Question: Please don't use the same answer. 03. An oil company owns a piece of land which may contain oil and/or gas. A competitor oil company

Please don't use the same answer.

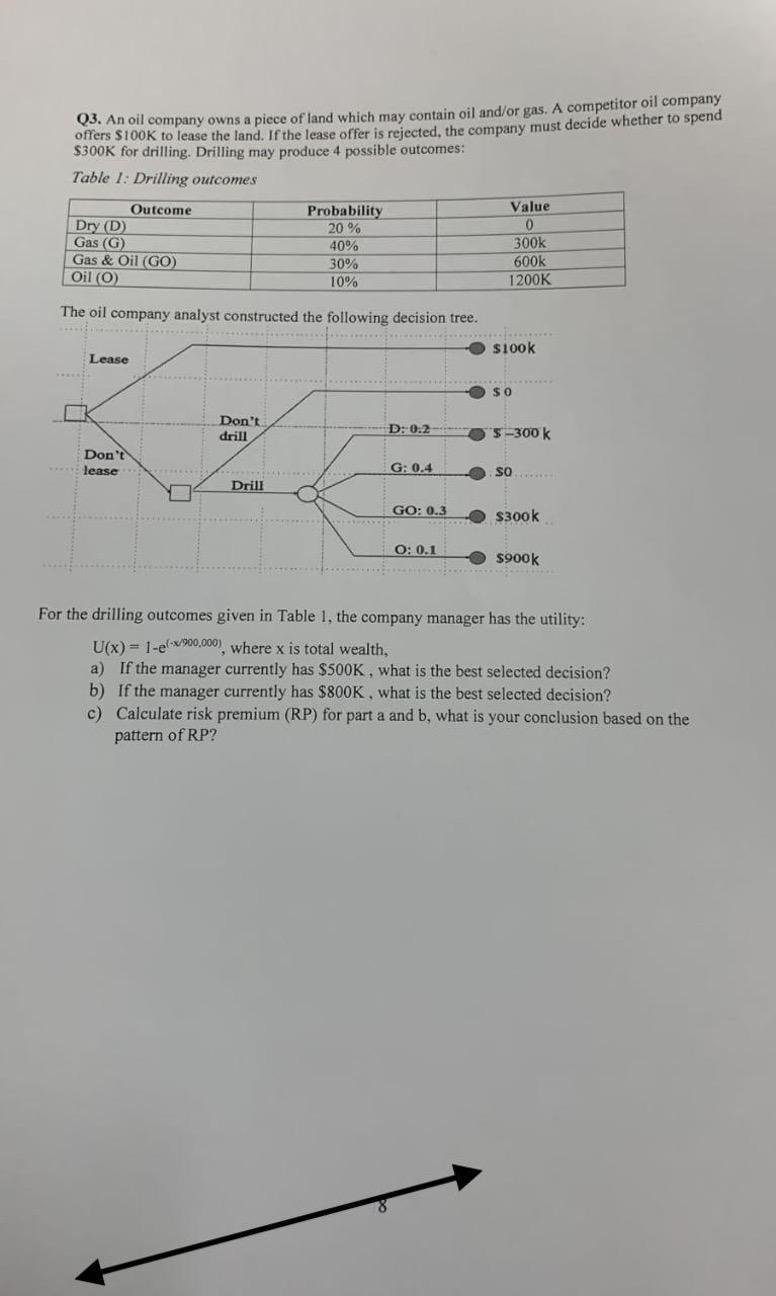

03. An oil company owns a piece of land which may contain oil and/or gas. A competitor oil company offers S100K to lease the land. If the lease offer is rejected, the company must decide whether to spend $300K for drilling. Drilling may produce 4 possible outcomes: Table 1: Drilling outcomes Outcome Probability Value Dry D 20 % 0 Gas (G) 40% 300k Gas & Oil (GO) 30% 600k Oil (O) 10% 1200K The oil company analyst constructed the following decision tree. $100k Lease $0 Don't drill D: 0.2 S-300k Don't lease G: 0.4 OSO Drill GO: 0.3 S300k O: 0.1 $900K For the drilling outcomes given in Table 1, the company manager has the utility: U(x) = 1-ex/900,000), where x is total wealth, a) If the manager currently has $500K , what is the best selected decision? b) If the manager currently has $800K , what is the best selected decision? c) Calculate risk premium (RP) for part a and b, what is your conclusion based on the pattern of RPStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock