Question: Please don't use excel or at least post write formula 1. You have $100,000 invested in this portfolio. $55,000 is invested in IBM: Recession Normal

Please don't use excel or at least post write formula

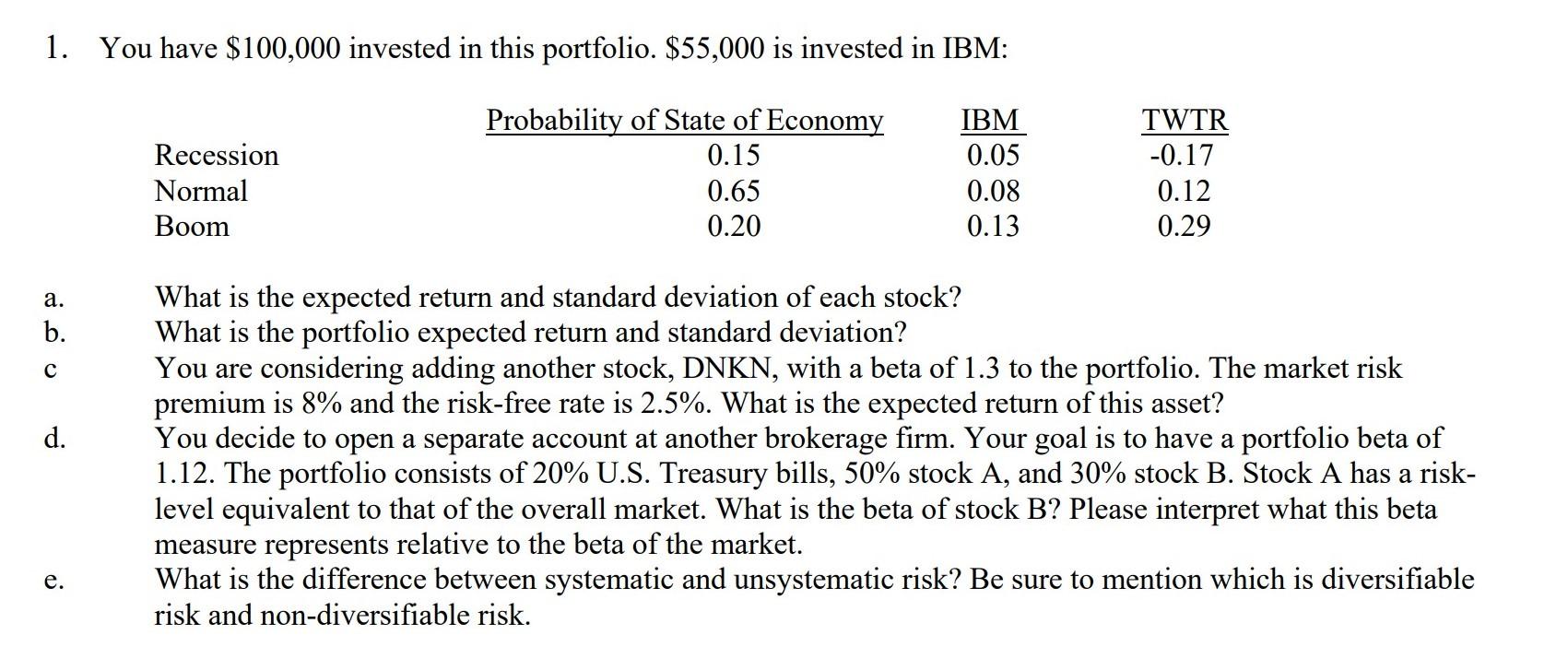

1. You have $100,000 invested in this portfolio. $55,000 is invested in IBM: Recession Normal Boom Probability of State of Economy 0.15 0.65 0.20 IBM 0.05 0.08 0.13 TWTR -0.17 0.12 0.29 a. b. d. What is the expected return and standard deviation of each stock? What is the portfolio expected return and standard deviation? You are considering adding another stock, DNKN, with a beta of 1.3 to the portfolio. The market risk premium is 8% and the risk-free rate is 2.5%. What is the expected return of this asset? You decide to open a separate account at another brokerage firm. Your goal is to have a portfolio beta of 1.12. The portfolio consists of 20% U.S. Treasury bills, 50% stock A, and 30% stock B. Stock A has a risk- level equivalent to that of the overall market. What is the beta of stock B? Please interpret what this beta measure represents relative to the beta of the market. What is the difference between systematic and unsystematic risk? Be sure to mention which is diversifiable risk and non-diversifiable risk. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts