Question: Please Draw a decision tree to solve part B only Part B The investor has the option to hire a consulting company to narrow down

Please Draw a decision tree to solve part B only

Part B

The investor has the option to hire a consulting company to narrow down the chances of facing a strong or weak real estate market. The cost of hiring this consulting company is $5,000. If the investors hire the consulting company, it provides a report about the state of the future economy, which shows either economic growth or decline. The consulting company informs the investor that:

If the future state of the economy is economic growth, then the probabilities of strong and weak real estate market conditions are 90% and 10%, respectively.

If the future state of the economy is an economic decline, then the probabilities of strong and weak real estate market conditions are 30% and 70%, respectively. The current macroeconomic indicators show a 60% chance of economic growth and a 40% chance of economic decline.

Draw a decision tree that includes the option of hiring the consulting company and answer the following:

5- What is the best course of action (best set of decisions)?

6- What is the expected profit for the best course of action?

7- Build a risk profile table

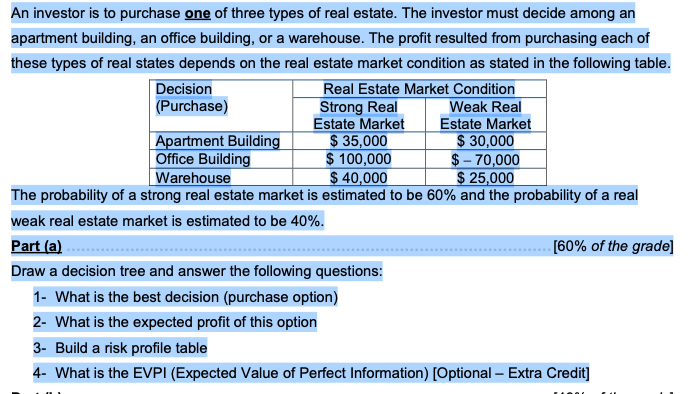

An investor is to purchase one of three types of real estate. The investor must decide among an apartment building, an office building, or a warehouse. The profit resulted from purchasing each of these types of real states depends on the real estate market condition as stated in the following table. Decision Real Estate Market Condition (Purchase) Strong Real Weak Real Estate Market Estate Market Apartment Building $ 35,000 $ 30,000 Office Building $ 100,000 $ - 70,000 Warehouse $ 40,000 $ 25,000 The probability of a strong real estate market is estimated to be 60% and the probability of a real weak real estate market is estimated to be 40%. Part (a) [60% of the grade) Draw a decision tree and answer the following questions: 1- What is the best decision (purchase option) 2- What is the expected profit of this option 3- Build a risk profile table 4- What is the EVPI (Expected Value of Perfect Information) [Optional Extra Credit]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts