Question: please don't use excel so i can understand how to do it on paper. thank you. 1. A stock is trading at $50 and has

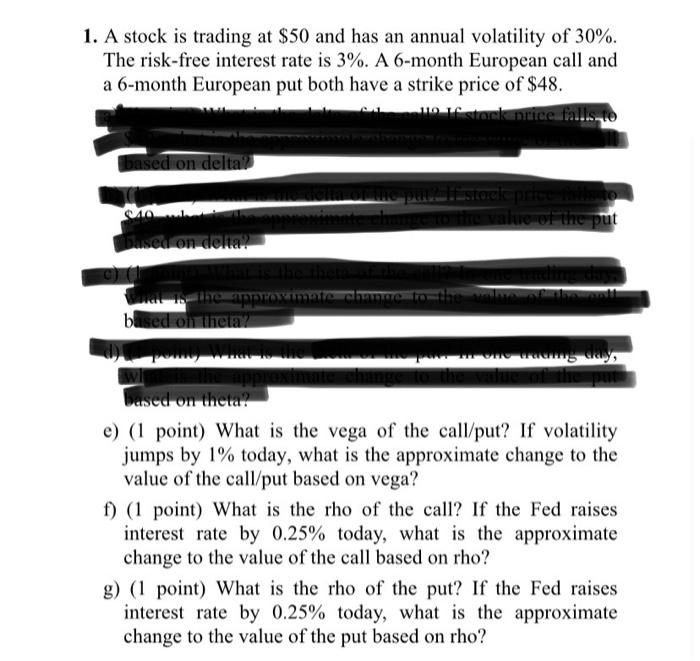

1. A stock is trading at $50 and has an annual volatility of 30%. The risk-free interest rate is 3%. A 6-month European call and a 6-month European put both have a strike price of $48. 110 stock nice falls to con delta? stere pre value of the put based on delia: Change - the approx based on theia? based on theta? e) (1 point) What is the vega of the call/put? If volatility jumps by 1% today, what is the approximate change to the value of the call/put based on vega? f) (1 point) What is the rho of the call? If the Fed raises interest rate by 0.25% today, what is the approximate change to the value of the call based on rho? g) (1 point) What is the rho of the put? If the Fed raises interest rate by 0.25% today, what is the approximate change to the value of the put based on rho? 1. A stock is trading at $50 and has an annual volatility of 30%. The risk-free interest rate is 3%. A 6-month European call and a 6-month European put both have a strike price of $48. 110 stock nice falls to con delta? stere pre value of the put based on delia: Change - the approx based on theia? based on theta? e) (1 point) What is the vega of the call/put? If volatility jumps by 1% today, what is the approximate change to the value of the call/put based on vega? f) (1 point) What is the rho of the call? If the Fed raises interest rate by 0.25% today, what is the approximate change to the value of the call based on rho? g) (1 point) What is the rho of the put? If the Fed raises interest rate by 0.25% today, what is the approximate change to the value of the put based on rho

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts