Question: please help answer this question, please use the decision tree in excel that where I am the most lost. General Ford Motors ( GFM )

please help answer this question, please use the decision tree in excel that where I am the most lost. General Ford Motors GFM has developed a new

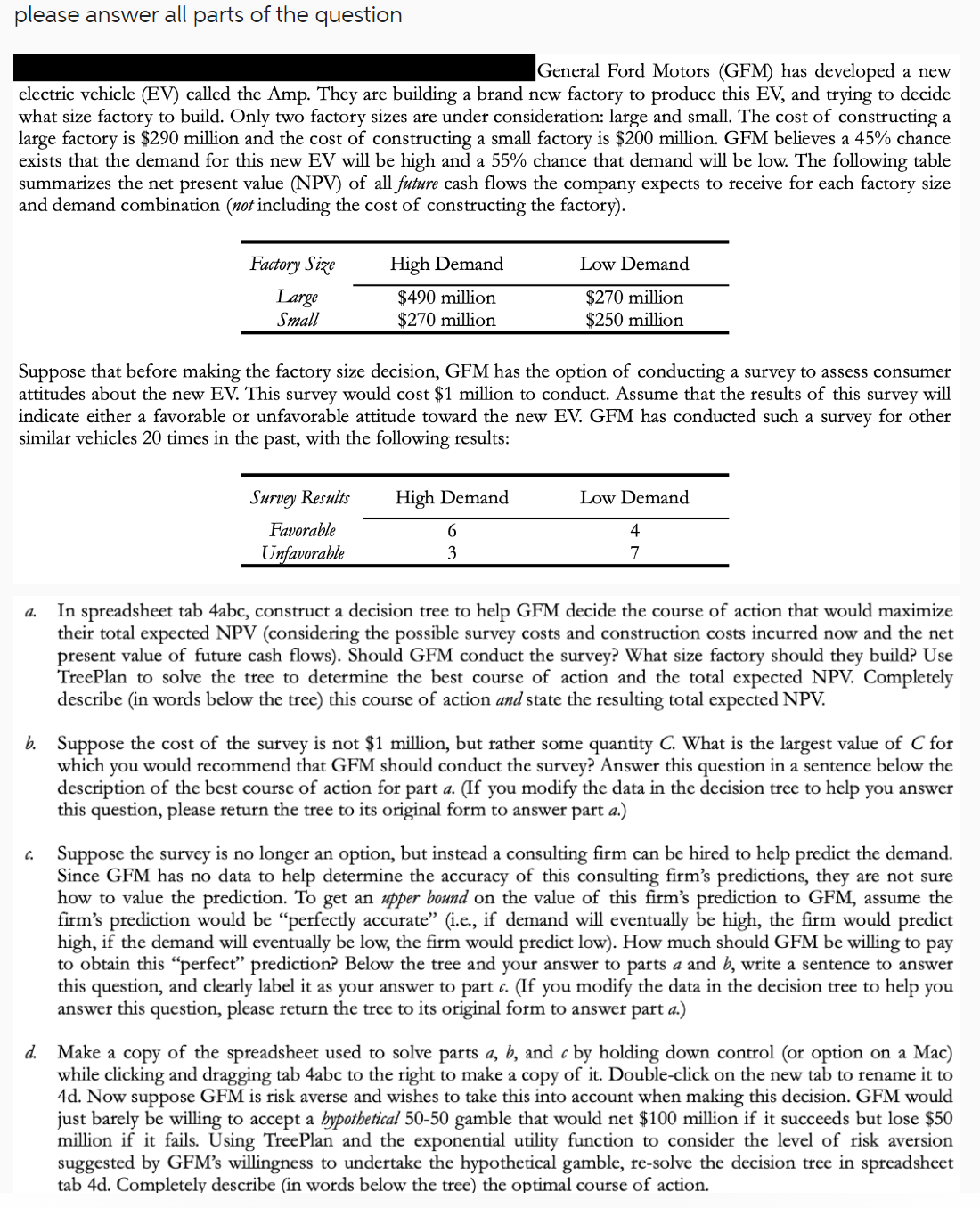

electric vehicle EV called the Amp. They are building a brand new factory to produce this EV and trying to decide

what size factory to build. Only two factory sizes are under consideration: large and small. The cost of constructing a

large factory is $ million and the cost of constructing a small factory is $ million. GFM believes a chance

exists that the demand for this new EV will be high and a chance that demand will be low. The following table

summarizes the net present value NPV of all future cash flows the company expects to receive for each factory size

and demand combination not including the cost of constructing the factory

Suppose that before making the factory size decision, GFM has the option of conducting a survey to assess consumer

attitudes about the new EV This survey would cost $ million to conduct. Assume that the results of this survey will

indicate either a favorable or unfavorable attitude toward the new EV GFM has conducted such a survey for other

similar vehicles times in the past, with the following results:

a In spreadsheet tab abc, construct a decision tree to help GFM decide the course of action that would maximize

their total expected NPV considering the possible survey costs and construction costs incurred now and the net

present value of future cash flows Should GFM conduct the survey? What size factory should they build? Use

TreePlan to solve the tree to determine the best course of action and the total expected NPV Completely

describe in words below the tree this course of action and state the resulting total expected NPV

b Suppose the cost of the survey is not $ million, but rather some quantity What is the largest value of for

which you would recommend that GFM should conduct the survey? Answer this question in a sentence below the

description of the best course of action for part If you modify the data in the decision tree to help you answer

this question, please return the tree to its original form to answer part a

c Suppose the survey is no longer an option, but instead a consulting firm can be hired to help predict the demand.

Since GFM has no data to help determine the accuracy of this consulting firm's predictions, they are not sure

how to value the prediction. To get an upper bound on the value of this firm's prediction to GFM assume the

firm's prediction would be "perfectly accurate" ie if demand will eventually be high, the firm would predict

high, if the demand will eventually be low, the firm would predict low How much should GFM be willing to pay

to obtain this "perfect" prediction? Below the tree and your answer to parts a and write a sentence to answer

this question, and clearly label it as your answer to part If you modify the data in the decision tree to help you

answer this question, please return the tree to its original form to answer part a

d Make a copy of the spreadsheet used to solve parts and by holding down control or option on a Mac

while clicking and dragging tab abc to the right to make a copy of it Doubleclick on the new tab to rename it to

d Now suppose GFM is risk averse and wishes to take this into account when making this decision. GFM would

just barely be willing to accept a bypothetical gamble that would net $ million if it succeeds but lose $

million if it fails. Using TreePlan and the exponential utility function to consider the level of risk aversion

suggested by GFMs willingness to undertake the hypothetical gamble, resolve the decision tree in spreadsheet

tab d Completely describe in words below the tree the optimal course of action.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock