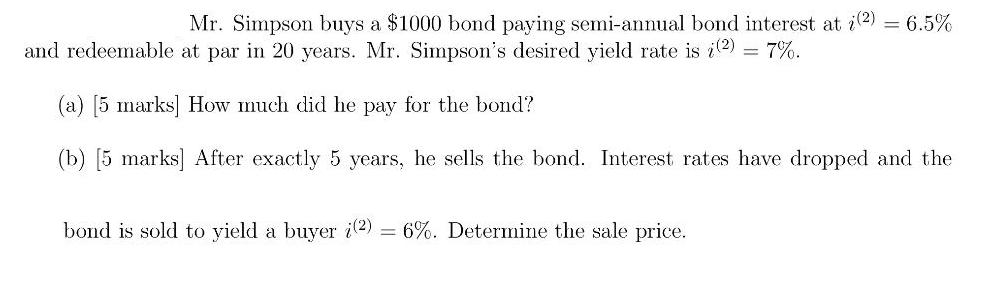

Question: Mr. Simpson buys a $1000 bond paying semi-annual bond interest at i2) = 6.5% and redeemable at par in 20 years. Mr. Simpson's desired

Mr. Simpson buys a $1000 bond paying semi-annual bond interest at i2) = 6.5% and redeemable at par in 20 years. Mr. Simpson's desired yield rate is i2) 7%. (a) [5 marks] How much did he pay for the bond? (b) [5 marks] After exactly 5 years, he sells the bond. Interest rates have dropped and the bond is sold to yield a buyer i(2) = 6%. Determine the sale price.

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

a Using a financial calculator enter PMT325 Semiannual coupon6510002 IY35 Sem... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6360f1834e1d1_234484.pdf

180 KBs PDF File

6360f1834e1d1_234484.docx

120 KBs Word File