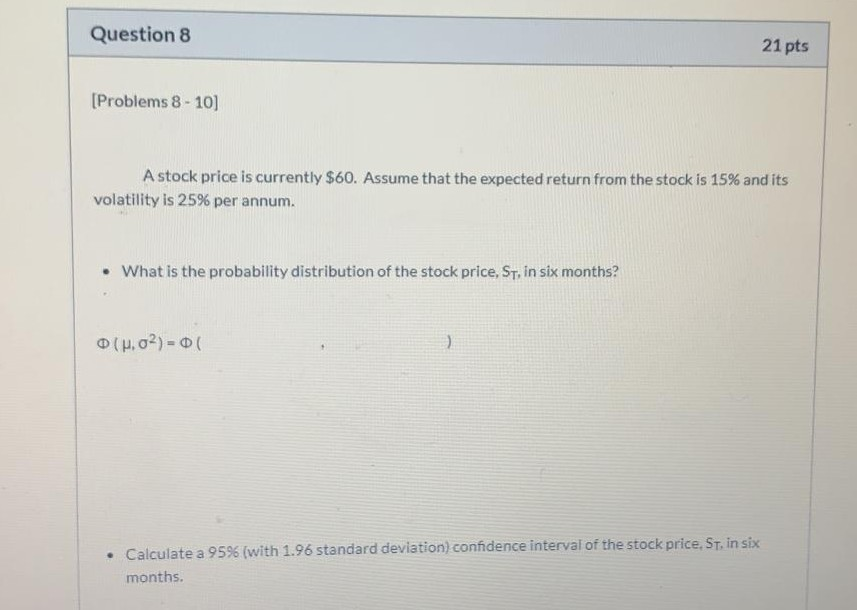

Question 8 21 pts [Problems 8 - 10 A stock price is currently $60. Assume that the expected return from the stock is 15% and its volatility is 25% per annum. What is the probability distribution of the stock price, St, in six months? (M.02) 0 Calculate a 95% (with 1.96 standard deviation) confidence interval of the stock price. St, in six months. Calculate a 95% (with 1.96 standard deviation) confidence interval of the stock price, Sr, in six months. What is the probability that a six-month European call option on the stock with an exercise price of $70 will be exercised? Question 8 21 pts [Problems 8 - 10 A stock price is currently $60. Assume that the expected return from the stock is 15% and its volatility is 25% per annum. What is the probability distribution of the stock price, St, in six months? (M.02) 0 Calculate a 95% (with 1.96 standard deviation) confidence interval of the stock price. St, in six months. Calculate a 95% (with 1.96 standard deviation) confidence interval of the stock price, Sr, in six months. What is the probability that a six-month European call option on the stock with an exercise price of $70 will be exercised

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts